Letter: USMI Joins Call for Reduction in Unnecessary GSE Fees on Borrowers

For Immediate Release

June 22, 2016

Media Contacts

Laura Capicotto (202) 777-3536 (lcapicotto@clsstrategies.com)

USMI Joins Call for Reduction in Unnecessary GSE Fees on Borrowers

Consumer and Industry Groups United for Lower LLPAs

(June 22, 2016) – Today, U.S. Mortgage Insurers (USMI) joined 25 financial services and residential real estate trade associations and consumer groups, including the National Association of Realtors, Mortgage Bankers Association, National Association of Home Builders, Credit Union National Association, as well as the Center for Responsible Lending and Consumer Federation of America, in a letter to Federal Housing Finance Agency (FHFA) Director Mel Watt calling for Fannie Mae or Freddie Mac (the government sponsored enterprises, or “GSEs”) to reduce or eliminate loan level price adjustments (LLPAs) charged by the GSEs.

“Housing credit remains too tight and too many qualified borrowers are unable to get access to affordable mortgage credit, in large part because the GSEs are still charging LLPAs eight years after the financial crisis,” said Lindsey Johnson, USMI President and Executive Director. “Low down-payment borrowers are being double charged for the risk being assumed by private mortgage insurance (MI). These additional fees are particularly burdensome for low- and moderate-income and first-time homebuyers. It’s time borrowers get the full benefit of the credit risk transferred away from the GSEs to private capital in the form of MI.”

For a copy of the joint letter, click here.

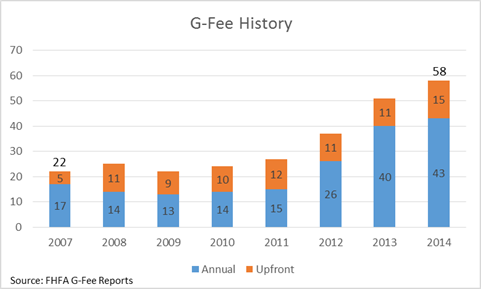

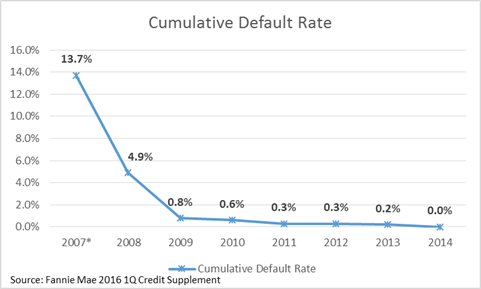

Guaranty fees (or “G-fees”) are fees charged by the GSEs on individual loans they purchase to cover any losses in the event of a default. LLPAs are additional fees first introduced by the GSEs in 2008, during the financial crisis. Borrowers often pay LLPAs in the form of higher mortgage rates. LLPAs continue to be charged nearly eight years later despite significant improvement in the credit quality of GSE-backed loans and strengthened participants in the mortgage finance industry, including lenders and private mortgage insurers. In fact, GSE fees, including LLPAs, are currently two and half times higher than during the mortgage crisis, while the cumulative default rate has decreased from 13.7 percent to near zero.

Low down-payment loans purchased by the GSEs are already covered by MI, which provides the GSEs with substantial protection against first losses on these loans, reducing GSE and taxpayer risk exposure. Mortgage Insurers (MIs) covered more than $50 billion in claims to the GSEs since conservatorship, resulting in substantial savings to taxpayers. MIs have raised $9 billion in new capital since the financial crisis and implemented the Private Mortgage Insurers Eligibility Requirements (PMIERs), a new, rigorous set of capital standards established by the GSEs. The MI industry covers first loss mortgage credit risk ahead of the taxpayers and is ready to do more. Accordingly, FHFA should ensure that the GSEs price credit risk in a manner that is transparent and that reduces arbitrary or unnecessary borrower costs.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.