With the recent passage of the bipartisan infrastructure bill, Congress has moved onto the Build Back Better Act, which includes approximately $170 billion in funding for housing initiatives. On December 1, a bill was introduced in the House to make permanent and expand eligibility for the federal tax deduction of mortgage insurance (MI) premiums. USMI recently submitted two comment letters to the Federal Housing Finance Agency (FHFA) on its proposed “Amendments to the Enterprise Regulatory Capital Framework Rule,” and its “Enterprise Equitable Housing Finance Plans.” Finally, USMI published a new blog examining the costs that are often additional and unanticipated by prospective homeowners. We delve into these developments and more below.

Build Back Better Act. The House passed the $1.75 trillion Build Back Better (BBB) Act on November 19, sending the social spending bill to the Senate. The legislation allocates about $170 billion to provisions for affordable housing. According to the Biden administration, this would be the largest investment in affordable housing in history and it will mean the construction or preservation of more than 1 million affordable homes. BBB, in its current form, would provide funding for numerous homeownership initiatives, including: $10 billion for first-generation first-time homebuyer down payment assistance (DPA) based on House Financial Services Committee Chairwoman Maxine Waters’ (D-CA) “Downpayment Toward Equity Act”; $10 billion for the U.S. Department of Housing and Urban Development’s (HUD) HOME Investment Partnerships Program to fund building, buying, and/or rehabilitating affordable housing for rent or homeownership; $5 billion for wealth-building loans (20-year subsidized mortgages) for first-generation first-time homebuyers based on Sen. Mark Warner’s (D-VA) “Low-Income First-Time Homebuyers Act” (LIFT Act); $1.75 billion for a new “Unlocking Possibilities” zoning and land use reform program; $800 million for fair housing activities; and $100 million for a pilot program at HUD to expand small-dollar mortgage options for homebuyers purchasing homes at $100,000 or less.

The Middle Class Mortgage Insurance Premium Act of 2021. On December 1, Reps. Ron Kind (D-WI) and Vern Buchanan (R-FL) introduced legislation that would make permanent and expand eligibility for the deduction of MI premiums from federal income taxes. USMI released a statement writing that the legislation “is smart public policy that benefits potentially millions of existing homeowners…Since 2007, the ability to deduct the cost of MI premiums has helped to put extra dollars back into the hands of millions of families each year and we strongly support legislation to make the tax deduction permanent.” MI deductibility has enjoyed broad bipartisan support, dating back to when the bill was originally introduced in 2005, and continues to have broad housing industry support, including from the Mortgage Bankers Association, National Association of Home Builders, National Association of REALTORS®, and National Housing Conference. National Mortgage News, DS News, Financial Regulation News and InsuranceNewsNet.com published articles on the proposed legislation that quote the bill’s sponsors and USMI.

USMI Submits Comment Letter for FHFA’s Proposed Amendments to the Enterprise Regulatory Capital Framework. On November 23, USMI submitted a comment letter on FHFA’s Notice of Proposed Rulemaking (NPR) on “Amendments to the Enterprise Regulatory Capital Framework (ERCF) Rule – Prescribed Leverage Buffer Amount and Credit Risk Transfer.” In its letter, USMI recommends that FHFA adjust the credit risk transfer (CRT) minimum risk weight floor to lower than 5 percent, consider alternative methods to determine the Prescribed Leverage Buffer Amount (PLBA), reduce the single-family risk weight floor to 10 percent or less, and make changes to the Countercyclical Adjustment. These recommendations are outlined further in USMI’s executive summary to the comment letter.

Most comments to the NPR support the proposed changes by FHFA to CRT and the PLBA. On the PLBA, many respondents note that the proposed changes would make the framework more risk-based and prevent the PLBA from being the typical binding requirement. On the proposed changes to reduce the minimum risk weight floor for CRT from 10 to 5 percent, most commenters generally supported the reduction and some suggested it be reduced or refined further. Most commenters also supported the removal of the overall effectiveness adjustment for CRT. In addition, many responses – including from insurance agency Guy Carpenter, Freddie Mac, and the Housing Policy Council – support reducing the single-family risk weight floor below the current 20 percent in the final rule. Further, several other organizations – including Urban Institute, Center for Responsible Lending, National Community Stabilization Trust, National Housing Conference, Consumer Federation of America, Leadership Conference and the National Association of REALTORS® – express concerns with the current Countercyclical Adjustment and recommend FHFA revisit this element within the final rule to ensure it will not have unintended consequences.

In a press release, USM President Lindsey Johnson is quoted saying, “We appreciate the work FHFA has undertaken to date to provide for minimum capital requirements for the Enterprises, including the December 2020 final rule to establish a post-conservatorship capital framework. While a robust framework is necessary to ensure the stability of the housing finance system, overly stringent requirements or ones that inaccurately reflect the risks of the assets held by the Enterprises can be disruptive. It is critical FHFA creates a capital framework that strikes an appropriate balance between maintaining borrowers’ access to affordable mortgage credit and ensuring the Enterprises and taxpayers are protected from risk.”

