By Lindsey Johnson

While the housing finance system in the United States has developed into an ad hoc set of entities and programs, so has the regulatory system around it with more than seven[i] federal agencies playing a role in the formation of policy and regulation of activities for housing finance. Despite the expansive reach of the federal government in the housing finance system and the exhaustive list of government agencies regulating it, safety and soundness gaps exist, access to credit remains tight, and potential homeowners continue to fall through the cracks. Housing policy has become political in addition to being complex and has therefore created an environment where meaningful reforms are rarely achieved. However, the outcome of the historic 2016 election means that one party will control all three branches of government starting in 2017, which presents a unique opportunity to examine the underpinnings of the housing finance system and establish a more comprehensive and coordinated approach to housing policy, rather than just tinkering around the edges of the mortgage finance industry.

Here are three overarching housing considerations and recommendations for the new Congress and Administration:

- There is a need for more coordinated, comprehensive, and transparent federal housing policy.

- All attempts to reform the housing finance system should fix the parts of the system that were and are broken, while enhancing the parts of the system that work. Part of the solution to fix what is broken is to identify and address areas of inconsistency and redundancy.

- Private capital should play a much greater role in the housing finance system. There should be a regulatory body that sets safety and reliability rules for market players on an equitable basis. Further private capital, not government and taxpayers support, should be encouraged to provide access to credit and protect against credit risk where possible in the housing finance system.

Since major housing policy tends to be reactionary and seldom comprehensive, inconsistencies and overlaps have developed resulting in dramatic shifts between the completely private market (PLS market), the semi-government backed market (conventional market via Fannie Mae and Freddie Mac), and the fully government-backed Ginnie Mae market (FHA, VA, and USDA). One such area of inconsistency is in low downpayment lending, which is increasing as a proportion of the overall residential mortgage market. Currently, a single borrower is subject to different requirements and pays different premium rates for insurance or a guarantee on a low downpayment loan under private mortgage insurance (MI), the FHA, the USDA’s Rural Housing Service, the Department of Veterans Affairs, or state Housing Finance Agency programs—even though the borrower’s risk profile remains the same.

