By Brendan Kihn, Senior Government Relations Director of USMI

As the country kicks off primary elections in the mere matter of weeks, policymakers and advocacy groups are already sizing up what can and cannot be accomplished before voters go to the polls on November 8 for the 2022 midterm election. Just over a year ago, the Democrats gained control of the White House, Senate, and House of Representatives – their first trifecta since January 2011 – and Democrats were hopeful that the party could advance a long list of policy priorities related to taxation, healthcare, and housing investments. Following the enactment of the American Rescue Plan Act, which included $10 billion in homeowners assistance and $22 billion in emergency rental assistance, and the Infrastructure Investment and Jobs Act (the “Bipartisan Infrastructure Deal”), Democrats turned their attention to the Build Back Better Act (BBB), which includes more than $150 billion in housing investments.

Status Update on the “Build Back Better” Agenda

Policymakers are acutely aware of the affordability challenges facing homebuyers and there is especially bipartisan support for increasing housing supply. BBB, both the specific bill and the Biden Administration’s general policy theme, represents a broad collection of policy objectives and programs which includes initiatives to promote access to homeownership, fair housing, and affordable rental opportunities. BBB’s historic investment in housing includes:

- $65 billion to preserve and rebuild public housing

- $26 billion to create and preserve affordable and accessible housing

- $24 billion for new Housing Choice Vouchers to support families struggling to afford their rent

- $10 billion in down payment assistance for first-time, first-generation homebuyers

- $500 million for a wealth-building home loan program

- $250 million increase in allocation to Federal Home Loan Bank Affordable Housing Programs (AHP)

- $100 million to increase access to small-dollar mortgages

The U.S. House of Representatives passed BBB on November 19 with a 220-113 vote only for the bill to hit a major roadblock in the Senate exactly one month later. On December 19, Sen. Joe Manchin (D-WV) announced that “[d]espite my best efforts, I cannot explain the sweeping Build Back Better Act in West Virginia and I cannot vote to move forward on this mammoth piece of legislation.” The Democrats’ razor thin majority in the Senate (50 plus Vice President Harris) creates a tenuous “working majority,” whereby a single defection or absence can make or break a piece legislation. In this case, it is crystal clear that BBB as passed by the House is dead.

2022 began with a certain degree of legislative soul searching among Democrats to strategize avenues to pass elements of BBB that can either: (1) garner bipartisan support and pass via regular order with a 60-vote threshold in the Senate; or (2) enjoy support from the entire Democratic caucus for passage via reconciliation. Democrats will face internal and external pressure to pass something in an effort to show voters that they can govern and deliver for the American people who handed them the levers of power in the 2020 election. Housing advocates remain adamant that housing investments should be included in any legislative packages that seek to advance the Biden Administration’s BBB agenda. And, while critics are concerned that BBB will “dramatically reshape our society,” there is an equally strong sentiment among others that such a “reshape” is exactly what is necessary to invest in the American people and expand economic opportunities, including access to affordable homeownership.

