News Filter: Newsletter

Newsletter: December 2021

With the recent passage of the bipartisan infrastructure bill, Congress has moved onto the Build Back Better Act, which includes approximately $170 billion in funding for housing initiatives. On December 1, a bill was introduced in the House to make permanent and expand eligibility for the federal tax deduction of mortgage insurance (MI) premiums. USMI recently submitted two comment letters to the Federal Housing Finance Agency (FHFA) on its proposed “Amendments to the Enterprise Regulatory Capital Framework Rule,” and its “Enterprise Equitable Housing Finance Plans.” Finally, USMI published a new blog examining the costs that are often additional and unanticipated by prospective homeowners. We delve into these developments and more below.

Build Back Better Act

The Middle Class Mortgage Insurance Premium Act of 2021

USMI Submits Comment Letter on FHFA’s Proposed Amendments to the Enterprise Regulatory Capital Framework

USMI Submits Comment Letter on FHFA’s Enterprise Equitable Housing Request for Input

New Blog: Hidden Costs Harmful to Homeownership

What We’re Reading

Nominations We’re Watching

ICYMI: USMI Member Spotlight – Essent

Build Back Better Act. The House passed the $1.75 trillion Build Back Better (BBB) Act on November 19, sending the social spending bill to the Senate. The legislation allocates about $170 billion to provisions for affordable housing. According to the Biden administration, this would be the largest investment in affordable housing in history and it will mean the construction or preservation of more than 1 million affordable homes. BBB, in its current form, would provide funding for numerous homeownership initiatives, including: $10 billion for first-generation first-time homebuyer down payment assistance (DPA) based on House Financial Services Committee Chairwoman Maxine Waters’ (D-CA) “Downpayment Toward Equity Act”; $10 billion for the U.S. Department of Housing and Urban Development’s (HUD) HOME Investment Partnerships Program to fund building, buying, and/or rehabilitating affordable housing for rent or homeownership; $5 billion for wealth-building loans (20-year subsidized mortgages) for first-generation first-time homebuyers based on Sen. Mark Warner’s (D-VA) “Low-Income First-Time Homebuyers Act” (LIFT Act); $1.75 billion for a new “Unlocking Possibilities” zoning and land use reform program; $800 million for fair housing activities; and $100 million for a pilot program at HUD to expand small-dollar mortgage options for homebuyers purchasing homes at $100,000 or less.

The Middle Class Mortgage Insurance Premium Act of 2021. On December 1, Reps. Ron Kind (D-WI) and Vern Buchanan (R-FL) introduced legislation that would make permanent and expand eligibility for the deduction of MI premiums from federal income taxes. USMI released a statement writing that the legislation “is smart public policy that benefits potentially millions of existing homeowners…Since 2007, the ability to deduct the cost of MI premiums has helped to put extra dollars back into the hands of millions of families each year and we strongly support legislation to make the tax deduction permanent.” MI deductibility has enjoyed broad bipartisan support, dating back to when the bill was originally introduced in 2005, and continues to have broad housing industry support, including from the Mortgage Bankers Association, National Association of Home Builders, National Association of REALTORS®, and National Housing Conference. National Mortgage News, DS News, Financial Regulation News and InsuranceNewsNet.com published articles on the proposed legislation that quote the bill’s sponsors and USMI.

USMI Submits Comment Letter for FHFA’s Proposed Amendments to the Enterprise Regulatory Capital Framework. On November 23, USMI submitted a comment letter on FHFA’s Notice of Proposed Rulemaking (NPR) on “Amendments to the Enterprise Regulatory Capital Framework (ERCF) Rule – Prescribed Leverage Buffer Amount and Credit Risk Transfer.” In its letter, USMI recommends that FHFA adjust the credit risk transfer (CRT) minimum risk weight floor to lower than 5 percent, consider alternative methods to determine the Prescribed Leverage Buffer Amount (PLBA), reduce the single-family risk weight floor to 10 percent or less, and make changes to the Countercyclical Adjustment. These recommendations are outlined further in USMI’s executive summary to the comment letter.

Most comments to the NPR support the proposed changes by FHFA to CRT and the PLBA. On the PLBA, many respondents note that the proposed changes would make the framework more risk-based and prevent the PLBA from being the typical binding requirement. On the proposed changes to reduce the minimum risk weight floor for CRT from 10 to 5 percent, most commenters generally supported the reduction and some suggested it be reduced or refined further. Most commenters also supported the removal of the overall effectiveness adjustment for CRT. In addition, many responses – including from insurance agency Guy Carpenter, Freddie Mac, and the Housing Policy Council – support reducing the single-family risk weight floor below the current 20 percent in the final rule. Further, several other organizations – including Urban Institute, Center for Responsible Lending, National Community Stabilization Trust, National Housing Conference, Consumer Federation of America, Leadership Conference and the National Association of REALTORS® – express concerns with the current Countercyclical Adjustment and recommend FHFA revisit this element within the final rule to ensure it will not have unintended consequences.

In a press release, USM President Lindsey Johnson is quoted saying, “We appreciate the work FHFA has undertaken to date to provide for minimum capital requirements for the Enterprises, including the December 2020 final rule to establish a post-conservatorship capital framework. While a robust framework is necessary to ensure the stability of the housing finance system, overly stringent requirements or ones that inaccurately reflect the risks of the assets held by the Enterprises can be disruptive. It is critical FHFA creates a capital framework that strikes an appropriate balance between maintaining borrowers’ access to affordable mortgage credit and ensuring the Enterprises and taxpayers are protected from risk.”

USMI Submits Comment Letter on FHFA’s Enterprise Equitable Housing Request for Input (RFI). On October 25, USMI submitted a comment letter to FHFA’s RFI on “Enterprise Equitable Housing Finance Plans” (the Plans), which articulates a framework by which the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, will be required to prepare and implement three-year plans to advance equity in housing finance. USMI writes in its letter that it “commends the FHFA for soliciting feedback on the Plans to identify the barriers to sustainable housing opportunities, set goals to address those barriers, and implement policies to address them. The private MI industry welcomes the opportunity to work with FHFA, the GSEs, and other housing finance stakeholders to support the Biden Administration’s goal of a comprehensive approach to advancing equity for all.” In its comment letter, USMI specifically recommends that FHFA review and reform loan-level price adjustments (LLPAs); review and revise the ERCF; modify the Preferred Stock Purchase Agreements (PSPAs); finalize the new products and activities rule; and provide greater data and transparency to address longstanding inequities in the housing finance system.

New Blog: Hidden Costs Harmful to Homeownership. In USMI’s latest blog on its 2021 National Homeownership Market Survey, we examined the way hidden or unanticipated costs impact homeownership. Home prices are increasing at historic levels and consumers expect both home prices and mortgage interest rates to increase over the next year. Sixty percent of respondents to the survey believe minorities face added homebuying costs because they tend to have lower credit and higher debt according to the survey. The survey also found that 60 percent of respondents believe reducing costs for low down payment homebuyers is the most important item for the homebuying process and 37 percent support cutting hidden costs on mortgages.

What We’re Reading. On December 2, Fannie Mae released a report titled, “Barriers to Entry: Closing Costs for First-Time and Low-Income Homebuyers,” which analyzed the costs associated with closing a mortgage loan and presented potential solutions to reduce certain closing costs for specific borrowers, where these additional costs may act as a barrier to homeownership. Based on a sample of 1.1 million conventional purchase mortgages acquired in 2020, Fannie Mae found that “median closing costs as a percent of home purchase price were 13 percent higher for low-income first-time homebuyers than for all homebuyers, and 19 percent higher than for non-low-income repeat homebuyers.”

Nominations We’re Watching. Julia Gordon, the nominee to lead the Federal Housing Administration, is still waiting on a full Senate vote. Meanwhile, the Senate Committee on Banking, Housing, and Urban Affairs on December 2 favorably reported via voice vote the nomination of Alanna McCargo to serve as the president of Ginnie Mae.

ICYMI: USMI Member Spotlight – Essent. In case you missed it, Essent Chairman and CEO Mark Casale was featured on our member spotlight. Casale shared his thoughts on Essent’s views on the housing market as we come out of the COVID-19 pandemic, the continued evolution of the private MI industry and the role of innovation, and how this evolution will better serve borrowers and the housing finance system. Read the full Q&A here.

