For Immediate Release

June 30, 2016

Media Contacts

Laura Capicotto (202) 777-3536 (lcapicotto@clsstrategies.com)

USMI Statement on FHFA Credit Risk Transfer Progress Report and RFI

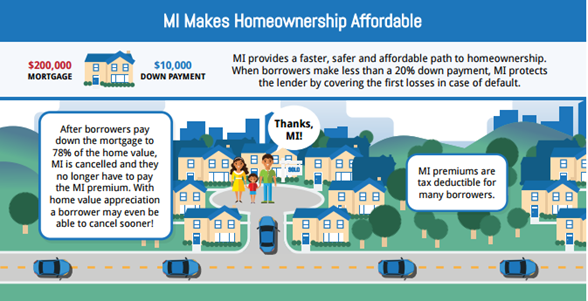

The Federal Housing Finance Agency (FHFA) has released a Progress Report and Request for Input (RFI) on Single-Family Credit Risk Transfers as a follow-up to the release of the 2016 Scorecard for Fannie Mae, Freddie Mac, and Common Securitization Solutions. U.S. Mortgage Insurers (USMI) welcomes the opportunity to work with FHFA and the government sponsored enterprises (GSEs) on specific steps the GSEs need to take to increase the amount and levels of credit risk transferred. Front-end risk sharing with deeper coverage using private mortgage insurance (MI) will address existing shortcomings in the GSEs’ credit risk transfer efforts and offers substantial benefits for taxpayers and borrowers.

“The MI industry has taken substantial steps to be well positioned to provide more private capital in front of the GSEs’ risk exposure with increased and enhanced capital and reliability standards. MIs are well positioned to do more right now to protect taxpayers and help borrowers,” said Lindsey Johnson, President and Executive Director of USMI. “In the absence of comprehensive reform, we should explore many options in the credit risk share market, with greater balance among them. With three years of largely back-end risk sharing transactions, the potential benefits of front-end risk sharing have not been realized. Unfortunately, the RFI inadequately portrays the role private mortgage insurers (MIs) play in assuming credit risk and the steps MIs have taken to strengthen capital and counterparty standards (click here for MI reliability fact sheet). The RFI discusses many risks but neither provides quantitative analysis of the size and relative importance of those risks, nor proposes or requests proposals for ways to quantify those risks. A strong case exists for expanding mortgage insurance coverage down to 50 percent of the value of the loan and doing it on the front-end, before the risk ever reaches the GSEs’ balance sheets, as part of the next phase of experimentation.”

USMI looks forward to commenting on the following issues as part of the RFI process:

- The need for a balance of methods to offload the mortgage risk concentrated at the GSEs and to enhance housing finance reform possibilities;

- The need for equivalency of standards to be consistently applied to all sources of housing finance and credit enhancement to ensure there is no regulatory arbitrage;

- The need to address pricing and modeling transparency;

- The need to ensure that a broad set of lenders have equitable access to the system; and

- The need to have risk sharing partners that will stay in the market in good times and bad, including during another market downturn when the housing finance system is under stress.

Front-end risk sharing via deeper cover MI transfers credit risk to MIs at the time the loan is originated, which reduces risk before it ever gets to the GSEs and provides real time price transparency so that any savings can be passed on to borrowers.

“While we understand the Enterprises’ consideration of exposure to all counterparties, we think increased private capital by strong counterparties further reduces taxpayer risk and should be encouraged. The MI industry is ready and prepared to do more,” said Johnson. “MIs have raised $9 billion in new capital since the financial crisis, and are well positioned to raise additional capital to meet demand.”

MIs covered roughly $50 billion in claims to the GSEs since conservatorship. Throughout the financial crisis, USMI members never stopped paying claims, never received any bailout money from the Federal government, and continued to write new insurance. In fact, since the crisis, MIs have paid all valid claims, with 96 percent paid in cash and the remainder due over time. MIs have materially increased their claims paying ability in both good and bad economic times due to new higher capital standards under the Private Mortgage Insurance Eligibility Requirements (PMIERs). All MIs have met or exceeded PMIERs requirements as of December 31, 2015.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.