October has been a busy month in housing finance. Last week, USMI issued a new report on the strength and resiliency of the private mortgage insurance (MI) industry. The report highlights regulatory and industry-led reforms since the 2008 financial crisis which have enabled it to better serve homebuyers and lenders. It also continued to urge the Federal Housing Finance Agency (FHFA) to develop policies for the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, to promote a more stable and equitable housing finance system post-conservatorship. While all eyes are on the election this week, below are other important issues USMI is tracking:

New USMI Report Released on MI Industry

USMI Blog on FHFA Re-Proposed Enterprise Regulatory Capital Framework (ERCF) and Strategic Plan

USMI’s Comments on FHFA Strategic Plan

FHFA Proposed Rule for New Enterprise Products and Activities

Urban Institute Releases October 2020 Chartbook

USMI President on “Main St. Finance” Podcast

ICYMI: CFPB Extends QM Patch

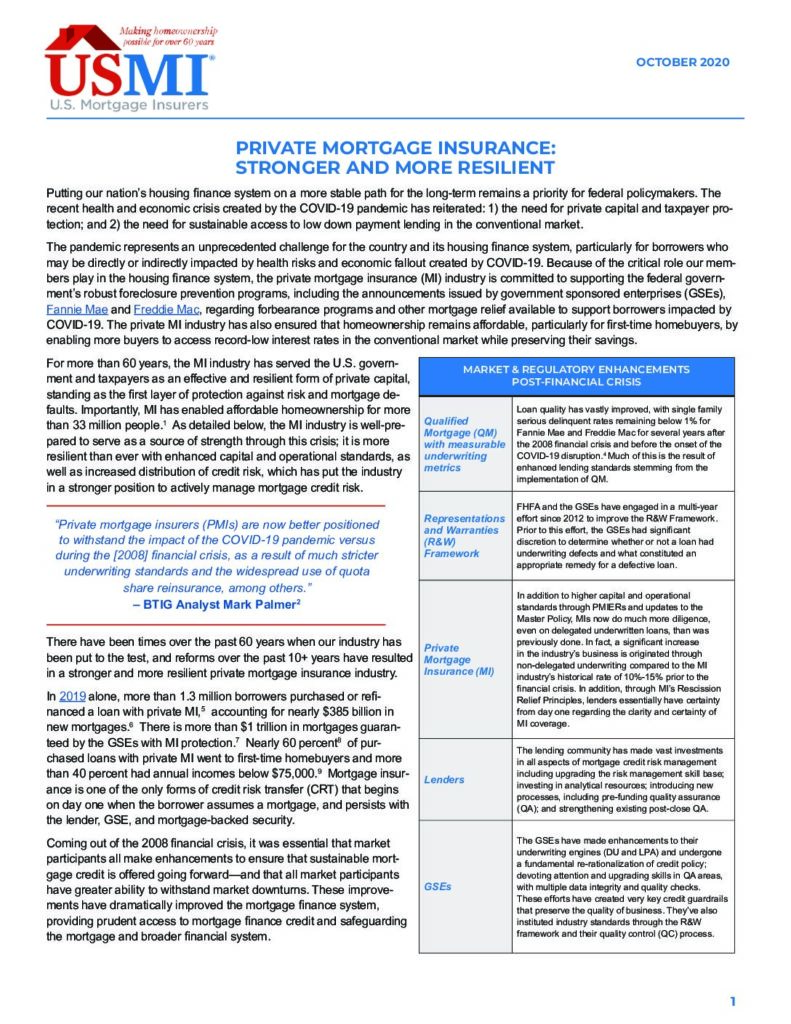

- New USMI Report Released on MI Industry. Last week, USMI released a new report titled, “Private Mortgage Insurance: Stronger and More Resilient.” The report highlights significant regulatory and industry-led reforms taken since the 2008 financial crisis to improve and strengthen the role of private MI in the nation’s housing finance system. It analyzes the various steps the industry and regulators have undertaken and continue to take to ensure sustainable mortgage credit through all market cycles and to better serve low down payment borrowers in the conventional market, especially during critical economic times like these.

Upon the report’s release, USMI President Lindsey Johnson said, “Though private mortgage insurers have been a crucial part of the housing finance system for more than 60 years, this is definitely ‘not your father’s’ MI industry. Enhanced capital and operational standards, as well as increased active management of mortgage credit risk, including through the distribution of credit risk to the global reinsurance and capital markets, has put the industry in a stronger position.” She added, “These enhancements will enable the industry to be a more stabilizing force through different housing cycles — including the current COVID-19 crisis — which greatly benefits the GSEs and taxpayers and enhances the conventional mortgage finance system.”

The report details several of the major enhancements to the industry in the last decade, including: Private Mortgage Insurer Eligibility Requirements (PMIERs); New Master Policy; Rescission Relief Principles; and MI Credit Risk Transfer (MI-CRT) Structures. The report provides an update on the growing MI-CRT market, noting that as of October 2020, private MI companies have transferred nearly $41.4 billion in risk on approximately $1.8 trillion of insurance-in-force (IIF) since 2015 using 23 reinsurance deals and 30 insurance-linked note (ILN) transactions.