Newsletter: October 2021

Autumn has arrived and Congress is in high gear as House and Senate Democrats work to advance their bipartisan infrastructure bill, despite being at odds over the size and scope of the budget reconciliation package. In addition, on Congress’ near-term to-do list is addressing the nation’s debt ceiling. The Administration’s housing access and affordability efforts have also gathered steam, most notably with the White House, Federal Housing Finance Agency (FHFA), and U.S. Department of Housing and Urban Development (HUD) making several announcements related to housing supply and fair lending last month, including a Memorandum of Understanding (MOU) announced on fair lending enforcement between FHFA and HUD.

September also marked the start of Hispanic Heritage Month, which runs through October 15. This month provides an opportunity to recognize the significant contributions and influence of Hispanic Americans to the history, culture, and achievements of the United States. In honor of Hispanic Heritage Month, USMI dove deeper into today’s Hispanic homeownership market and how it will shift in the future. We further detail these and more developments below.

Hispanic Homeownership: How the Hispanic Population Growth Helps Drive the Homeownership Market

Hispanic Heritage Month Industry Leader Q&A: Marisa Calderon

Developments at FHFA

White House Plan to Address Housing Supply Agenda

Budget Reconciliation Package Makes Progress

Nominations and Confirmations

What We’re Watching: Housing Finance Strategies and National Housing Conference Panels

What We’re Reading: MBA Path to Diversity Scholarship Q&A

Hispanic Homeownership: How the Hispanic Population Growth Helps Drive the Homeownership Market. On September 15, the first day of Hispanic Heritage Month, USMI published a blog post on Hispanic homeownership, the impact this demographic is having in today’s market, and the various challenges this population faces in attaining the American Dream of owning a home. Over the last few years, the Hispanic population has been a key component in the growth of the homeownership market in the U.S., and it is projected to be the demographic group leading this segment of the industry for the next several decades. We also referenced data from our 2021 National Homeownership Market Survey, which provides greater insights into perceptions and challenges pertaining to the housing market and homebuying process. This blog post was also posted in Spanish, and was featured in National Mortgage Professional and Insurance News Net.

Hispanic Heritage Month Industry Leader Q&A: Marisa Calderon. In honor of Hispanic Heritage Month, USMI reached out to Hispanic leaders in the mortgage industry to discuss their work and perspectives on the goal of increasing Hispanic homeownership in America. Marisa Calderon, Executive Director of National Community Reinvestment Coalition’s (NCRC) Community Development Fund and a housing and financial services industry veteran, recently shared with USMI her thoughts on these issues and others, relating to the mortgage finance sector in 2021 and beyond. Read the full Q&A here.

Developments at FHFA. Under Acting Director Sandra Thompson, FHFA has announced a number of changes and proposals designed to increase access and affordability for borrowers.

- On August 11, FHFA announced that Fannie Mae will consider 12 months of positive rental payment history in its risk assessment processes for loans that would otherwise be ineligible for acquisition due to thin or nonexistent borrower credit history. Speaking about the announcement, Acting Director Sandra Thompson said, “[w]ith this update, Fannie Mae is taking another step toward understanding how rental payments can more broadly be included in a credit assessment, providing an additional opportunity for renters to achieve the dream of sustainable homeownership.”

- On September 7, FHFA announced that the government sponsored enterprises (GSES or Enterprises), Fannie Mae and Freddie Mac, will be required to submit Equitable Housing Finance Plans to the Agency by the end of 2021. The plans will aim to identify and address barriers to sustainable housing opportunities, including the GSEs’ goals and action plans to advance equity in housing finance for the next three years. FHFA released a Request for Input (RFI) on the Enterprises Equitable Housing Finance Plans that is due on October 25. FHFA also held a listening session on September 28 soliciting additional input from stakeholders. Speakers detailed several recommendations for FHFA to enhance the plans, as well as other actions FHFA and the GSEs might take to combat the racial homeownership gap and possible fair lending violations, including focuses on targeted down payment assistance, reviewing and reassessing loan level pricing adjustments (LLPAs), and additional changes to the GSEs’ final capital rule than those that were proposed by FHFA in September 2021 among others.

- On September 14, the FHFA and the U.S. Department of the Treasury suspended certain provisions added to the Preferred Stock Purchase Agreements (PSPAs) with Fannie Mae and Freddie Mac on January 14, 2021. In the announcement about the suspended provisions, Acting Director Sandra Thompson said, “this suspension will provide FHFA time to review the extent to which these requirements are redundant or inconsistent with existing FHFA standards, policies, and directives that mandate sustainable lending standards.”

- Lastly, on September 15, FHFA announced that it is seeking comment on a Notice of Proposed Rulemaking (NPRM) that would amend the Enterprise Regulatory Capital Framework (ERCF) for Fannie Mae and Freddie Mac. The proposed amendments would “refine the prescribed leverage buffer amount (PLBA) and the capital treatment of credit risk transfers (CRT) to better reflect the risks inherent in the Enterprises’ business models and to encourage the distribution of credit risk from the Enterprises to private investors.”

On August 31, 2020, USMI submitted a comment letter on FHFA’s Proposed Rule on ERCF emphasizing the importance of constructing a balanced, transparent, and analytically justified post-conservatorship capital framework for the GSEs.

White House Plan to Address Housing Supply. On September 1, the White House announced a plan to increase affordable housing supply as part of President Biden’s “Build Back Better” agenda. While Congress works on the budget reconciliation and bipartisan infrastructure bills, the White House’s plan includes provisions such as relaunching the Federal Financing Bank and HUD risk sharing program, increasing Fannie Mae and Freddie Mac’s low-income housing tax credit investment cap, and making funding available for affordable housing production under the Capital Magnet Fund.

Budget Reconciliation Package Makes Progress. A $3.5 trillion reconciliation bill passed the House Budget Committee on September 25. The House Financial Services Committee (HFSC) held a markup in mid-September for its portion of the Build Back Better Act. The bill, passed by a vote of 30-24 on September 14, would provide for $322 billion in funding for new and existing federal housing programs, including: $90 billion for new rental assistance; $80 billion to address public housing capital backlog; $80 billion in housing supply investments; and $10 billion in first-time, first-generation homebuyer down payment assistance (DPA).

Nominations and Confirmations. On September 13, the White House announced that President Joe Biden intends to nominate Alanna McCargo for President of the Government National Mortgage Association (Ginnie Mae) at HUD and she is scheduled to testify before the Senate Committee on Banking, Housing, and Urban Affairs on October 7. USMI welcomed the decision and cited McCargo’s extensive experience in mortgage policy.

On September 21, the Senate voted 49-48 to discharge from the Senate Committee on Banking, Housing, and Urban Affairs the nomination of Rohit Chopra to head the Consumer Financial Protection Bureau (CFPB), and voted 50-48 to confirm him as CFPB Director on September 30. Lastly, the Committee also announced it would hold a hearing on October 5 to vote on several nominees, including Julia Gordon to serve as Federal Housing Administration (FHA) Commissioner.

What We’re Watching: Housing Finance Strategies and National Housing Conference Panels. On September 20, USMI President Lindsey Johnson joined a Housing Finance Strategies panel with several other housing industry leaders to discuss the Biden Administration’s changing regulatory environment, the transition to digital mortgages, and the remote workforce in the housing industry. The program is available here.

On September 30, Johnson joined a National Housing Conference (NHC) panel for a conversation on Fannie Mae and Freddie Mac’s role in affordable homeownership, housing reforms, and closing the racial homeownership gap. Johnson specifically shared the results from USMI’s 2021 National Homeownership Market Survey, which was released earlier this year. Watch the panel here.

What We’re Reading: MBA Path to Diversity Scholarship Q&A. USMI is proud to partner with the Mortgage Bankers Association (MBA) in support of their Path to Diversity Scholarship program, which has a strong record of increasing diverse representation in the housing finance industry. USMI President Lindsey Johnson spoke with MBA NewsLink for a Q&A session about the scholarship and its impact. Read more here.

Newsletter: July 2021

As the August recess approaches, there have been several notable developments in the housing finance industry. Policymakers and industry leaders continue to focus on top priorities including new homeowner protections, the bipartisan infrastructure deal, housing affordability and supply, and down payment assistance (DPA), among others. Further, during the past month, U.S. Mortgage Insurers (USMI) released its latest Member Spotlight highlighting a Q&A with Enact’s President and CEO, Rohit Gupta; a statement congratulating Julia Gordon on her nomination to serve as Federal Housing Administration (FHA) Commissioner; and published two blog posts noting and discussing the top findings from USMI’s 2021 National Homeownership Market Survey. Below are some of the key developments USMI has been following over the last month.

