The following statement can be attributed to Lindsey Johnson, USMI president and executive director:

“Private mortgage insurance is a 60-year old bedrock of the housing system that for decades has helped low down payment borrowers qualify for mortgage financing—more than 25 million borrowers to date—and has provided critical credit risk protection to the government and taxpayers through numerous housing cycles. MI works and is a reliable form of credit risk protection, as evidenced by the more than $50 billion in claims that mortgage insurers paid to the GSEs through the downturn. As FHFA states in its progress report, private mortgage insurance remains the primary form of credit enhancement used on mortgages sold to the GSEs with loan-to-value ratios over 80 percent, and in the first quarter of 2017 MI covered $48 billion of mortgages the agencies purchased.

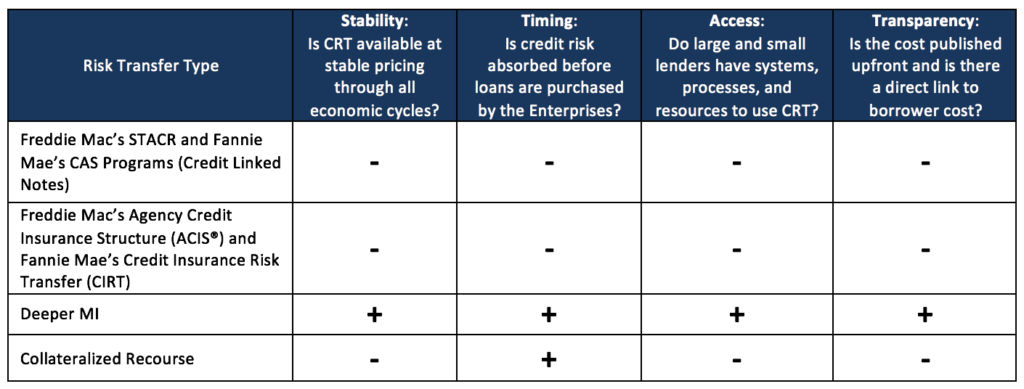

“In the absence of comprehensive GSE reform, FHFA is rightfully exploring options in the credit risk share market through various pilots, and USMI encourages greater balance, transparency, and comparable standards among these options. The cost of credit enhancement has more than doubled for many of the back-end CRT tranches sold, which indicates price volatility continues to be present for these transactions. Our industry remains confident that greater potential benefits can be realized through front-end risk sharing, specifically as outlined in our proposal last year to explore deeper MI coverage, where even more risk is transferred away from the government before it ever touches the GSEs’ balance sheets. The vast majority (more than 97 percent based on risk in force) of CRT transactions to date have been done on the back-end, with the GSEs warehousing credit risk before transferring to the private sector. The GSEs need not carry this level of risk considering there is ample opportunity to increase or at a minimum balance the level of front-end transactions.

“We also encourage equivalent counterparty standards for other CRT transactions, similar to the stringent requirements of mortgage insurers. Doing this will ensure taxpayers are better protected. In the last two years, MIs have materially increased their claims paying ability in both good and bad economic times due to new higher capital standards under the Private Mortgage Insurance Eligibility Requirements (PMIERs). All MIs have met or exceeded PMIERs requirements as of December 31, 2015.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.