Two types of mortgage insurance (generally)

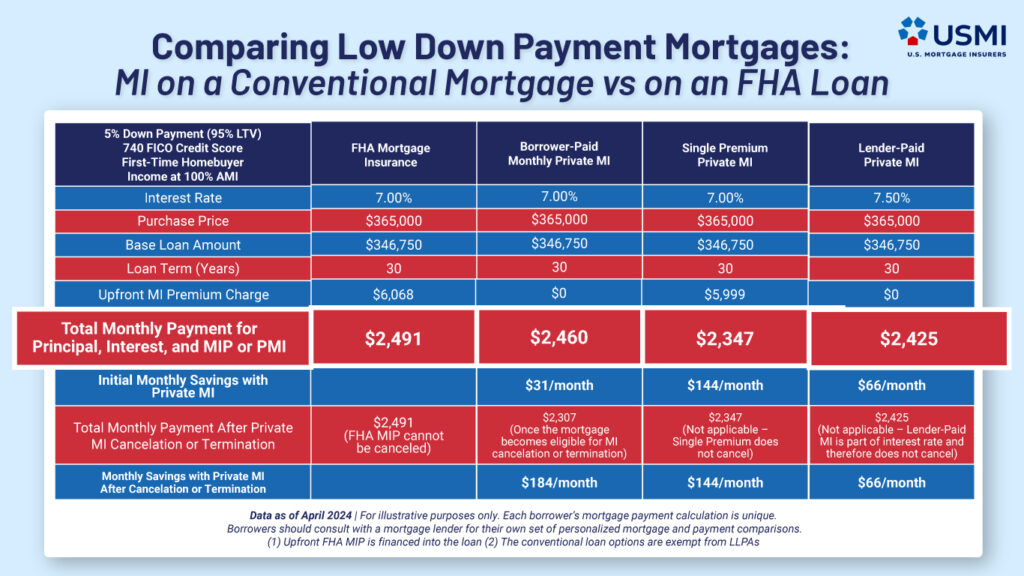

- Private. MI on low down payment conventional mortgages that is backed by private capital. Most often, borrower paid MI (BPMI) is used, which is paid monthly by the borrower and can be cancelled after 20 percent equity in the mortgage is established. Lender paid MI (LPMI) is another form of MI. Because the cost of LPMI is not in the form of a monthly payment, it is not cancellable.

- Government. MI premiums on government-backed loans. These include loans insured or guaranteed by the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA) and U.S. Department of Agriculture’s Rural Housing Service (RHS). Government-backed MI cannot be cancelled.

Private mortgage insurers and the FHA should support efforts to expand homeownership in complementary ways. The FHA traditionally serves underserved borrowers, while private MI enables borrowers to access a loan through the conventional market when they are unable to put 20 percent down.

Understanding the differences between the two types of MI:

Private MI on Conventional Loans

How It Works:

Private MI satisfies GSE’ requirements for borrowers to purchase a home with a down payment as low as 3%. MI insures lenders against losses if a borrower defaults.

Consumer Impact:

Private MI coverage and premiums paid by a borrower cancel when the mortgage loan-to-value reaches approximately 78%.

If a borrower experiences financial hardships, MI companies have strong financial incentives to help borrowers avoid foreclosure, often through loan modifications.

Tax Treatment:

Private MI premiums have been treated as “mortgage interest” since 2007 and are tax deductible for many borrowers.

MI Premiums on FHA Loans

How It Works:

FHA is a government-administered mortgage insurance program. The FHA requires a 3.5% down payment.

Consumer Impact:

Unlike private MI, most FHA insurance premiums typically never cancel, and borrowers must pay insurance premiums for the entire life of the loan.

In addition to the annual insurance premiums, borrowers pay an Upfront Mortgage Insurance Premium equal to 1.75% of the loan that is typically financed into the mortgage loan amount.

Tax Treatment:

FHA insurance premiums have been treated as “mortgage interest” since 2007 and are tax deductible for many borrowers.