Bipartisan Infrastructure Deal

USMI’s 2021 National Homeownership Market Survey

USMI Member Spotlight: Enact CEO Rohit Gupta Talks About First-Time Homebuyers

USMI Joins Coalition Letter to Infrastructure Bipartisan Senate Group on Usage of G-Fees

USMI’s Statement on Julia Gordon’s Nomination as FHA Commissioner

Biden Administration Announces New Homeowner Protections

FHFA Dropping Fee Introduced During COVID-19

House Financial Services Committee Holds Hearing with HUD Secretary Marcia Fudge

What We’re Reading: Congressional Proposals to Increase Homeownership

Bipartisan Infrastructure Deal. On July 28, the $1.2 trillion infrastructure deal cleared a major procedural vote in the Senate. The 67-32 vote passed with support from all 50 Democrats and 17 Republicans. This vote allows the Senate to start the debate and amendment process to resolve outstanding issues. Draft legislative text of the bill circulated on Thursday; however, the bill’s authors noted today that the text has not yet been finalized. According to the draft text, the bill would provide about $550 billion in new federal money for roads, bridges, and other physical infrastructure programs. While agreement on final text and clearing final votes in the House and Senate remain, if passed, the bill would mean the largest infusion of federal money into public works in more than a decade.

USMI’s 2021 National Homeownership Market Survey. Following the June release of USMI’s 2021 National Homeownership Market Survey, fielded by ClearPath Strategies to 1,000 adults in the U.S., USMI published two blog posts titled, “National Homeownership Market Survey: Key Takeaways,” and “Top Homebuying Challenges: Affordability and Supply.” In these posts, USMI highlights that more than 7 in 10 respondents view owning a home as important for stability and financial security. In addition, nearly 7 in 10 respondents ranked the lack of affordable housing as the number one housing challenge, while nearly 6 in 10 stated that low housing supply is another top issue, all of which become more acute among minority and lower income homebuyers. The latest blog notes that just this week, “the Federal Housing Finance Agency (FHFA) released its Home Price Index and reported that home prices were up 1.7 percent in May, and up an astonishing 18 percent year over year. This significant home price appreciation is largely driven by the lack of housing supply in today’s market and is impacting borrowers’ access to homeownership across the country.”

USMI Member Spotlight: Enact CEO Rohit Gupta Talks About First-Time Homebuyers. Earlier this month, USMI talked with Rohit Gupta, President and CEO of Enact, formerly Genworth Mortgage Insurance (MI), about the company’s new brand as well as how it is better positioned to serve low down payment borrowers and the first-time homebuyer market. Gupta said that private MI “is imperative in order for borrowers with low down payments to have access to home mortgage financing options,” and noted that Enact’s First-Time Homebuyer Market Report shows how the housing finance system continues to perform well with the private MI industry ensuring access to credit for first-time homebuyers.

USMI Joins Coalition Letter to Bipartisan Senate Infrastructure Group on Usage of G-Fees. Last week,USMI joined a coalition of housing finance organizations, including Mortgage Bankers Association (MBA), National Association of REALTORS®, and National Housing Conference, in sending a letter to the bipartisan Senate group negotiating infrastructure legislation. In this letter, the coalition requested that lawmakers refrain from utilizing guarantee fees (g-fees) charged by the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, as a source of funding offsets. G-fees are charged by the GSEs and intended to cover the credit risk and other costs that the GSEs incur when they acquire single-family loans from lenders, and the consumer ultimately pays for these fees in their mortgage costs. It is important that future homeowners not be saddled with additional cost burdens, especially those from spending that is not housing-related. As representatives of institutions that span the entire housing finance ecosystem, the coalition reaffirmed the belief that g-fees should only be used as originally intended: “a critical risk management tool to protect against potential mortgage credit losses and to support the GSEs’ charter duties.”

USMI Statement on Julia Gordon’s Nomination as FHA Commissioner. On June 28, USMI released a statement on President Biden’s nomination of Julia Gordon to serve as FHA Commissioner. Gordon has broad experience in the housing finance system, specializing in supporting affordable homeownership and promoting consumer protection policies for underserved markets. USMI President Lindsey Johnson said, “[w]e look forward to working closely with Gordon in seeking to promote a complementary, collaborative, and consistent housing finance system that enables sustainable homeownership for American families while also protecting taxpayers.”

Biden Administration Announces New Homeowner Protections. Last week, the Biden Administration unveiled additional actions to prevent foreclosures, offering loan modifications and payment reductions for homeowners with government-backed mortgages to help them stay in their homes, as the federal ban on foreclosures is set to end on July 31. The Biden Administration said about 1.8 million Americans remain in forbearance today, more than a year after emergency safeguards were put in place due to the COVID-19 crisis. The new loan modification programs for mortgages backed by the FHA, Department of Agriculture (USDA), and Department of Veterans Affairs will “aim to provide homeowners with a roughly 25 percent reduction in borrowers’ monthly principal and interest (P&I) payments to ensure they can afford to remain in their homes and build equity long-term.”

Additionally, on Thursday, the White House called on Congress to extend the eviction moratorium and announced that President Biden has “asked the U.S. Departments of Housing and Urban Development, Agriculture, and Veterans Affairs to extend their respective eviction moratoria through the end of September, which will provide continued protection for households living in federally-insured, single-family properties.” Today, FHA announced an extension of its single family eviction moratorium through September 30, and FHFA announced that it will be extending its COVID-19 real estate owned (REO) Eviction Moratorium through September 30, 2021. The REO eviction moratorium applies to properties that have been acquired by an Enterprise through foreclosure or deed-in-lieu of foreclosure transactions. The current moratorium was set to expire on July 31, 2021.

Lastly, late Thursday evening, U.S. House Financial Services Committee (HFSC) Chairwoman Maxine Waters (D-CA) and 100 Democratic cosponsors introduced H.R. 4791, the “Protecting Renters from Evictions Act of 2021,” which would extend the moratorium on residential evictions through December 31, 2021.

FHFA Dropping Fee Introduced During COVID-19. On July 16, the FHFA announced that the GSEs will eliminate the Adverse Market Refinance Fee for loan deliveries effective August 1, 2021. At the direction of FHFA, the GSEs implemented a 50-basis point refinance fee for mortgages at or above $125,000 to cover potential losses due to the COVID-19 pandemic. The fee took effect December 1, 2020 and, according to the MBA, added approximately $1,400 to the cost of refinancing most mortgages. “The COVID-19 pandemic financially exacerbated America’s affordable housing crisis,” said FHFA Acting Director Sandra L. Thompson, adding, “[e]liminating the Adverse Market Refinance Fee will help families take advantage of the low-rate environment to save more money.”

House Financial Services Committee Holds Hearing with HUD Secretary Marcia Fudge. On July 20, the HSFC held a hearing titled, “Building Back A Better, More Equitable Housing Infrastructure for America: Oversight of the Department of Housing and Urban Development,” (HUD) in which Secretary Marcia Fudge participated as a witness. During the hearing, legislators demonstrated bipartisan agreement on housing affordability becoming a growing challenge. Secretary Fudge indicated in her opening remarks that housing affordability “keeps families awake at night,” and said that housing is “the number one crisis in this country today.” Committee members discussed several facets of the issue and a variety of approaches to address it, particularly in support of first-time homebuyers finding themselves priced out of a competitive market. Representatives Blaine Luetkemeyer (R-MO) and Ted Budd (R-NC) inquired about HUD’s potential tools to combat the impacts of regulations on housing costs. Secretary Fudge conveyed that HUD is exploring tools at the federal level to incentivize localities to update their zoning policies and remove other statutory barriers to affordable housing. Representative Ted Budd (R-NC) asked Secretary Fudge about how the $213 billion in funding proposed in President Biden’s infrastructure plan for new and rehabilitation of existing affordable housing would be divided. Fudge noted that dollar amounts had not been decided but the administration is targeting the development of 2 million new units and rehabilitation of 500,000 existing units. Other topics discussed included accessibility and affordability of FHA credit, GSE lending to minority borrowers, HUD appraisal task force, climate risks, and Property Assessed Clean Energy (PACE) loans.

