Data show homeownership has become out of reach for many and that reducing or eliminating upfront fees is overdue.

By Lindsey Johnson

Eight years after the global financial crisis, the U.S. housing market still lags the recovery of the overall economy—and the homeownership rate is at a 50-year low.[1] While the new administration will have many housing related issues to address in the first few years, access to credit should not be overlooked. I was reminded of this and inspired to write this blog after reading a front page story in The Wall Street Journal on December 4 titled “Credit Restrictions Cost Home Buyers ‘Deal of a Lifetime.’”[2]

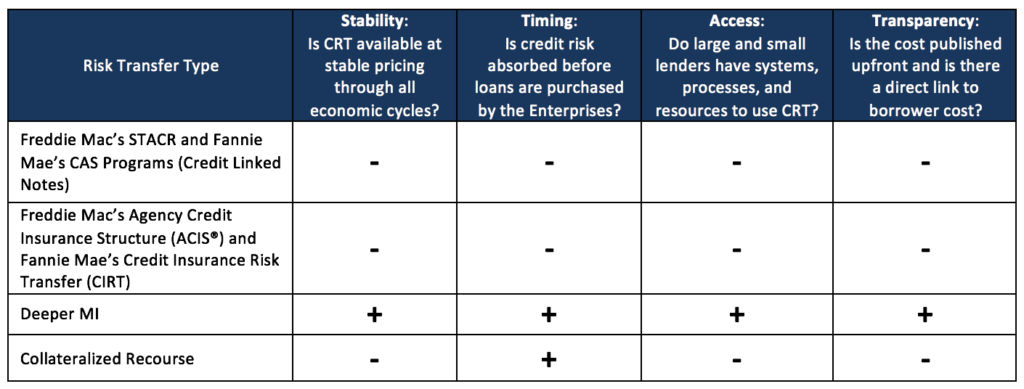

Following the financial crisis, policymakers aimed to eliminate the riskiest mortgage products on the market and shore up the financials of those institutions that make up the housing industry. And, while we cannot turn our eyes away from safety and sound mortgage lending nor can we ever allow any of the riskier types of mortgages to return that led to the financial crisis, the pendulum has swung too far in some areas. To truly address concerns about consumers’ access to mortgage finance, a number of areas of government policy need to be discussed including: 1) the GSEs’ guaranty fees (“g-fees”) policy that was adopted after the financial crisis; 2) GSE Loan Level Pricing Adjustment (LLPA) fees that were added to g-fees during the crisis; 3) private mortgage insurers’ new Private Mortgage Insurer Eligibility Requirements (PMIERs) that were established by the GSEs; and 4) the Federal Housing Administration’s (FHA) pricing and underwriting practices. We will explore many of these topics in future writings, but will focus on one specific aspect here—LLPAs.

Fannie Mae and Freddie Mac charge g-fees, which are the fees borrowers pay to have their mortgage backed by the Federal government through the GSEs. In 2008, the GSEs added LLPAs to further shield the GSEs against the risk of defaults. These crisis-era fees were levied on homebuyers in addition to other fees and costs for managing their risk, based largely on two factors—credit score and the size of their down payment—and most borrowers do not even know about these additional fees. The current president of the National Association of Realtors (NAR) put it best in an American Banker column when he stated “homebuyers are paying a steep price at the closing table in the form of unnecessary fees that, for some, put homeownership out of reach.”[3] Without being transparent about these so-called upfront risk fees, LLPAs will continue to exacerbate a serious concern over the efforts to re-balance these fees in a post-crisis environment.

Low-down payment programs are designed for families who need the help, but the impact of LLPAs on the cost of Fannie or Freddie-backed low-down payment mortgages has been chilling. The Wall Street Journal reports that, “Fannie and Freddie increased fees for riskier borrowers, widening the gap between mortgage rates available to borrowers with good and weak credit.”

