It is a common misconception that a 20 percent down payment is required to buy a home. Advice to wait and save a large down payment is often based on the theory that the cost of mortgage insurance (MI), which is required when you buy with a smaller down payment, should be avoided. This may not be the best advice and is, in fact, not in line with market trends, considering 60 percent of homebuyers buy with a down payment of 6 percent or less, according to the National Association of Realtors.

Yes, you can qualify for a conventional mortgage with a down payment as small as 3 percent of the purchase price. It is also true that you can reduce your monthly mortgage payment by paying for discount points at closing, but that can be 5 or 10 percent of the purchase price — not 20. And because every buyer’s situation is unique, it’s important to do the math. In today’s market, it could take a family earning the national median income up to 20 years to save 20 percent, according to calculations by U.S. Mortgage Insurers using a methodology developed by the Center for Responsible Lending; a lot can change during that time, in the family’s personal finances and in overall mortgage market trends.

How can buying now save you money later?

Consider you want to purchase a $235,000 home. A 5 percent down payment is $11,750 versus $47,000 in cash for 20 percent down. With a 740 credit score at today’s MI rates, your monthly MI payment would be about $110, which is added to your monthly mortgage payment until MI cancels. MI typically cancels after five years; therefore, you will only have this added cost for a short period of time versus waiting an average of 20 years to save for 20 percent.

With home price appreciation, today’s $235,000 home will likely cost more in the years ahead and this will also have an impact on the necessary down payment and length of time required to save for it. There are other variables in the equation too, such as interest rates. As federal rates rise, so too can the costs associated with financing a mortgage. The savings a borrower might calculate today could be altogether negated by waiting even a few more years. Another factor is that rents are on the rise across the nation, leading to a reduced capacity for many would-be homebuyers to save for larger down payments.

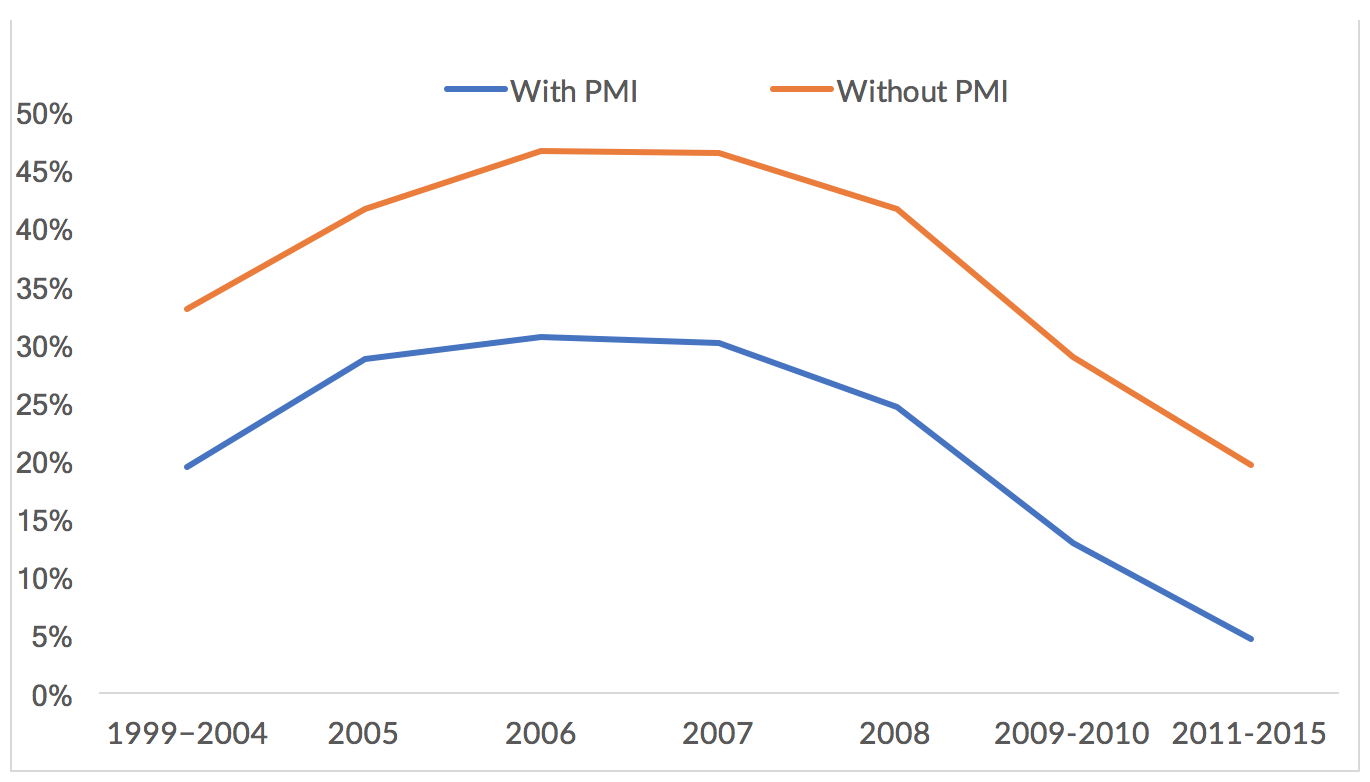

If you decide to buy today with a low down payment mortgage option, it is true that MI is an added cost on top of mortgage principal and interest, but keep in mind that it is temporary and goes away. Again, it typically lasts about five years. Private MI can be cancelled once a homeowner builds approximately 20 percent equity in the home through payments or appreciation and automatically terminates for most borrowers once he or she reaches 22 percent equity. And when MI is cancelled, the monthly bill goes down. Importantly, the insurance premiums on an FHA mortgage — the 100 percent taxpayer-backed government version of mortgage insurance — cannot be cancelled for the vast majority of borrowers with FHA mortgages.

So, do the math and let the numbers guide you. There are many online mortgage calculators that can help. Check out lowdownpaymentfacts.org to learn more.