What We’re Reading: Congressional Proposals to Increase Homeownership. On July 19, USMI published a blog post titled, “Washington Focuses on Infrastructure and Equity with an Eye Toward Homeownership.” The blog notes that as policymakers shift their focus from the COVID-19 pandemic to negotiating and drafting legislative text for President Biden’s infrastructure proposals, Congressional Democrats are championing housing policies intended to promote equitable communities and give traditionally underserved Americans a stake in those communities. In this sense, the piece outlines and details the various legislative proposals put forth by Democratic legislators to help these underserved communities. Many of these proposals seek to address issues such as the critical housing supply shortage, first-time/first-generation DPA proposals, tax incentives to support homeownership, and home equity building opportunities.

USMI released principles for Access and Affordability in January, in which it suggests that “existing DPA programs— and any expansions – should balance responsible underwriting that promotes sustainable homeownership and access to affordable low down payment mortgages. DPA programs should be targeted to serve the creditworthy borrowers who are unable to attain even a 3 [percent] or 3.5 [percent] down payment. It is important that DPA programs are structured and operated in a sustainable manner so as to not create excessive leverage and risk within the mortgage finance system, or pose undue risk to taxpayers and the economy, which will ultimately hurt vulnerable homeowners most.” Further, USMI encouraged policymakers, including HUD Secretary Marcia Fudge, to pursue policies that promote affordable and sustainable access to mortgage finance credit, but that do not add fuel to the fire in terms of artificially lowering what is already relatively affordable mortgage finance credit as such actions would inject more “demand” into the market without addressing the “supply” side—which will only drive-up home prices further, hurting affordability at the lower end of the market most.

Newsletter: June 2021

June marks the official start of summer and National Homeownership Month. This week, USMI released its 2021 National Homeownership Market Survey, which examined perceptions around homeownership, the mortgage process, and the challenges people face when trying to purchase a home. USMI also released its annual MI in Your State report in early June, which found borrowers were able to access home financing three times sooner in 2020 because of private mortgage insurance (MI). We dig further into these reports and more below.

USMI’s 2021 National Homeownership Market Survey

Black Homeownership Collaborative Launches in Ohio

USMI’s MI in Your State Report

Supreme Court Decision: Collins v. Yellen

Federal Agencies Extend Foreclosure Moratoria

MI Premium Tax Deductibility Proposal in Congress

Credit Risk Retention Rule

HUD Confirmations and Nominations

What We’re Listening To: “Radian On Air” Podcast

What We’re Watching: New American Funding Panel on Down Payment Assistance & Increasing Black Homeownership

What We’re Reading: Redwood Trust’s Employee Home Access Program

USMI’s 2021 National Homeownership Market Survey. On June 22, USMI released its 2021 National Homeownership Market Survey. This new research, fielded by ClearPath Strategies to 1,000 adults in the U.S., found that nearly 7 in 10 (69 percent) ranked lack of affordable housing and nearly 6 in 10 (57 percent) ranked low housing supply among the biggest homebuying challenges. The survey also specifically looked at these responses by race to better understand minorities’ perceptions and challenges around homeownership, housing affordability, and the mortgage process. It also revealed that many people continue to not understand the down payment requirements to purchase a home. Housing insecurity (66 percent) was also among the top concerns from respondents. Socioeconomic disparities – such as lower income, lack of intergenerational wealth, limited savings, and the percentage of monthly income dedicated to housing costs – were reported to make these challenges more acute, particularly among minorities.

Black Homeownership Collaborative. In collaboration with more than 100 organizations and individuals involved in the Black Homeownership Collaborative, USMI supports policies that promote equity and work to increase homeownership rates among Black Americans. On June 18, the Collaborative unveiled a solutions-based initiative to close the Black homeownership gap. The Collaborative’s seven-point plan includes homeownership counseling, targeted down payment assistance, housing production, credit and lending reforms, civil and consumer rights enforcement, advancing homeownership sustainability, and marketing and outreach. The goal is to create 3 million net new Black homeowners by 2030. Read more at 3by30.org.

USMI’s MI in Your State Report. On June 2, USMI released its annual MI in Your State report on the role of private MI in all 50 states and the District of Columbia. The report found that home loans backed by private MI increased 53 percent in 2020, with more than 2 million borrowers securing mortgage financing — a record year for the industry’s 65-year-history. The report also found that saving for a 20 percent down payment could take potential homebuyers 21 years — three times longer than it could take to save 5 percent down. Texas, California, Florida, Illinois, and Michigan were the top five states for mortgage financing with private MI. Fact sheets for all 50 states, plus the District of Columbia, are available here.

Supreme Court Decision: Collins v. Yellen. On June 23, the Supreme Court released its opinion for Collins v. Yellen, giving the U.S. President greater control over the Federal Housing Finance Agency (FHFA) and the future of the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. The Court held that “[t]he Recovery Act’s restriction on the President’s power to remove the FHFA Director, 12 USC 4512(b)(2), is unconstitutional.” This provides President Biden with the authority and opportunity to nominate a new FHFA Director who will be in better alignment with the Biden Administration’s policy positions and priorities. The Court also held that GSE shareholders’ statutory claim must be dismissed since the FHFA’s actions regarding the Net Worth Sweep did not exceed its “powers or functions” as a conservator. This is undoubtedly a significant determination for the future of the leadership of FHFA, as well as the future of the GSEs. USMI continues to promote a housing finance system that is backed by private capital, and also promotes sensible reforms to the GSEs that include utility-like regulation of the GSEs.

Following the Court’s opinion, President Biden appointed Sandra Thompson, formerly the Deputy Director of the Division of Housing Mission and Goals, as the Acting Director of the FHFA. Prior to joining the FHFA in 2013, Acting Director Thompson spent more than 23 years at the Federal Deposit Insurance Corporation (FDIC), most recently as the Director of the Division of Risk Management Supervision. Her experience in financial supervision, consumer protection, and outreach will continue to benefit the FHFA and housing finance system. USMI looks forward to continued engagement with Acting Director Thompson and her FHFA colleagues to promote a robust conventional mortgage market and access to affordable mortgage credit.

Federal Agencies Extend Foreclosure Moratoria. On June 24, the White House announced a number of actions to protect renters and homeowners still experiencing financial hardships due to the COVID-19 pandemic. The Administration indicated that the U.S. Department of Housing and Urban Development (HUD), U.S. Department of Veterans Affairs (VA), and U.S. Department of Agriculture (USDA) are extending their foreclosure moratoria for one month, until July 31, 2021, and that homeowners with mortgages insured or guaranteed by the agencies may enter into COVID-related forbearance through September 30, 2021. FHFA followed with a statement that the GSEs are extending their foreclosure moratoria on single family foreclosures and real estate owned (REO) evictions through July 31, 2021. Homeowners with GSE-backed single family mortgages continue to be eligible for COVID-related forbearance.

Credit Risk Retention Rule. On June 11, USMI joined with several other housing and finance organizations on a comment letter to banking and housing regulators. The letter provided observations and recommendations with respect to the review of certain provisions of the 2014 Credit Risk Retention Rule that was jointly issued by the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the FDIC, the Securities and Exchange Commission, the FHFA, and HUD. Following careful analysis of the changes issued by the Consumer Financial Protection Bureau (CFPB) in its final Qualified Mortgage (QM) rule, the organizations expressed strong support for the continued alignment of the Qualified Residential Mortgage (QRM) and QM frameworks.

HUD Confirmations and Nominations. This month, Adrianne Todman was confirmed as HUD’s Deputy Secretary, Damon Smith was nominated to serve as the agency’s General Counsel and Julia Gordon was nominated to serve as the commissioner of the Federal Housing Administration (FHA). Smith previously served as the acting general counsel for HUD in 2014. Gordon had managed the single-family policy team at the FHFA from 2011 to 2012, and more recently, was a member of the FHFA and HUD agency review team for the Biden administration. USMI looks forward to working with HUD leadership and the FHA team on policies to best serve borrowers and responsibly facilitate access to homeownership.

What We’re Listening To: “Radian On Air” Podcast. Lindsey Johnson sat down with Radian President of Mortgage and current USMI Chairman Derek Brummer for the company’s latest podcast episode of “Radian On Air” titled, “National Homeownership Month: Expanding Minority Homeownership.” They discussed the importance of homeownership, barriers for first-time homebuyers, solutions to address low housing supply, and the role of private MI in promoting homeownership. Listen to the full episode here.