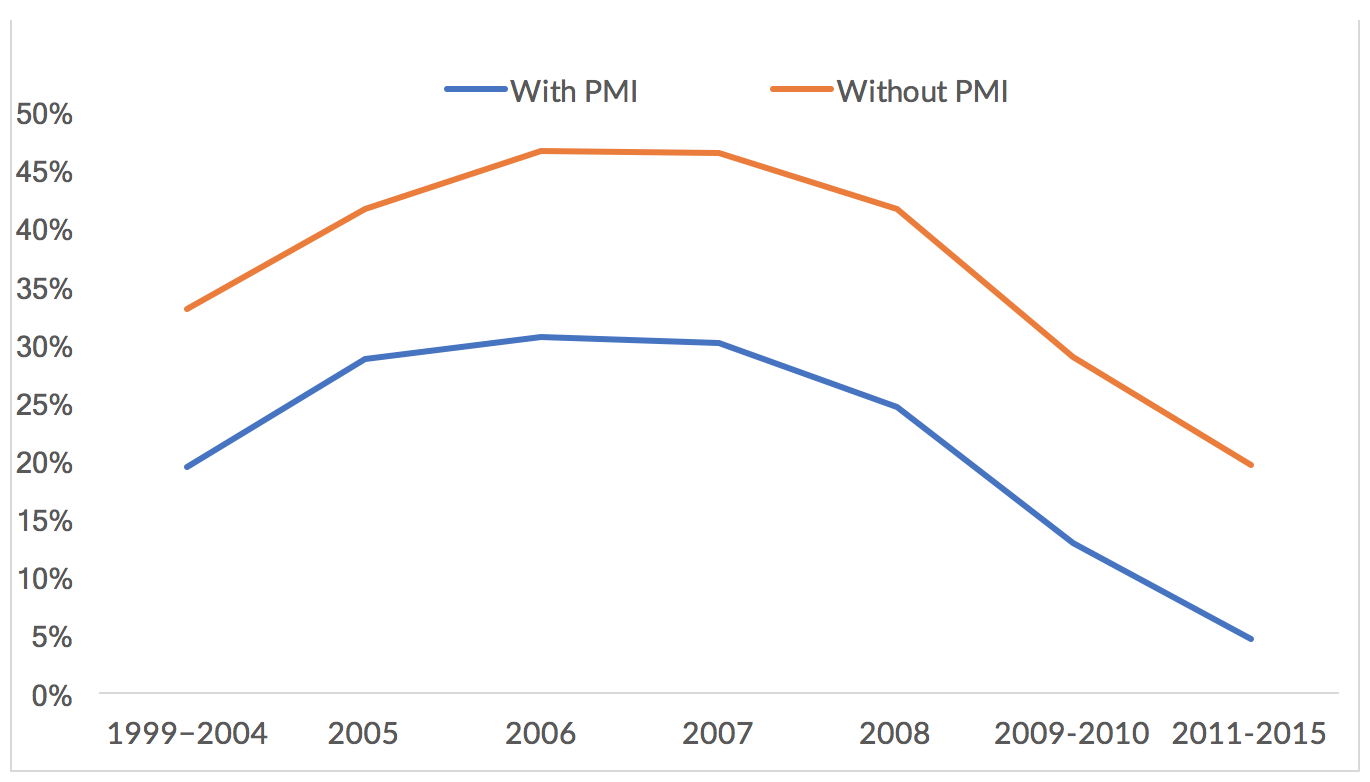

A coordinated policy would inform how low downpayment lending in the U.S. is carried out. For example, it is common in other types of insurance such as crop, flood and terrorism insurance, to limit government programs to higher risk borrowers or to condition access to supplemental capacity by requiring some demonstration of the need for that capacity. The FHA’s current loan limits do not provide a level playing field nor is there a direct preference for a private capital alternative. Instead, any preference is done indirectly through premium rate setting and competition, which results in an unstable policy environment. The resulting outcome is dramatic fluctuations between these mortgage finance markets, which at times is most evident between the private mortgage insurance market and the 100% government-backed mortgage insurance market at FHA. While it may seem normal to have some fluctuations during different housing cycles, the recent market fluctuations have most often been the result of competition for market share between the two. This is neither conducive for the most efficient and effective mortgage finance market nor does it ensure that borrowers are being best served. Furthermore, there are redundancies and significant overlap between several government agencies such as FHA and the Rural Housing Service (RHS), where on repeated occasions the GAO[ii] and others have suggested consolidating the agencies or at least specific areas of intersection between them.

Of course a true comprehensive, coordinated housing policy will require reform of the GSEs—or as previously stated, fixing the parts of the housing finance system that were and are broken while enhancing the parts of the system that work. Although housing finance reform may not be the first focus of the new Congress and Administration, significant steps could be taken in the near-term to encourage greater reliance of private capital and market discipline in the housing finance system by establishing clarity about the roles of the different agencies in facilitating homeownership and by providing much greater transparency at both FHA and the GSEs about how these agencies price credit risk. Again, this difference between agencies is particularly sharp in the case of FHA and the conventional lending space with Fannie Mae and Freddie Mac, which use private capital, such as private MI, to insure against a portion of first-loss on high LTV loans. However, in this case, a single borrower either pays a premium rate determined on an average basis (FHA) or a risk-based one (private MI), with the risk-based premium driven by “asset requirements” established by the government-guaranteed GSEs but not by the government-guaranteed FHA. So while there continues to be bipartisan support for reducing the government’s footprint and reducing taxpayers’ exposure to mortgage credit risk, the current market’s inconsistencies are considerable roadblocks to achieving that goal.

There are a number of different proposals for reforming the housing finance system, but most essential going forward is that Congress fixes one of the greatest flaws of the previous and current system, namely that government-backed entities – whether completely government controlled such as FHA or quasi-government such as the GSEs – should not set rules for and then compete on an unlevel playing field with the private market. These entities should perform explicit functions that foster greater participation by the private market, should promote a race-to-the top and not a race-to-the-bottom, and should be highly regulated. They should also be completely transparent in the credit risk they guarantee and how they price that credit risk. Transparency about how government prices credit risk would facilitate the greatest level of liquidity in these markets, and for credit risk transfer would foster an understanding of how these transactions are priced and the best execution for each. Finally, providing greater transparency will help end a structure where only a few agencies control the housing finance system because of their ownership of proprietary data, systems, and pricing. In conservatorship, the GSEs have an explicit guarantee on their Mortgage Backed Securities from the federal government. Therefore, until comprehensive housing finance reform is realized, critical steps could be taken now to improve transparency and foster greater understanding by market participants that will ultimately better inform borrowers. More transparent pricing will benefit lenders, investors, and most of all consumers and taxpayers.

As stated by former FHFA Director Ed DeMarco, housing finance reform “remains the great unfinished business from the Great Recession.” The complexity and political nature of the issues surrounding housing finance reform make it a daunting task to be sure, but the new Administration and Congress have a unique opportunity to make the housing finance system more coordinated, transparent, and disciplined to work for taxpayers and borrowers.

[i] Federal agencies involved with housing finance policy and regulation include FHFA, HUD, VA, USDA, Treasury, NCUA, and CFPB

[ii] U.S. Government Accountability Office, HOME MORTGAGE GUARANTEES: Issues to Consider in Evaluating Opportunities to Consolidate Two Overlapping Single-Family Programs (September 29, 2016). See http://www.gao.gov/assets/690/680151.pdf.