Expanding Access to Mortgage Finance

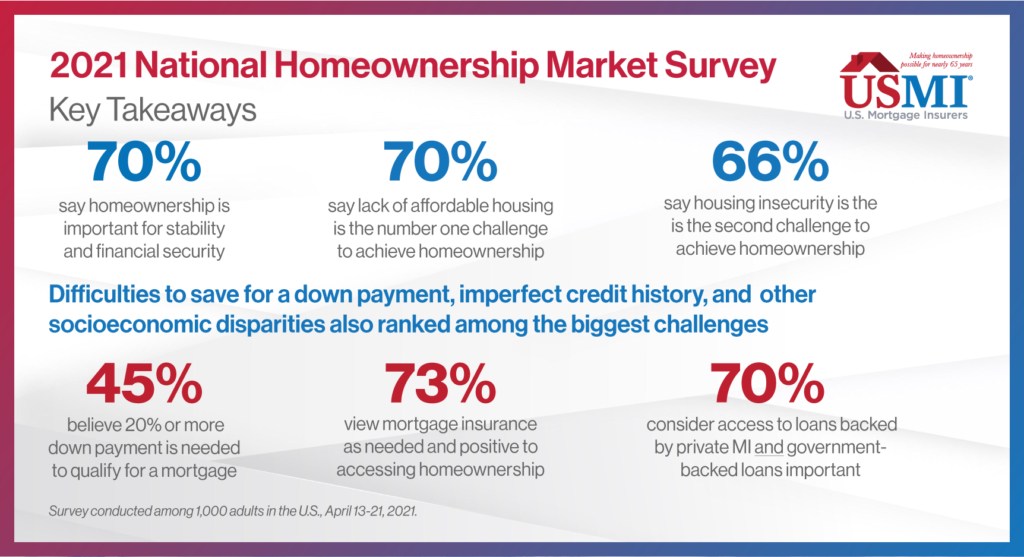

USMI, as articled in its “2022 Policy Priorities for Access, Affordability & Sustainability in the U.S. Housing Finance System,” has consistently supported legislative and regulatory reforms to remove barriers to homeownership and promote an equitable and sustainable housing finance system. As policymakers seek to advance equity in the housing finance system and address significant affordability issues, they must thread the needle of expanding access to homeownership without further driving up housing costs in a very tight market. The country is experiencing an alarming shortage of homes, most notably in the “starter home” segment of the market, with only 1.8 months of supply for existing homes at the end of 2021, according to the National Association of Home Builders (NAHB). This has been one of the primary drivers of strong home price appreciation which came in at 17.5 percent for 2021, according to the Federal Housing Finance Agency’s (FHFA) House Price Index (HPI). While home price appreciation is a boon for existing homeowners who rapidly build up equity that can be tapped for other financial goals, increasing house prices represent a real hurdle for families looking to attain homeownership.