What We’re Watching: New American Funding Panel on Down Payment Assistance & Increasing Black Homeownership. On May 20, Lindsey Johnson joined Freddie Mac’s Sam Noel, and Stockton Williams, Executive Director of National Council of State Housing Agencies, in a virtual discussion hosted by New American Funding for its New American Dream initiative. Panelists discussed the pressing problem of bridging the down payment gap, how potential homebuyers can overcome that obstacle, and how to increase and sustain Black homeownership.

What We’re Reading: Redwood Trust’s Employee Home Access Program. In case you missed it, Redwood Trust announced its Employee Home Access Program (“the Redwood Benefit”), an MI benefits program for its workforce that supports employees seeking a path to homeownership. Through the program, Redwood is reimbursing all MI costs to help its employees put down roots in areas of their choosing. Citing limited access to affordable housing supply and challenges to access affordable housing, Redwood CEO, Chris Abate encouraged other corporate leaders to offer MI support for their employees: “If as a corporate leader you’re focused on environmental, social and governance objectives, I urge you to consider this benefit for your employees, too.”

Newsletter: April 2021

We are well into Spring and there continues to be numerous developments in housing finance. April is Financial Literacy Month, so U.S. Mortgage Insurers (USMI) has been hard at work highlighting the unique role private mortgage insurance (MI) plays in the mortgage finance system and the importance of financial literacy in the homebuying process. Washington policymakers have also been busy moving forward confirmations of key administration officials as well as holding congressional hearings and introducing legislation on housing. Below are some of the key developments USMI has been following over the last month.

- USMI Member Spotlight: MGIC CEO Tim Mattke Talks Financial Literacy

- 2020 Numbers Are in: Private MI Industry Record Year in Mortgage Originations

- House Financial Services Committee Holds Hearing on Equitable and Affordable Housing Infrastructure

- HUD Maintains Pricing on FHA’s MI Premiums

- What We’re Watching: National MI CEO Claudia Merkle Explains Private MI

- What We’re Listening To: USMI President Lindsey Johnson on Housing Wire’s News Podcast

USMI Member Spotlight: MGIC CEO Tim Mattke Talks Financial Literacy. Earlier this month, USMI talked with MGIC CEO Tim Mattke about the company’s efforts to ensure first-time homebuyers have access to the right information and resources to be “mortgage-ready.” Mattke noted that “understanding the process” is the most difficult step, after finding the right property, among those aged 22 to 40, according to the National Association of REALTORS®. “To help overcome this challenge, MGIC has provided homebuyer education for decades,” said Mattke, adding that “[l]ast year alone, over 100,000 people took our online tests in English or Spanish. More recently we launched a consumer site, Readynest,” which serves “to demystify the homebuying journey through relatable explanations and stories of others who have gone through the process.”

Mattke also called on federal policymakers to recognize the importance of low-down payment lending, especially for minority, lower-wealth, millennial, and first-time homebuyers. He noted the need to address the shortage in supply to increase affordable housing options and encouraged policymakers to explore ways to reduce regulatory red tape for new home construction and incentivize increased remodeling and rehabilitation of distressed properties.

2020 Numbers are in: Private MI Industry Record Year in Mortgage Originations. In late March, USMI announced a record year for the private MI industry, having helped over 2 million low down payment borrowers secure mortgage financing in 2020, a 53 percent increase from the previous year. Of these, nearly 900,000 were first-time homebuyers, up 25 percent from 2019. The industry supported $600 billion in mortgage originations — approximately 65 percent of this volume was for new purchases while 35 percent was for refinanced loans. This resulted in nearly $1.3 trillion in outstanding mortgages with active private MI coverage at year’s end, underscoring the industry’s critical role in enabling American families to obtain affordable and sustainable low down payment mortgages. “Despite the unprecedented challenges presented by the COVID-19 pandemic, conventional loans backed by private MI continued to make the dream of homeownership a reality for millions of low down payment borrowers,” said Lindsey Johnson, President of USMI.

Johnson also discussed the record volume with National MI CEO Claudia Merkle, who noted two key factors that contributed to the strong production: “First, there are more and more first-time homebuyers coming into the market. They have good credit but struggle to put 20 percent down on their first house. Private MI is a great fit for them. A second factor is attributed to low interest rates, which helped fuel the strong mortgage market momentum in 2020, for both the purchase segment and also for refinances.”

House Financial Services Committee Holds Hearing on Equitable and Affordable Housing Infrastructure. On April 14, the House Financial Services Committee (HFSC) held a hearing titled, “Build Back Better: Investing in Equitable and Affordable Housing Infrastructure.” Several bills proposed by Democratic committee members on issues ranging from lead abatement to broadband infrastructure were discussed. The main proposal, presented by Chairwoman Maxine Waters (D-CA), was the “Housing is Infrastructure Act of 2021.” Chairwoman Waters introduced similar legislation in the past and the 2021 iteration incorporates several of the other proposed bills considered by the committee, including the Down Payment Toward Equity Act of 2021 that would provide for $10 billion in targeted down payment assistance (DPA) for first-generation, first-time homebuyers of up to $20,000 and $25,000 for socially and economically disadvantaged individuals. A recent analysis from the Urban Institute estimates that between 2.51 million and 5.37 million renters households could be eligible for the proposed DPA.

There was also bipartisan agreement among committee members that the persisting shortage of affordable housing is a pressing crisis, and that the nation would benefit from more robust infrastructure investments. The parties, however, differed on what constituted as “infrastructure,” the implications of spending two trillion dollars on President Biden’s infrastructure proposal, and the effect of raising taxes to cover the costs.

HUD Maintains Pricing on FHA MI Premiums. Following the Senate’s bipartisan confirmation of Marcia Fudge as the Secretary of the U.S. Department of Housing and Urban Development (HUD) on March 10, USMI said in a statement that “[i]n HUD Secretary Marcia Fudge, America gains a housing advocate with proven leadership and an accomplished record while serving in Congress and supporting investments in housing programs and community development.” In one of her first actions as HUD Secretary, Fudge announced that the agency would maintain the current pricing of MI premiums on loans backed by the Federal Housing Administration (FHA) due to the agency’s high level of serious delinquency rates and the need to continue focusing on helping the tens of millions of families impacted by the COVID-19 pandemic. USMI President Lindsey Johnson said in a statement that “USMI is encouraged by HUD’s continued support of borrowers impacted by the pandemic, and its focus to ensure an equitable recovery for FHA borrowers. FHA is a critical resource for borrowers to attain homeownership through FHA-backed loans—especially for borrowers who may not have access through the conventional market.”

What We’re Watching: National MI CEO Claudia Merkle Explains Private MI. USMI released a short video of Merkle explaining the role of private MI in the housing market, and how it helps borrowers with down payments of less than 20 percent.

What We’re Listening To: USMI President Lindsey Johnson on Housing Wire’s News Podcast. In April, Johnson was a guest on Housing Wire’s News Podcast to discuss the unique role private mortgage insurers play in helping low down payment borrowers. Johnson also discussed how the industry was well-positioned in 2020 due in part to reforms it had implemented following the 2008 financial crisis. She also highlighted the record year that the private MI industry had through 2020 in helping more than 2 million borrowers purchase or refinance their home. In responding to questions about access and affordability in today’s housing market, Johnson spoke about the challenges of affordability, largely stemming from the lack of affordable housing supply, and spoke about specific proposals that industry and policymakers can pursue together to address these market challenges.

Newsletter: March 2021

It’s hard to believe there’s only 15 days until the first day of Spring 2021—a time that marks, for most years, the start of the busiest homebuying season. As the Biden Administration has filled more of its key positions, policymakers and industry leaders continue to focus on top priorities, including COVID-19 and its impact on many borrowers and the housing market, as well as ways to address racial and economic disparities in mortgage lending to ensure homeownership is an achievable goal for all Americans through thoughtful rulemakings and targeted polices. Below are some of the key developments U.S. Mortgage Insurers (USMI) has been following over the last month.