- USMI Blog on FHFA Re-Proposed ERCF and Strategic Plan. This week, USMI published a blog titled, “Capital Alone is Not Comprehensive Housing Finance Reform: More Administrative Actions are Required & FHFA’s Re-Proposed Capital Framework Should be Modified.” The piece emphasizes the importance of the appropriate level of capital for Fannie Mae and Freddie Mac, but also the need for additional reforms prior to the GSEs’ exit from conservatorship. FHFA’s re-proposed ERCF will guide FHFA as it works to release the GSEs from conservatorship. As proposed, the ERCF would require the GSEs to hold about 10 times their current capital levels ($243 billion versus $28 billion, respectively, as of Q2 2020) and roughly five times their projected losses under a severe economic downturn. USMI submitted its comment letter on the re-proposed ERCF in August 2020 and published an executive summary as well.

USMI agrees that a robust and appropriately tailored capital standard for the GSEs is necessary and should strike the right balance to ensure consumers’ continued access to affordable mortgage credit while also protecting taxpayers. However, the ERCF has several overly conservative elements, such as the treatment of private MI and CRT transactions, as well as numerous non-risk adjusted capital buffers. Instead, USMI suggests FHFA should reduce or eliminate non-risk based elements and build the capital rule around an insurance framework, given the GSEs’ core function is a guaranty business. The framework should ultimately ensure adequate capital for the risks taken by the GSEs, but should not be set to an arbitrarily high level that puts homeownership out of reach for many American families.

- USMI’s Comments on FHFA’s Strategic Plan. USMI’s blog also discusses USMI’s recommendations for FHFA’s Strategic Plan for Fiscal Years 2021-2024. USMI welcomes FHFA’s work on a post-conservatorship capital framework, but notes that it is important to recognize that capital alone is not comprehensive GSE reform, and additional actions are necessary to reform the housing finance system and put it on more stable footing for the long-term.Earlier this month, USMI submitted a comment letter to FHFA on its Strategic Plan. In its comment, USMI recommended that FHFA take further steps to reduce the GSEs’ risk exposure, level the playing field, and increase transparency around the GSEs’ pricing and business operations. USMI called for FHFA to take five specific actions in advance of the GSEs’ exit from conservatorship:

- Limit the GSEs’ activities to those necessary to fulfill their intended role of facilitating a liquid secondary market for mortgages, preserving the “bright line” separation between the primary and secondary mortgage markets;

- Increase transparency around the GSEs’ operations, credit decisioning, technologies, and role in the housing finance system;

- Require a “notice and comment period” process and prior approval for new products and activities at the GSEs;

- Require that counterparty standards be set by or in coordination with FHFA, and not just the GSEs; and

- Promote a clear, consistent, and coordinated housing finance system.

- FHFA Proposed Rule for New Enterprise Products and Activities. Last week, FHFA released a proposed rule concerning “Prior Approval for Enterprise Products” that would require the GSEs to provide notice to FHFA before undertaking a new activity and obtain prior approval from FHFA before offering a new product. USMI welcomes Director Calabria’s effort to establish a more transparent and objective process for the development and implementation of new GSE products and activities. USMI further believes that the GSEs should only introduce new products, activities, and pilots when there is clear and compelling evidence that the GSEs are needed to fill a market void that the private market cannot meet. This rule would allow a rigorous review of the GSEs’ efforts and ensure that the GSEs’ activities are not duplicative nor unfairly competitive with the primary and private market participants.

In response to the release of the proposed rule, the National Taxpayers Union (NTU) published a blog titled, “Latest GSE Rule Protects Taxpayers and Businesses from Government Overreach.” NTU praised the rule as it would “help to ensure that the GSEs are neither crowding out private market competitors nor expanding obligations back-stopped by taxpayers.” NTU said the proposed rule is a “constructive step that protects taxpayers and private businesses from government overreach.”

- Urban Institute Releases October 2020 Chartbook. This week, the Urban Institute published its October chartbook on housing finance. Included in this comprehensive analysis of industry data are updates on the MI industry, beginning on page 32. The Chartbook highlights that “Mortgage insurance activity via the FHA, VA and private insurers increased from $197 billion in Q2 2019 to $327 billion in Q2 2020, a 57.4 percent increase. In the second quarter of 2020, private mortgage insurance written increased by $51.3 billion, FHA increased by $17.2 billion and VA increased by $56.4 billion relative to Q2 2019.”

- USMI President on “Main St. Finance” Podcast. USMI’s members work to help low down payment borrowers have access to affordable mortgage credit. To share that message, USMI President Lindsey Johnson joined the “Main St. Finance” podcast to discuss the 20 percent down payment myth and the different low down payment options available to borrowers. Specifically, she explained how private MI bridges the down payment gap to help home-ready buyers get in their home sooner while also protecting lenders, the GSEs, and taxpayers from mortgage credit-related losses. Listen to podcast here.

- ICYMI: CFPB Extends GSE Patch. On October 22, the Consumer Financial Protection Bureau (CFPB) issued a final rule to extend the GSE Patch until the CFPB implements a new General Qualified Mortgage (QM) definition. USMI previously submitted a comment letter on the Bureau’s proposed updates to the General QM definition, as well as a comment letter which recommended the CFPB set the sunset date for the GSE Patch to be at least six months after the effective date of the General QM definition final rule.