For 60 years, private mortgage insurance (MI) has helped more than 25 million families become successful homeowners. To commemorate this milestone, the Urban Institute examined the industry’s history and the positive role MI has served for homebuyers and the mortgage finance system overall. Urban notes in its study, “[p]rivate mortgage insurers have played a crucial role over the past six decades enabling first-time homebuyers to gain access to high-[loan-to-value] conventional financing while reducing losses for the GSEs.” The report confirms that the presence of private mortgage insurance makes it easier for creditworthy borrowers with limited down payments to access conventional mortgage credit. This is the primary function of MI – to help borrowers qualify for home financing.

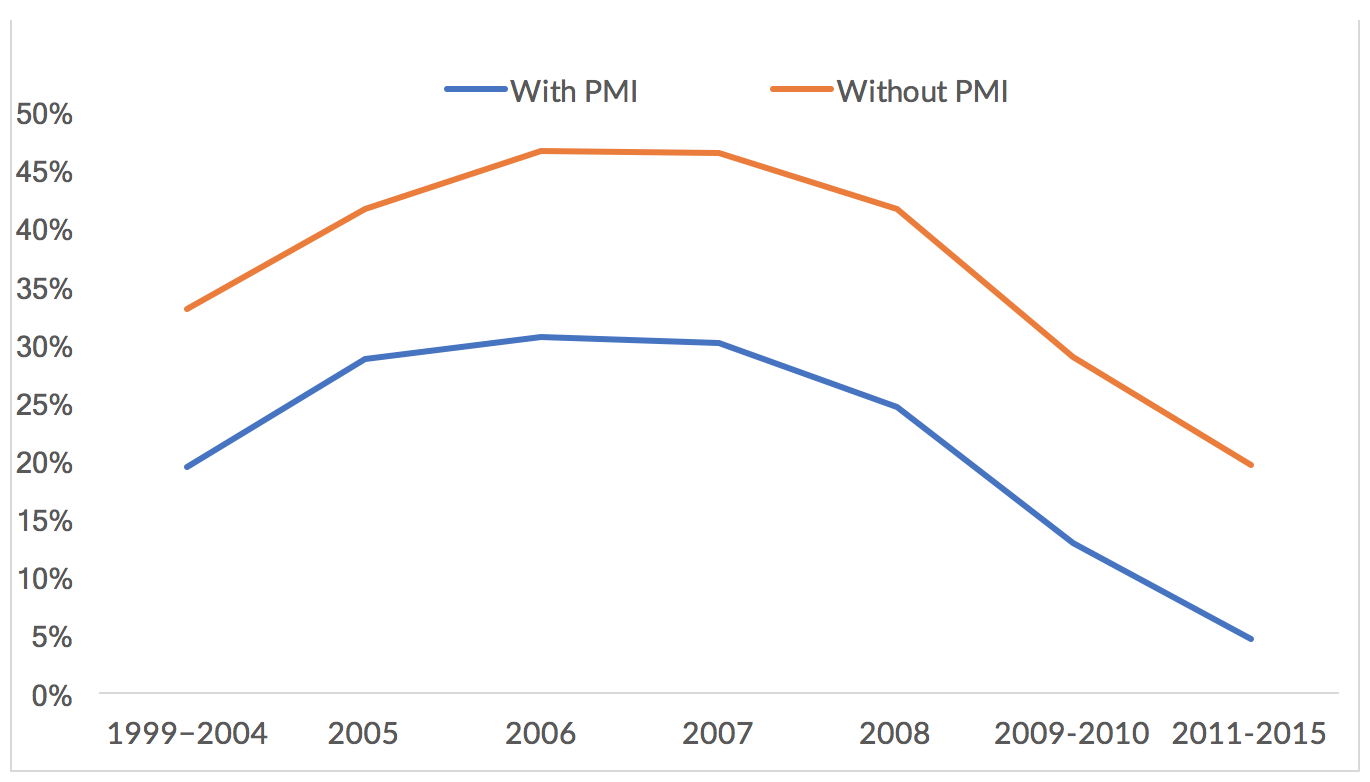

The report also focuses on the role MI plays to reduce taxpayers’ exposure to mortgage credit risk. MI insures the first-loss credit risk to the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, helping to reduce GSE losses, and therefore taxpayers’ losses, on defaulted mortgages. And historical experience and data show MI works. Urban found that GSE loans with MI consistently have lower loss severities than those without MI. In fact, for nearly 20 years, loans with MI have exhibited lower loss severity each origination year. The Urban analysis shows that “for 30-year fixed rate, full documentation, fully amortizing mortgages, the loss severity of loans with PMI is 40 percent lower than [loans] without.”

Loss Severity for GSE Loans with and without PMI, by Origination Year Groupings

Sources: Fannie Mae, Freddie Mac, and the Urban Institute.

Note: GSE = government-sponsored enterprise; PMI = private mortgage insurance. The GSE credit data are limited to 30-year fixed-rate, full documentation, fully amortizing mortgage loans. Adjustable-rate mortgages and Relief Refinance Mortgages are not included. Fannie Mae data include loans originated from the first quarter of 1999 (Q1 1999) to Q4 2015, with performance information on these loans through Q3 2016. Freddie Mac data include loans originated from Q1 1999 to Q3 2015, with performance information on these loans through Q1 2016.

This data, coupled with the more than $50 billion in claims our industry paid since the GSEs entered conservatorship—which represents over 97% of valid claims paid, underscores how MI provides significant first-loss protection for the government and taxpayers. By design, MI provides protection before the risk even reaches the GSEs’ balance sheets. As the government explores ways to further reduce mortgage credit risk while also ensuring Americans continue to have access to affordable home financing, the data shows private MI is an important solution.

The MI industry, like nearly all other industries in financial services, was tested like never before through the financial crisis. Urban’s report acknowledges the challenges the industry has overcome from the financial crisis and the opportunities ahead for the industry. Coming out of the crisis, the MI industry is even stronger with more robust underwriting standards, stronger capital positions, and improved risk management. Additionally, in the last two years, private mortgage insurers have materially increased their claims paying ability in both good and bad economic times due to new higher capital standards under the Private Mortgage Insurance Eligibility Requirements (PMIERs).

Urban notes that the industry “should be more resilient going forward” because of the important changes applied to the industry today – including the enhanced capital, operational, and risk standards ‒ and highlights the broad agreement among parties studying GSE reform for the need to reduce the government’s footprint and increase the role of private capital. These developments have helped strengthen the industry and new reforms can allow MI to take on an even greater role to continue protecting taxpayers and expanding access to homeownership for the next 60 years and beyond.