USMI Highlights Industry Leaders in Honor of Black History Month

USMI Member Spotlight: Radian

COVID Stimulus Bill Provides Housing Support

CFPB Delays QM Rule Implementation

Senate Banking Committee Holds Hearing on CFPB Director Nominee

Government Agencies Extend Forbearance & Foreclosure Protections

USMI Submits Comments to FHFA on Appraisal Policies

What We’re Listening To: Natixis Podcast

What We’re Reading: Brookings on GSE Reform

- USMI Highlights Industry Leaders in Honor of Black History Month. In February, USMI reached out to prominent leaders in the housing finance industry to discuss their work and perspectives on the goal of increasing Black homeownership in America. USMI spoke with Congressman Emanuel Cleaver (D-MO), chair of the House Committee on Financial Services’ Subcommittee on Housing, Community Development, and Insurance; Phyllis Caldwell, former Chief of the Homeownership Preservation Office at the U.S. Department of the Treasury; Lisa Rice, President and CEO of the National Fair Housing Alliance; and Alanna McCargo, Senior Advisor for Housing Finance at the U.S. Department of Housing and Development (HUD). Each of these leaders offered insights on the housing industry and how policymakers can work to help close the racial homeownership gap. USMI is grateful for their leadership and looks forward to continuing to work with them to expand Black homeownership and build wealth.

- USMI Member Spotlight: Radian. In February, USMI began a new blog series to spotlight its members every couple of months and highlight how the industry is working to address critical issues within the housing finance system. Topics include expanding access to affordable and sustainable homeownership opportunities, ensuring taxpayer protection through increased capacity for risk sharing with mortgage insurance (MI), and providing recommendations for a coordinated federal housing policy. USMI kicked off the series with Derek Brummer, President of Radian’s Mortgage Business and Chairman of USMI’s Board. In the interview, Brummer emphasized Radian’s commitment to “the American dream of homeownership responsibly and sustainably through products and services that span the mortgage and real estate spectrum.” He noted the key role MI plays in bridging the down payment gap, and the benefits borrowers receive from having access to low down payment mortgages in the conventional market backed by private MI rather than being limited to mortgages backed by the Federal Housing Administration (FHA). “Optionality is a key component of affordability and accessibility,” he remarked.

He also discussed the future of housing policy, touching on President Biden’s executive order to address racial equity through housing, the nomination of Marcia Fudge to serve as the next HUD Secretary, and the opportunities for policymakers to increase Black homeownership and access to affordable mortgage credit. Brummer said, “Policymakers and the housing industry have the opportunity to correct inequities and sustainably increase minority homeownership.” Read the full interview here.

- COVID Stimulus Bill Provides Housing Support. In the early hours of February 27, the House passed H.R. 1319, the American Rescue Plan Act of 2021, in a 219-212 vote. The $1.9 trillion aid package includes a significant amount of housing aid—$30 billion in emergency rental assistance, $10 billion for a Homeowner Assistance Fund, $100 million for housing counseling services, $20 million for fair housing initiatives, and several programs for the homeless. The bill is now in the Senate where it has already been subject to numerous modifications, including the elimination of the minimum wage increase due to the “Byrd Rule,” and more targeted direct payments to Americans. Earlier this year, USMI joined with several consumer and industry groups in sending letters to President Biden and congressional leadership urging them to include direct homeowner assistance in a COVID-19 relief bill to help families who are at risk of losing their homes due to the economic fallout from the pandemic. Click here to read more about USMI’s policy priorities to expand access and affordability in housing.

- CFPB Delays QM Rule Implementation. On March 3, the Consumer Financial Protection Bureau (CFPB) released a notice of proposed rulemaking (NPRM) to delay the planned July 1 mandatory compliance date for the December 2020 General Qualified Mortgage (QM) Final Rule by 15 months to October 1, 2022. The CFPB is accepting comments until April 5. If finalized, the NPRM would allow for mortgages whose applications were received by lenders prior to October 1, 2022 to receive QM status using any of the following three standards: (1) the 2013 General QM definition that relied on a debt-to-income (DTI) cutoff; (2) the 2020 price-based General QM definition; (3) or the government sponsored enterprises (GSEs) Patch (so long as the GSEs remain in conservatorship). The CFPB noted it “believes that an extension of the mandatory compliance date may help to ensure stability and access to affordable, responsible credit in the mortgage market.”

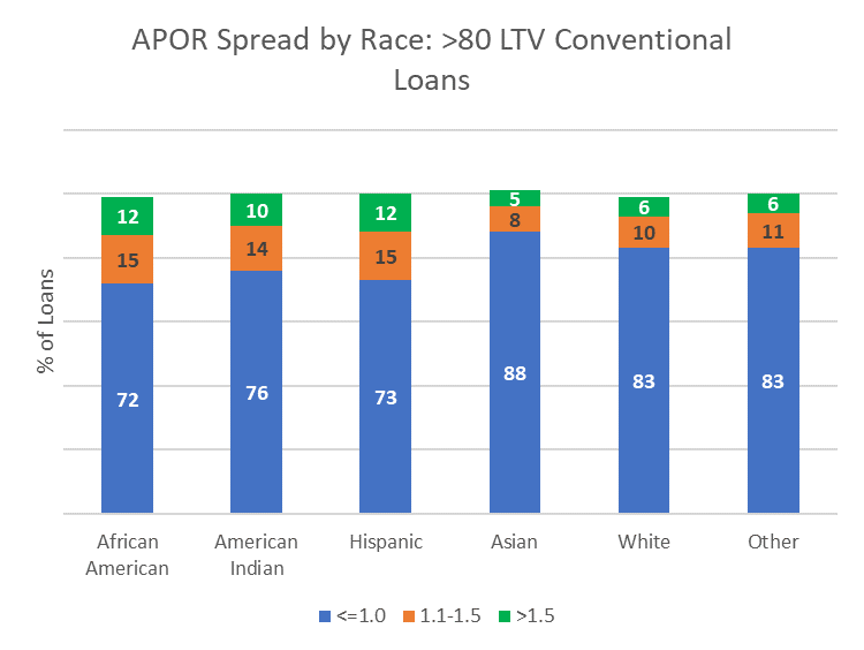

The CFPB previously announced on February 23 that it is considering whether to revisit the December 2020 General QM and Seasoned QM Final Rules. The first replaced the 43 percent DTI ratio QM standard with a price-based definition and the second created a new QM category based on loan seasoning. Should the CFPB reevaluate aspects of the General QM definition, it could decide to modify the thresholds for Safe Harbor (Average Prime Offer Rate, or APOR, + 150 basis points, or bps) and Rebuttable Presumption (APOR + 225 bps). USMI, along with consumer groups and other industry organizations, has repeatedly urged the CFPB to increase the Safe Harbor threshold to APOR + 200 bps to best level the playing field across the mortgage market and ensure minority, low-income, and first-time homebuyers continue to have access to affordable and safe conventional mortgages.

- Senate Banking Committee Holds Hearing On CFPB Director Nominee. On March 2, Rohit Chopra, President Biden’s nominee for CFPB Director, testified before the Senate Banking Committee. In his written testimony, Chopra highlighted the ongoing challenges facing Americans in the housing sector due to the impacts of COVID-19 and suggested opportunities for reform in the mortgage market. He said that “fair and effective oversight” in the market could promote a “resilient and competitive financial sector,” while also addressing the systemic inequities faced by families of color. He also said, “administration of consumer protection laws can help families navigate their options to save their homes.”

In response to questions from Senator Jon Tester (D-MT), Chopra stated that “the CFPB is not here to dictate housing finance policy, it’s to make sure that the prohibitions when it comes to our mortgage laws are adhered to. And when it comes to QM it is important that we balance the consumer protections that Congress has put into place with access to mortgages.”

- Government Agencies Extend Forbearance & Foreclosure Protections. On February 16, President Biden announced the extension of COVID-19 forbearance and foreclosure protections for homeowners with government-backed mortgages through June 30. This included expanding COVID-19 forbearance to allow for up to 2-3 month extensions for homeowners who requested a forbearance on or before June 30. The administration outlined its priorities to extend protections as providing immediate relief to homeowners across America, supporting hard-hit communities of color, and providing a centralized resource for housing assistance.

The Federal Housing Finance Agency (FHFA) followed suit February 25 and announced extensions of COVID-19 relief for single-family mortgages guaranteed by the GSEs, Fannie Mae and Freddie Mac. This included extending the moratorium on foreclosures and real estate owned evictions through June 30 and expanding the maximum forbearance period to 18 months for borrowers with active COVID-19 forbearance plans as of February 28. FHFA Director Mark Calabria stated that “[f]rom the start of the pandemic, FHFA has worked to keep families safe and in their home, while ensuring the mortgage market functions as efficiently as possible. Today’s extensions of the COVID-19 forbearance period to 18 months and foreclosure and eviction moratoriums through the end of June will help align mortgage policies across the federal government.”

