Blog: Addressing the Increasing Costs of Homeownership

Buying a home is the largest single investment most Americans will make, but during the last few years, that dream has become increasingly unreachable for a significant portion of the population as the housing market experiences strong home price appreciation (HPA) and historically low levels of supply. A recent Wall Street Journal article reported on this rising home price trend, outlining how mortgage payments can become unaffordable as a result. According to the Federal Reserve Bank of Atlanta, the median American household would need 32.1 percent of its income to cover mortgage payments on a median-priced home – the most since November 2008, when the same outlays would require 34.2 percent of income. Moreover, the Federal Housing Finance Agency’s (FHFA) 2021 Q3 House Price Index (HPI®) report indicates that house prices were up 4.2 percent compared to the second quarter of 2021, but the real surprise comes when you look over the one year period during which home prices climbed 18.5 percent.

With this in mind, it is no surprise that an increasing number of consumers (64 percent) believe it is a bad time for buying a home, according to Fannie Mae’s latest Home Purchase Sentiment Index (HPSI®). This is a dramatic change from a year ago when that rate stood at only 35 percent, a change driven by consumers’ sentiments that home prices (plurality at 45 percent) and mortgage rates (majority at 58 percent) will increase over the next 12 months.

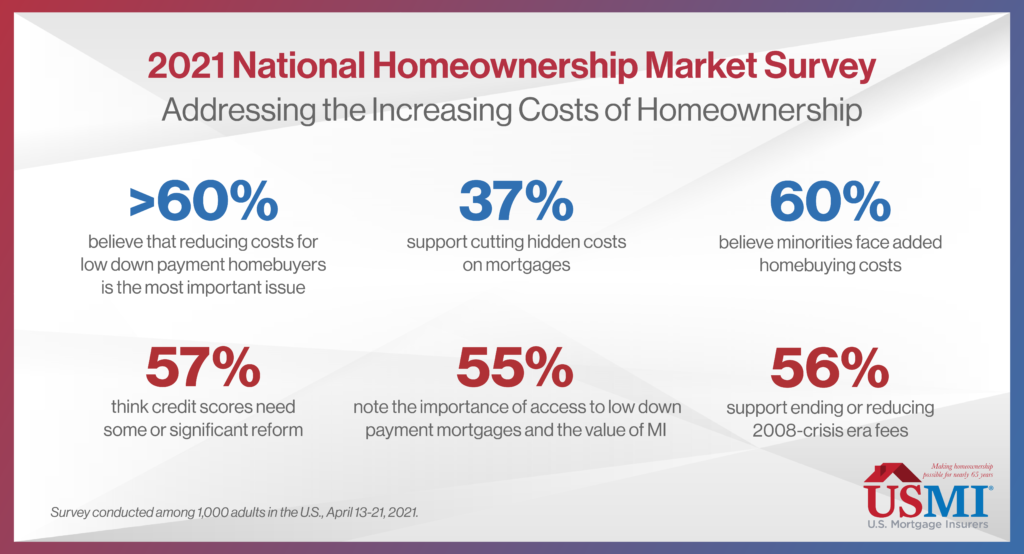

This entire situation only serves to push the goal of owning a home further out of reach for many prospective first-time, minority, and low- to moderate-income (LMI) homebuyers. In addition, there are other fees and charges that potential homebuyers could incur, increasing the cost of homeownership for creditworthy borrowers throughout the country. In fact, USMI’s 2021 National Homeownership Market Survey, which polled 1,000 adults in the U.S., found that 60 percent of respondents believe minorities face added homebuying costs because they tend to have lower credit and higher debt.

Moreover, when asked about the priorities and reforms the housing finance industry should focus on, over 60 percent of respondents believe that reducing costs for low down payment homebuyers is the most important item for the home buying process, and 37 percent support cutting hidden costs on mortgages. Other issues respondents conveyed include:

- Nearly 70 percent of respondents ranked the lack of affordable housing as the number one housing challenge and almost 60 percent stated that low housing supply is another top issue.

- 61 percent of respondents want to eliminate added costs for low down payment homebuyers and 56 percent of respondents specifically support ending Loan-Level Price Adjustments (LLPAs), 2008-crisis era fees that disproportionately affect minority and first-time homebuyers.

- 55 percent of respondents noted the importance of access to low down payment mortgages and the value of mortgage insurance (MI) to help borrowers qualify for mortgage financing.

- 57 percent think credit scores need some or significant reform, driven by respondents’ view that credit score is the underwriting element that most impacts mortgage costs.

Many of the “hidden costs” that borrowers reference when purchasing a mortgage are not really “hidden,” but instead are costs that they may not have anticipated incurring as part of closing the loan. Last week, Fannie Mae released a report titled, “Barriers to Entry: Closing Costs for First-Time and Low-Income Homebuyers,” which finds “[i]n a sample of approximately 1.1 million conventional home purchase loans acquired by Fannie Mae in 2020, median closing costs as a percent of home purchase price were 13 [percent] higher for low-income first-time homebuyers than for all homebuyers, and 19 [percent] higher than for non-low-income repeat homebuyers.” The report also finds that “Black and white Hispanic low-income first-time homebuyers on average paid higher closing costs relative to purchase price than their white non-Hispanic or Asian counterparts […] For some low-income first-time homebuyers, closing costs can be particularly onerous.” Fannie Mae found that some of these “homebuyers had closing costs equal to or exceeding their down payment.”

The FHFA released an Equitable Housing Finance Plans Request for Input (RFI) in September 2021, and the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, are required to submit Equitable Housing Finance Plans to FHFA by December 31, 2021. The plans will be in effect on January 1, 2022. USMI submitted its comment to the RFI in October. Given the private MI industry is one of the only forms of private capital available through market cycles and whose core business is focused on helping people without large down payments achieve affordable and sustainable homeownership, private MIs share the FHFA and GSEs’ view that the two pillars of good mortgage lending are sustainability and affordability. The goal should be a strong housing finance system that ensures equitable access to all mortgage-ready borrowers. USMI strongly supports efforts to remove barriers to homeownership and increase access and affordability, including for historically underserved households, while instilling sustainability for these same borrowers. The MI industry welcomes the opportunity to work with the FHFA, the GSEs, and other housing finance stakeholders to advance these goals.