This is indeed true. The Treasury Department noted in a recent report, the “credit score of the typical new mortgage borrower is nearly 40 points higher than the typical borrower in the early 2000s.” The “average credit score for those obtaining a loan backed by Fannie Mae and Freddie Mac…in conservatorship is nearly 750”—near perfect credit. And the “loan-to-value” is 80%, which means average down payments are roughly 20% of the home purchase price. These facts are “especially sobering given the fact that more than 40% of all FICO scores nationally fall below 700.”[4] I would argue that these trends mean there are many creditworthy families of all socioeconomic backgrounds deserving of conventional mortgages who are simply unable to buy their first home!

Costs of LLPA Fees on Homebuyers and Taxpayers

LLPAs impose significant costs on homebuyers and disproportionately harm first-time homebuyers and those without large down payments. If a homebuyer puts down 5% on a $200,000 home, and the borrower has a 660 FICO score and is applying for a $190,000 mortgage, then the upfront LLPA is 2.25% on this loan. The borrower will pay for this by either bringing $4,275 additional funds to closing (190,000* 2.25%) or accepting a 0.50%-0.55% higher interest rate. That higher interest rate translates to an additional $50 per month on your mortgage payment. Over 5 years that is more than $3,000 in additional interest and over the life of the loan the borrower pays more than $18,000 in additional interest.

USMI was one of 25 organizations that wrote to FHFA Director Mel Watt in June about the need to eliminate or reduce these arbitrary crisis-era fees. Fortunately, since the financial crisis, defaults have gone down for a variety of reasons, not the least of which is the fact that new underwriting rules have dramatically improved the quality of the GSE portfolio of new home loans, meaning there is a whole lot less risk on the GSEs’ books as these mortgages are performing well. Yet while the cumulative default rate has decreased from 13.7% to almost zero, GSE g-fees, which include LLPAs, have nearly tripled since the mortgage crisis. Therefore, these arbitrary fees are being imposed on borrowers, even though lending is safer and the fact that private mortgage insurance already mitigates the risk the borrower may not repay their loan. Essentially, LLPAs are double charging the borrower for the same risk. The data simply does not justify these fees anymore.

FHFA Responds…

Director Watt’s August 1 response to the 25 groups who called for FHFA and the GSEs to reduce or eliminate these LLPA fees was that “although positive developments in the mortgage market continue to occur, we believe the current g-fees and LLPAs continue to strike the risk balance.”[5] However, speaking at the MBA’s Annual Convention & Expo in October, Director Watt acknowledged that the post-2008 recovery in the housing market has been “disappointingly uneven” in many areas of the country. Not only has the recovery been slower for urban and low-income communities, but these same communities continue to have the hardest time achieving homeownership today.

NAR said in the American Banker column that the GSEs are “charging homeowners for far more risk than they [the GSEs] took on, driving tremendous profit.” The GSEs have paid more than $200 billion to the U.S. Treasury in recent years; given the GSEs are under conservatorship and are mandated to go to zero capital by 2018, the GSEs should continue to focus on providing access to credit for a broad range of borrowers.

The GSEs have a mission to “promote homeownership, especially access to affordable housing.”[6] It is time to eliminate or reduce these unnecessary fees and bring down costs for homebuyers, considering most low-down payment mortgages already come with private mortgage insurance protection—risk that Fannie and Freddie do not have to bear. Private MI has covered first loss mortgage credit risk ahead of American taxpayers for 60 years and mortgage insurers are ready to do more.

[1] Census Bureau

[2] http://www.wsj.com/articles/credit-restrictions-cost-home-buyers-deal-of-a-lifetime-1480874593

[3] http://www.americanbanker.com/bankthink/fees-meant-to-shield-gses-from-risk-are-hurting-homebuyers-1091054-1.html

[4] Antonio Weiss and Karen Dynan, Housing Finance Reform: Access and Affordability in Focus https://medium.com/@USTreasury/housing-finance-reform-access-and-affordability-in-focus-d559541a4cdc#.gu5ifppus

[5] Mel Watt, FHFA Letter to Stakeholders on LLPAs

[6] Chairman Ben Bernanke, ICBA Conference Speech: GSE Portfolios, Systemic Risk, and Affordable Housing https://www.federalreserve.gov/newsevents/speech/bernanke20070306a.htm