- USMI Submits Comments to FHFA on Appraisal Policies. On February 26, USMI submitted a comment letter to FHFA providing feedback on initiatives to modernize appraisal processes and answer specific questions in the agency’s Request for Information (RFI) on Appraisal-Related Policies, Practices, and Processes. USMI wrote that “FHFA should implement rules designed to ensure that innovations around the appraisal process are done when there is demonstrable benefit to the broader housing finance system, including greater transparency, efficiency, accuracy of property valuations, and lower costs for borrowers and market participants.” USMI also emphasized that attention should be given to the expansion of appraisal waivers, particularly for the 80 percent loan-to-value (LTV) market, where “appraisal waivers can materially impact LTV ratios, the pricing and risk assessments associated with the GSEs’ guarantee fees, MI premiums, and loan-level capital requirements.” USMI noted that these considerations are “more acute for higher LTV loans since the margin of error is slim for these mortgages and could expose the GSEs and the housing finance system to greater credit risk.”

- What We’re Listening To: Natixis Podcast. USMI President Lindsey Johnson spoke with Natixis Investment Managers’ Vice President of Government Relations Susan R. Olson on the Natixis Insights podcast. They discussed housing finance reform and possible changes under the Biden administration.

- What We’re Reading: Brookings on GSE Reform. The Brookings Institution published a new report titled, “Government-sponsored enterprises at the crossroads: The value of the Treasury’s interest in the GSEs should be used to increase affordable housing and advance racial equity, and the GSEs should be regulated as utilities.” Authored by Michael Calhoun, President of the Center for Responsible Lending, and Lewis Ranieri, Chairman and CEO of Ranieri Solutions, who assert that “[a] utility structure should be implemented permanently in order to secure the GSEs as an emergency backstop during a crisis, enhance operation of the GSEs in regular times, and advance the GSEs’ public mission.”

Newsletter: February 2021

2021 is off to a quick start as the Biden administration has made housing policy a key focus during its first month in office. U.S. Mortgage Insurers (USMI) is ready to work with the new administration and Congress to advance sound housing policies that create a more equitable and sustainable housing finance system. Below are some of the key developments from the beginning of the year:

USMI Publishes Op-Ed in The Hill on Housing Affordability

USMI Co-Signs Letter with Diverse Collation to Biden Administration on Housing Recovery

President Biden Signs Executive Order on Housing Equity

USMI Sends Letter to HUD Secretary-Designee Marcia Fudge

USMI Publishes Blog on the New Congress

What We Are Reading

- USMI Publishes Op-Ed in The Hill on Housing Affordability. On January 31, The Hill published an op-ed by USMI President Lindsey Johnson titled, “We must increase access to affordable mortgages for minority borrowers.” Johnson outlines ways the housing finance system can use data-driven, targeted approaches to reduce barriers to affordable mortgages for Black and Hispanic households. She notes that while COVID-19 has compounded existing racial and economic gaps, there are several long-term issues that unnecessarily increase costs or create barriers for minority borrowers seeking to become homeowners. Impending changes like the recently finalized capital requirements for the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, could further stress mortgage affordability; while current policies like the GSEs’ arbitrary loan-level price adjustments (LLPAs) further drive up costs and push homeownership out of reach.

Johnson called on policymakers to recognize the critical role of low down payment mortgage options in facilitating homeownership, noting that more than 80 percent of first-time homebuyers used these options in the past several years. She also called for more targeted assistance programs for borrowers who may lack intergenerational wealth or equity from a previous home to contribute to a down payment, and highlighted Rep. Al Lawson’s (D-FL) First-Time Homeowners Assistance Act and President Biden’s interest in a first-time homebuyer tax credit. Johnson also recommends that the Biden administration assemble a housing affordability task force that “includes broad representation from industry, consumer advocate community, and government to formulate an action plan, build consensus, and get to work.”

- USMI Co-Signs Letter with Diverse Collation to Biden Administration on Housing Recovery. On January 21, USMI joined the Black Homeownership Collaborative, along with more than 30 industry stakeholders, on a letter to the Biden administration requesting that the American Rescue Plan include assistance to homeowners impacted by COVID-19. The group noted the growing risk to homeownership caused by the pandemic, which has profound implications for people of color, adding that “our country cannot afford to see more damage done to minority homeowners.”

Specifically, the signatories urged President Biden to include in his relief proposal to Congress a $25 billion Housing Assistance Fund, modeled on the 2010 Hardest Hit Fund, to facilitate direct assistance to homeowners. The direct assistance would provide funds to state housing finance agencies to help households experiencing COVID-19 related hardship bring their mortgage loans current. The letter also called on the Biden administration to extend the foreclosure moratorium and continue to process forbearance applications on federally-backed mortgages.

The National Housing Conference (NHC), National Fair Housing Alliance (NFHA), Mortgage Bankers Association (MBA), Local Initiatives Support Corporation (LISC), and the Leadership Conference on Civil and Human Rights, were among the letter’s signatories.

- President Biden Signs Executive Order on Housing Equity. On January 26, President Biden issued an executive order titled, “Memorandum on Redressing Our Nation’s and the Federal Government’s History of Discriminatory Housing Practices and Policies.” The order highlighted that throughout the 20th century, the U.S. government “systematically implemented racially discriminatory housing policies,” the effects of which can be seen today in the racial homeownership gap and the systemic barriers to safe, accessible, and affordable housing for traditional marginalized groups, including people of color. The order further called on the federal government to play a critical role “in overcoming and redressing this history of discrimination and in protecting against other forms of discrimination by applying and enforcing Federal civil rights and fair housing laws.” Before signing the executive order, President Biden stressed that his administration will strive to implement policies that embrace equity, and not merely equality, in order to address systemic issues and provide for equal access to the American Dream of homeownership. To this end, President Biden called on the Secretary of Housing and Urban Development (HUD) to review several rules enacted in 2020 and ensure that all rules comply with HUD’s statutory duty to further fair housing and prevent practices with an unjustified discriminatory effect.

- USMI Sends Letter to HUD Secretary-Designee Marcia Fudge. Last week, USMI sent HUD Secretary-designate Fudge a letter, outlining several policies HUD should consider to ensure it is effectively promoting sustainable and affordable diverse homeownership. USMI cautioned against simply lowering credit costs, such as reducing the Federal Housing Administration (FHA) mortgage insurance premiums, as doing so will likely only increase demand during a time when supply constraints in the market have caused home prices to increase by nearly 12 percent just in the past year. Further, it will push affordability out of reach for many homeowners, especially borrowers on the lower end of the market. As FHA continues to support borrowers through the COVID-19 crisis, it will be important to not take actions that could potentially undermine FHA’s ability to help existing and future borrowers. The letter also called on policymakers to explore targeted policies to support borrowers most in need, such as targeted down payment assistance (DPA) programs for borrowers who may not even have the resources for a 3 or 3.5 percent down payment, and considering establishing reserve accounts to promote sustainable homeownership. USMI noted, “it is more important than ever that the government-backed FHA program and the conventional market backed by private MI operate in a consistent and coordinated manner,” as the two play an important and distinct role in the market and should not compete for market share.

Meanwhile, the Senate Banking Committee voted 17 to 7 yesterday to approve Honorable Marcia Fudge as HUD Secretary. She now awaits a confirmation vote by the full U.S. Senate.

- USMI Publishes Blog on New Congress. USMI posted a blog providing an overview of the 117th Congress with insights on new members to the House Financial Services Committee and Senate Banking Committee, as well as priorities for COVID-19 relief and housing policy.

- What We Are Reading. The Urban Institute published a new report titled, “The Future of Headship and Homeownership,” which examined trends in homeownership in the United States through 2040 based on current housing policies. The report found that the United States will likely see modest declines in homeownership, mostly for Black households, and that decreasing the racial homeownership gap would require expanded financial education, re-examining the mortgage qualification process, and implementing programs that sustain homeownership for borrowers with less wealth, especially people of color.

Newsletter: December 2020

As the end of 2020 approaches, U.S. Mortgage Insurers (USMI) want to recognize and thank everyone who has worked to support homeowners and the U.S. housing finance system during a year full of unprecedented challenges. This past year has also ushered in significant federal regulatory and policy proposals and changes, and below are some of the key developments that we are following late this year. In 2021, USMI looks forward to working with policy makers and others to support a housing finance system that creates homeownership opportunities backed by private capital for more Americans.

