Newsletter: August 2020

While this summer has posed new and unexpected challenges, policymakers and U.S. Mortgage Insurers (USMI) and our members continue to work hard to make sure the U.S. housing system remains strong as we face unprecedented economic and health challenges resulting from COVID-19. Below are topics we have been following:

USMI Member Company COVID-19 Response

CFPB Kraninger’s Semi-Annual Hearings

USMI Submits Comment Letter to CFPB on GSE Patch Extension

SCOTUS to Hear Arguments on FHFA’s structure

Dana Wade Confirmed as FHA Commissioner

USMI President in Mortgage Professional America

- USMI Member Company COVID-19 Response. USMI updated its COVID-19 resource webpage with its members’ response fact sheet, highlighting many of the important actions that USMI members have taken to support homeowners, servicers, and lenders across the country during the pandemic. Because of the critical role USMI members play in the housing finance system, the mortgage insurance (MI) industry is committed to supporting the federal government’s robust mortgage relief initiatives, including the nationwide forbearance programs implemented by Fannie Mae and Freddie Mac (GSEs). The fact sheet outlines areas of common ground between USMI members and how they have focused their efforts on helping borrowers remain in their homes by supporting their lender customers during these challenging times.

- CFPB Kraninger’s Semi-Annual Hearings. On July 29 and 30, Consumer Financial Protection Bureau (CFPB) Director Kathleen Kraninger testified before the Senate Banking Committee and House Financial Services Committee, respectively. Both hearings focused on the Bureau’s response to the COVID-19 pandemic and on its ongoing rulemakings and supervision activities. In her written testimony submitted to the Senate Banking Committee, Director Kraninger provided an update on the CFPB’s proposed changes to the GSE provision (GSE Patch) of the Bureau’s Ability-to-Repay (ATR)/Qualified Mortgage (QM) Rule, which is set to expire in January 2021. The CFPB is still considering removing the QM loan definition’s 43 percent debt-to-income (DTI) ratio and replacing it with a pricing threshold.

During the Senate Banking hearing, Senator Tim Scott (R-SC) asked Director Kraninger why the QM standard and safe harbor thresholds would be different and stated, “I think we should do all that we can for credit worthy borrowers to become homeowners when it makes sense. By harmonizing the QM and the safe harbor, it might make it easier for financial institutions to not go to the default position of the safe harbor that’s 50 (basis) points lower.” In addition, during the House Financial Services Committee hearing, members from both parties expressed interest in the CFPB’s rulemaking on the General QM definition and its effect on prudent underwriting and consumers’ access to credit. Representatives Bill Foster (D-IL) and French Hill (R-AR) emphasized that any new QM standard should retain robust underwriting standards to ensure ATR and promote sustainable homeownership. Further, Representatives Hill and Steve Stivers (R-OH) noted that there should be a single pricing standard for QM and Safe Harbor since, unlike the 2013 ATR/QM Rule, pricing would be used to measure both under the proposed rule.

- USMI Submits Comment Letter to CFPB on GSE Patch Extension. On August 10, USMI submitted a comment letter to the CFPB in response to the Notice of Proposed Rulemaking (NPR) regarding the extension of the sunset date for the Temporary GSE QM definition, or the “GSE Patch,” under the Qualified Mortgage Definition under the Truth in Lending Act (Regulation Z), which is currently set to expire on January 10, 2021. USMI recommended to Director Kraninger that the CFPB should “set the sunset date for the GSE Patch to be at least six months after the effective date of the finalized General QM definition rule.” Doing so would allow all industry stakeholders sufficient time to fully understand and implement the new rule and afford industry participants an appropriate amount of time to develop, test, and implement new models to facilitate a smooth transition to the new general QM framework. Moreover, as the financial services industry grapples with implications of COVID-19 and works to support market participants, consumers, and the economy, USMI believes a six-month overlap period would promote an orderly implementation of the new General QM definition while offering continued assistance to homeowners across the county.

In June 2020, the CFPB issued a NPR on the General QM definition under the Truth in Lending Act (Regulation Z) and the GSE Patch. The Bureau’s NPR proposes to change the current QM standard in favor of a pricing threshold; specifically, the difference between the loan’s Annual Percentage Rate (APR) and the Average Prime Offer Rate (APOR) for a comparable transaction at 200 basis points (bps) above APOR. The Bureau justifies this threshold using early delinquency data as an indicator of determining consumers’ ATR.