USMI Submits Comment Letter on FHFA’s Enterprise Equitable Housing Request for Input (RFI). On October 25, USMI submitted a comment letter to FHFA’s RFI on “Enterprise Equitable Housing Finance Plans” (the Plans), which articulates a framework by which the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, will be required to prepare and implement three-year plans to advance equity in housing finance. USMI writes in its letter that it “commends the FHFA for soliciting feedback on the Plans to identify the barriers to sustainable housing opportunities, set goals to address those barriers, and implement policies to address them. The private MI industry welcomes the opportunity to work with FHFA, the GSEs, and other housing finance stakeholders to support the Biden Administration’s goal of a comprehensive approach to advancing equity for all.” In its comment letter, USMI specifically recommends that FHFA review and reform loan-level price adjustments (LLPAs); review and revise the ERCF; modify the Preferred Stock Purchase Agreements (PSPAs); finalize the new products and activities rule; and provide greater data and transparency to address longstanding inequities in the housing finance system.

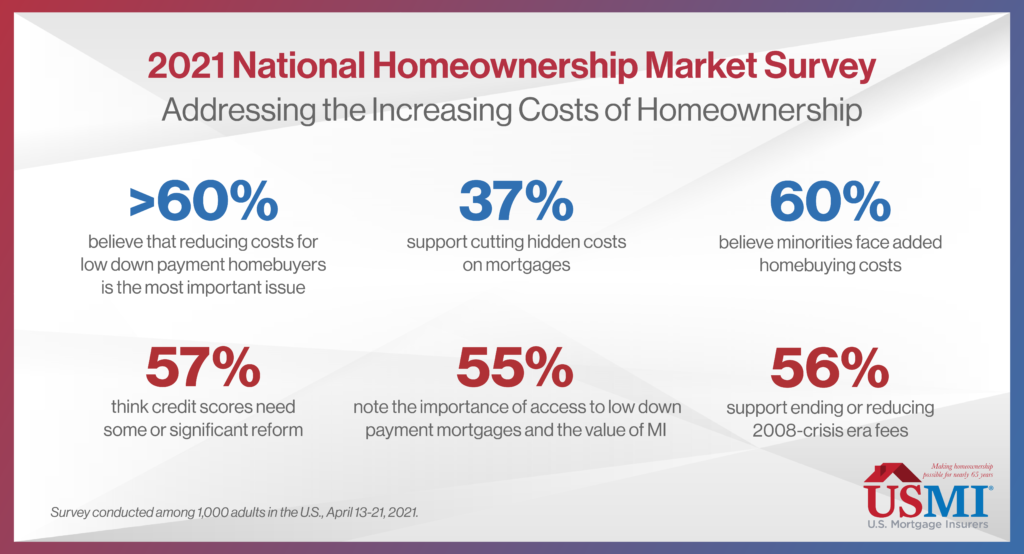

New Blog: Hidden Costs Harmful to Homeownership. In USMI’s latest blog on its 2021 National Homeownership Market Survey, we examined the way hidden or unanticipated costs impact homeownership. Home prices are increasing at historic levels and consumers expect both home prices and mortgage interest rates to increase over the next year. Sixty percent of respondents to the survey believe minorities face added homebuying costs because they tend to have lower credit and higher debt according to the survey. The survey also found that 60 percent of respondents believe reducing costs for low down payment homebuyers is the most important item for the homebuying process and 37 percent support cutting hidden costs on mortgages.

What We’re Reading. On December 2, Fannie Mae released a report titled, “Barriers to Entry: Closing Costs for First-Time and Low-Income Homebuyers,” which analyzed the costs associated with closing a mortgage loan and presented potential solutions to reduce certain closing costs for specific borrowers, where these additional costs may act as a barrier to homeownership. Based on a sample of 1.1 million conventional purchase mortgages acquired in 2020, Fannie Mae found that “median closing costs as a percent of home purchase price were 13 percent higher for low-income first-time homebuyers than for all homebuyers, and 19 percent higher than for non-low-income repeat homebuyers.”

Nominations We’re Watching. Julia Gordon, the nominee to lead the Federal Housing Administration, is still waiting on a full Senate vote. Meanwhile, the Senate Committee on Banking, Housing, and Urban Affairs on December 2 favorably reported via voice vote the nomination of Alanna McCargo to serve as the president of Ginnie Mae.

ICYMI: USMI Member Spotlight – Essent. In case you missed it, Essent Chairman and CEO Mark Casale was featured on our member spotlight. Casale shared his thoughts on Essent’s views on the housing market as we come out of the COVID-19 pandemic, the continued evolution of the private MI industry and the role of innovation, and how this evolution will better serve borrowers and the housing finance system. Read the full Q&A here.