FHFA Issues Final Capital Rule

Treasury Secretary Mnuchin Testifies Before Congress

House Financial Services Chairwoman Sends Letter to President-Elect Biden

Changes in FHFA Leadership

FHA Issues New Loan Limits and Commissioner Dana Wade Reacts

What We Are Reading

- FHFA Issues Final Capital Rule. On November 18, the Federal Housing Finance Agency (FHFA) released its final rule on the Enterprise Regulatory Capital Framework (ERCF) outlining post-conservatorship capital requirements for the government sponsored entities (GSEs), Fannie Mae and Freddie Mac. The GSEs will collectively be required to hold $284 billion in capital, representing approximately $20 billion more than was outlined in the 2020 proposed rule and more than $100 billion than the 2018 proposal. FHFA Director Mark Calabria said the ERCF “puts Fannie Mae and Freddie Mac on a path toward a sound capital footing” and it is “another milestone necessary for responsibly ending the conservatorships.” While appropriate capital standards for the GSEs is a critical reform, USMI continues to urge FHFA to implement additional reforms necessary to put the housing finance system on a more stable footing. It is essential for these reforms to occur before the GSEs are released from conservatorship in order to strengthen the housing finance system and ensure that the GSEs’ operations comply with their congressional charters.

Many organizations commented that the capital rule is an essential component of reforming the nation’s housing finance system, though several housing groups and policymakers also expressed concern about the impact of the final rule on consumers’ cost and access to mortgage finance credit. The Center for Responsible Lending said the final rule “places the burden of future catastrophic risk on the backs of these hardworking families and will unnecessarily raise the cost of mortgages for all borrowers, resulting in limited credit availability.” It added, “the rule pushes homeownership farther away from families of color long denied mortgage credit access.” Similarly, the National Association of REALTORS® also raised concerns about the impact of the rule on the cost of mortgage finance credit. Sen. Sherrod Brown (D-OH), ranking member of the U.S. Senate Committee on Banking, Housing, and Urban Affairs, wrote in a statement that “the GSEs help millions fulfill the dream of homeownership – especially those living in underserved rural and urban areas. Director Calabria’s rush to finish this rule without addressing concerns raised about its effects is a recipe for disaster and is patently unfair to America’s homeowners and renters.”

The final rule goes into effect 60 days after it is published in the Federal Register.

- Treasury Secretary Mnuchin Testifies Before Congress—Fields Questions on Possible GSE Exit from Conservatorship. On December 1 and 2, Treasury Secretary Steven Mnuchin testified before the Senate Banking Committee and the House Financial Services Committee (HFSC), respectively. While both hearings focused on the Treasury Department’s response to the COVID-19 crisis and its implementation of the CARES Act programs and relief, Secretary Mnuchin also addressed the GSEs’ possible exit from conservatorship.

Senators on both sides of the aisle expressed concern regarding an exit from conservatorship for the GSEs. Senator Mike Round (R-SD) noted that in “a perfect world that conservatorship should have been ended some time ago,” but voiced his concern that releasing the GSEs too early would call into question the strength of the housing sector and asked Secretary Mnuchin about an appropriate timeline. Secretary Mnuchin reiterated the importance of the GSEs having “appropriate capital” levels before being released and emphasized that the Treasury Department has made “no decisions” on this matter. The Secretary also fielded similar questions and concerns from lawmakers when he appeared before the HFSC the next day. Among those that raised objections to the GSEs’ exit from conservatorship was HFSC Chairwoman Maxine Waters (D-CA), who expressed concerns that the Treasury Department is working with the FHFA to “rush” the GSEs out of conservatorship.

In a December 10 blog post, the American Action Forum (AAF) opined on the parameters of consent orders for the GSEs and the need for additional actions to ringfence Fannie and Freddie. AAF President Doug Holtz-Eakin wrote, “The GSEs are notorious for sidestepping caps on compensation, lobbying bans, accounting standards, and more. Capital accumulation is the easy part. A really tight leash would require a consent decree specifying in great detail the management and operation of the GSEs, and with sufficient foresight to anticipate the condition that will prevail in future housing and financial markets.”

In a blog post released in recent weeks, USMI outlined key reforms that should occur, especially ahead of the possible release of the GSEs from conservatorship.

- House Financial Services Chairwoman Waters Sends Letter to President-Elect Biden. Last week, Chairwoman Waters sent a letter to President-elect Joe Biden and his transition team detailing recommendations to immediately reverse several of the actions by the Trump Administration that fall within the HFSC’s jurisdiction, including changes to the Consumer Financial Protection Bureau’s (CFPB) rulemaking and enforcement activities, as well as enhancements for oversight of Wall Street. Chairwoman Waters also called on President-elect Biden to issue an order preventing evictions and to promote stable housing during the pandemic. Key housing regulations in the letter include FHFA’s Enterprise Regulatory Capital Framework, which Chairwoman Waters said should be rescinded and also the CFPB’s General Qualified Mortgage rulemaking, which the Chairwoman recommended be paused until “various options can be thoroughly analyzed examining the potential impact for access to credit and consumer protections.”

More broadly, Chairwoman Waters called on President-elect Biden to support affordable housing by addressing homelessness, promoting housing affordability, and fair housing regulations. The Chairwoman detailed a full list of policy recommendations for the Biden Administration, which can be found here.

- Changes in FHFA Leadership. FHFA announced that Principal Deputy Director Adolfo Marzol plans to retire on December 18, 2020. Director Calabria praised Marzol for his work at FHFA, specifically his leadership to “spearhead the Enterprise capital rule” and his “central role in the response to COVID-19.” Chris Bosland, FHFA’s Senior Advisor for Regulation, will succeed Marzol as the Principal Deputy Director.

- FHA Issues New Loan Limits and Commissioner Dana Wade Reacts. On December 2, the Federal Housing Administration (FHA) released its 2021 Nationwide Forward Mortgage Limits. The new national conforming limit is $548,250 for a one-unit property. The FHA’s low-cost area limit for a single unit property will increase to $356,362, or 65% of the new confirming mortgage limit. However, in high-cost areas, the new loan limit is $822,375, or 150% of the 2021 conforming loan limit. This is the fifth year in a row that the FHA has increased the floor limits. FHA Commissioner Dana Wade expressed concern about the increase stating, “FHA has seen consistent increases in loan limits during the past few years, putting it in a position to serve a segment of borrowers that may be better-served by the conventional market.” Wade continued, “FHA’s mission is to support low-to-moderate income borrowers, so why does the law permit FHA to insure mortgages up to $822,375? This is a question for Congress and the taxpayers who stand behind FHA to answer.”

- What We Are Reading: Forbes published an article titled, “4 Ways To Get A Low-Down-Payment Mortgage Without An FHA Loan.” The article noted one of the main benefits of private mortgage insurance (PMI) over government-backed loans: “You can cancel [PMI] once you have 20% equity. With an FHA loan, you would have to pay monthly mortgage insurance premiums for at least 11 years, if not for the life of the loan.”

Newsletter: October 2020

October has been a busy month in housing finance. Last week, USMI issued a new report on the strength and resiliency of the private mortgage insurance (MI) industry. The report highlights regulatory and industry-led reforms since the 2008 financial crisis which have enabled it to better serve homebuyers and lenders. It also continued to urge the Federal Housing Finance Agency (FHFA) to develop policies for the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, to promote a more stable and equitable housing finance system post-conservatorship. While all eyes are on the election this week, below are other important issues USMI is tracking:

New USMI Report Released on MI Industry

USMI Blog on FHFA Re-Proposed Enterprise Regulatory Capital Framework (ERCF) and Strategic Plan

USMI’s Comments on FHFA Strategic Plan

FHFA Proposed Rule for New Enterprise Products and Activities

Urban Institute Releases October 2020 Chartbook

USMI President on “Main St. Finance” Podcast

ICYMI: CFPB Extends QM Patch

- New USMI Report Released on MI Industry. Last week, USMI released a new report titled, “Private Mortgage Insurance: Stronger and More Resilient.” The report highlights significant regulatory and industry-led reforms taken since the 2008 financial crisis to improve and strengthen the role of private MI in the nation’s housing finance system. It analyzes the various steps the industry and regulators have undertaken and continue to take to ensure sustainable mortgage credit through all market cycles and to better serve low down payment borrowers in the conventional market, especially during critical economic times like these.