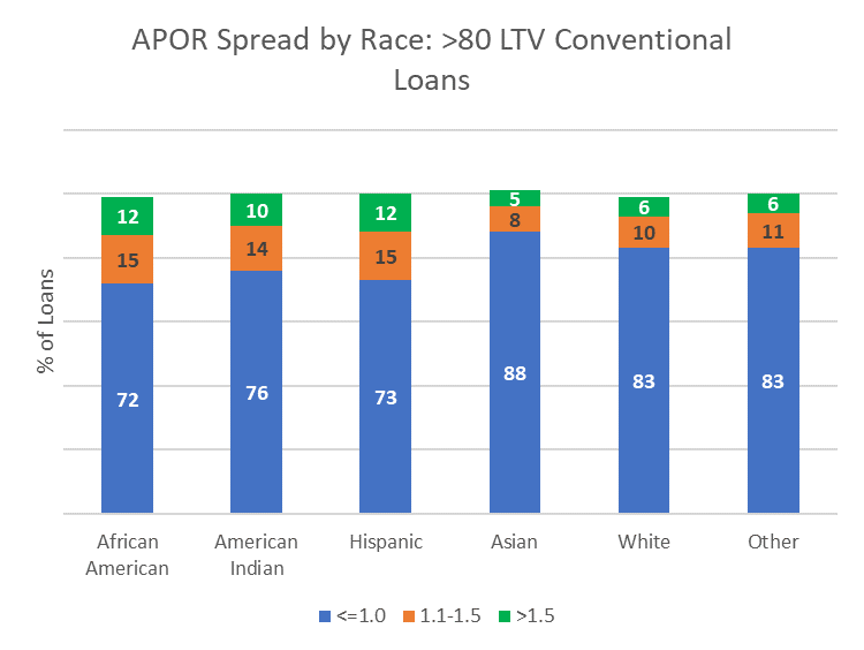

In a September 2019 comment letter to the CFPB, USMI emphasized that, should the Bureau move forward to replace the QM definition with one based on a pricing threshold, it can and should increase the spread that is used to delineate Safe Harbor loans. The previous 2013 ATR/QM Rule created two legal presumptions for QM loans: “Safe Harbor” and “Rebuttal Presumption.” These presumptions have, in turn, created a norm by which lenders will not typically lend above the Safe Harbor line and avoid making Rebuttable Presumption loans as to avoid risk to legal responsibility. This standard has disproportionality impacted Black and Hispanic homebuyers, who were twice as likely as White borrowers to have low down payment conventional purchase loans outside of the Safe Harbor. Under the proposed rule, many of the borrowers who are above the 150 bps threshold will be left only with the option of a Federal Housing Administration (FHA) loan, which means they have vastly different competitive choices in terms of product offerings and loan terms. Further, due to the discrepancies for how this threshold is calculated between the conventional and FHA markets, leaving the Safe Harbor threshold at 150 bps will arbitrarily distort the market and shift borrowers to FHA.

Based on this, USMI and other industry members recommend that the Bureau increase the Safe Harbor threshold to 200 bps above APOR to be consistent with the proposed QM APOR threshold that the Bureau recommended in its June 2020 NPR.

- SCOTUS to Hear Arguments on FHFA’s structure. On July 9, the Supreme Court announced that it would hear Collins v. Mnuchin upon its return in October. The suit questions the constitutionality of the FHFA’s single-director structure. Currently, the FHFA director is appointed to serve a five-year term and can only be removed “for-cause;” he or she cannot be fired at-will by the president. This follows the Court striking down the CFPB’s single-director structure in a 5-4 ruling in Seila Law v. CFPB in June, declaring it unconstitutional and severable from the other provisions of the Dodd-Frank Act.

In a statement, the FHFA said it did not believe the Court’s ruling applied to the FHFA. “The Seila Law decision does not directly affect the constitutionality of FHFA, including the for-cause removal provision.” It continued, “FHFA looks forward to the U.S. Supreme Court taking up the Collins case and clarifying these important issues.”

- Dana Wade Confirmed as FHA Commissioner. On July 28, the Senate confirmed Dana Wade in a 57-40 bipartisan vote as commissioner of the FHA. USMI issued a statement praising Wade’s confirmation. USMI President Lindsey Johnson said, “Commissioner Wade has shown commitment to keeping FHA’s core mission of providing affordable housing opportunities to moderate and low-income households, who need the agency’s 100 percent taxpayer-backed loans the most. We are confident that Commissioner Wade will continue to carry out this mission as she understands the important role the agency plays in our housing financial system.” Mortgage Professional America included USMI’s statement in its coverage of Wade’s confirmation.

- USMI President in Mortgage Professional America. Mortgage Professional America published USMI President Lindsey Johnson’s op-ed titled, “Low Down Payments Backed by Mortgage Insurance More Important Than Ever.” Using data from USMI’s 2020 “MI in Your State” report, Johnson explains why low down payment lending will be even more critical for future homeowners as the country endures and recovers from the current COVID-19 pandemic. The report found that it could take the average American homebuyer over 20 years to save for a 20 percent down payment. With private MI, the wait time could drop to just 7 years with a 5 percent down payment. Low down payments with private MI enable more well-qualified borrowers to become homeowners while keeping more cash on hand, a critical aspect during these trying times. Private MI also assumes the first layer of protection against mortgage credit risk protecting the federal government, and thus, American taxpayers. She concludes stating, “right now, more than ever, we are even more aware of the benefits of owning a home—from building wealth to creating stability to the importance of having a safe place to call your own.”