On October 13, the comment period closed for the Federal Housing Finance Agency (FHFA)’s Single-Family Credit Risk Transfer (CRT) Request for Input (RFI). Below is a roundup of the comment letters submitted by USMI and numerous other housing finance organizations that expressed support behind efforts to reduce government, and therefore taxpayers’, risk exposure by positioning more private capital in a “first loss” position ahead of the government sponsored enterprises (GSEs) through expanded mortgage insurance.

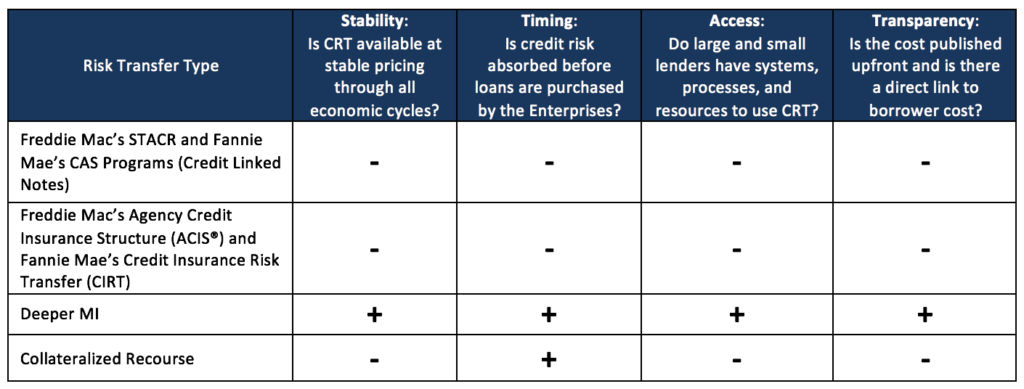

- USMI notes in its comment letter the distinct advantages of front-end CRT done through expanded use of MI: “Increasing the proportion of front-end CRT in the Enterprises’ CRT strategy will advance four key objectives of a well-functioning housing finance system by ensuring that: (1) a substantial measure of private capital loss protection is available in bad times as well as good; (2) such private capital absorbs and deepens protection against first losses before the government and taxpayers; (3) all sizes and types of financial institutions have equitable access to CRT; and (4) CRT costs are transparent, thereby enhancing borrower access to affordable mortgage credit.” These comments were further highlighted in an article by the Mortgage Professional America magazine. The full comment letter is available here. USMI’s RFI fact sheet can be found here.

Following the submission of USMI’s comment letter, an op-ed by USMI President Lindsey Johnson was published in The Hill that echoes the benefits provided to the GSEs and US taxpayers by front-end CRT through expanded use of MI.

- A number of other stakeholders and organizations also weighed in, supporting efforts to expand the use of MI:

- Urban Institute wrote: “The GSEs could share additional credit risk through this channel by having some MIs cover a deeper level of first loss, down to, say, an effective LTV of 50%. So-called deep cover MI has several attractive features. First, it extends a structure already in wide use, making it easy for lenders of all sizes to adopt. Second, in contract to the front-end structures used to date, it is equally available to and can be equally priced for lenders of all sizes. Third, it is completely transparent… Since mortgage insurance is the only product MIs offer, they will provide capital in good times and bad.”

- National Association of Home Builders wrote: “Deep coverage MI would allow mortgage insurance companies to reduce the Enterprises’ exposure to credit losses to as low as 50 percent of the mortgage loan amount. The Enterprises would reduce their guarantee fees on the mortgage loans commensurate with the cost of the risk they transfer to the mortgage insurers. The reduced guarantee fee charged by the Enterprises in exchange for incurring less credit risk can be passed on to consumers, reducing the cost of the mortgage loans and increasing the availability of credit.”

- Mortgage Bankers Association wrote: “Up-front risk-sharing structures with committed mortgage market participants such as lenders, mortgage Real Estate Investment Trusts (REITs) and mortgage insurers can distribute mortgage credit risk prior to the loan(s) being acquired by the GSEs, while offering potential borrower benefits… Well-conceived up-front risk sharing pilot programs, such as expanded lender recourse offerings, deeper mortgage insurance or other capital markets structures that are executed prior to GSE acquisition, can help the GSEs better determine which transaction structures are best able to expand the sources of private capital and withstand both the peaks and valleys in the credit cycle.” These comments were further highlighted in an article by Scotsman Guide.

- Community Mortgage Lenders of America wrote: “There is no substitute for the depth of experience, the broad web of customer relationships and level of service that the MI industry provides to lenders, nor to the key role played by mortgage insurers in facilitating low down payment lending for borrowers whose home finance needs are served with a low down payment mortgage.”

- Credit Union National Association wrote: “… private mortgage insurance needs to be maintained as an option as it can be utilized as an effective risk transfer strategy.”

- Housing Policy Council wrote: “We specifically recommend that FHFA and the Enterprise test deeper mortgage insurance through a pilot program. Of the various structures discussed in the RFI, only deeper mortgage insurance has yet to be tested in the marketplace.”

In addition, last week the Congressional Budget Office (CBO) released a report entitled “The Effects of Increasing Fannie Mae’s and Freddie Mac’s Capital.” The October 20th report came at the request of Senate Banking Committee Chairman Richard Shelby (R-AL) and analyzes a policy that would allow the GSEs to increase their capital by reducing payments to Treasury, as well as discusses the effects it would have on the federal budget and the U.S. mortgage market.