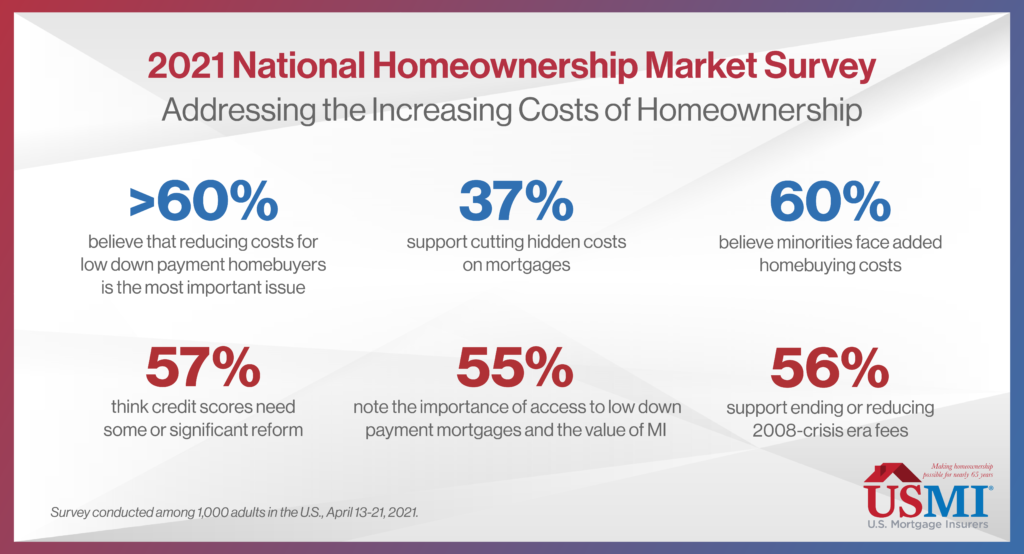

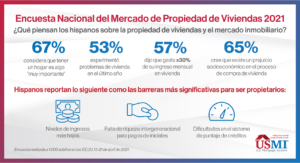

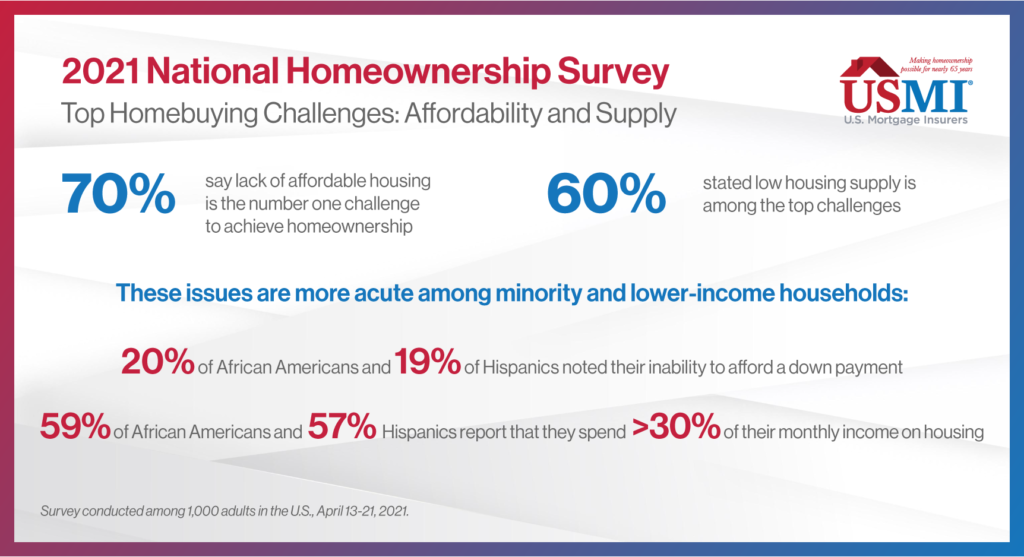

Survey and reports, including USMI’s 2021 National Homeownership Market Survey, routinely identify saving for a down payment as one of the primary challenges that families face when it comes to purchasing. Recent year’s home price appreciation demonstrates the critical need to ensure continued robust access to low down payment mortgages, where borrowers can put as little as 3 percent down with private mortgage insurance (MI) and 3.5 percent down with government-backed insurance. However, for those who are unable to cobble together the funds for a 3 or 3.5 percent down payment, non-profit organizations and governmental entities throughout the country operate thousands of down payment assistance (DPA) programs designed to help these homebuyers. Policymakers have honed in on DPA as a tool to expand homeownership and legislative proposals, most notably House Finance Services Committee (HFSC) Chairwoman Waters’ (D-CA) Downpayment Toward Equity Act (H.R. 4495 / S. 2920). These proposals understand the need to focus these programs to those who need assistance most, targeting first-time, first-generation homebuyers. BBB included $10 billion for such a program and housing advocates had called for that number to be increased to $100 billion. In the wake of BBB stalling in the Senate, policymakers in the House are exploring upcoming legislative vehicles to appropriate funds for targeted DPA.

Housing Tax Provisions

Mortgage Insurance Premium Tax Deduction

At the end of 2021, various temporary tax provisions commonly referred to as “tax extenders” expired, including the deduction for MI premiums. Borrowers who are unable to put down 20 percent for their homes typically finance the purchase transaction with loans that have either private MI of government-backed MI through the Federal Housing Administration (FHA), U.S. Department of Veterans Affairs (VA), or U.S. Department of Agriculture (USDA), and these premiums have been tax deductible for many homeowners since 2007. This deduction has been extremely beneficial for first-time, younger, and minority homebuyers who often rely on low down payment mortgages to purchase homes due to limited access to funds or intergenerational wealth for large down payments.

In December 2021, Reps. Ron Kind (D-WI) and Vern Buchanan (R-FL) introduced H.R. 6109 and earlier this month Sens. Maggie Hassan (D-NH) and Roy Blunt (R-MO) introduced S. 3590 to permanently extend the tax deduction for MI premiums and expand taxpayer eligibility by increasing the income threshold. This bipartisan, bicameral legislation would ensure that millions of homeowners continue to benefit from this tax deduction, which in 2019 amounted to an average deduction of more than $2,000.

State and Local Tax Deduction

One housing-related tax provision that has been extremely important to senators from high-cost states (which often happen to be Democratic states) is addressing the $10,000 limit on state and local tax (SALT) deductions through tax year 2025 imposed by the Tax Cuts and Jobs Act of 2017. In fact, changes to the SALT deduction are so high on the priority list for some members of Congress that they have declared “No SALT, no deal” with regard to supporting a BBB-like package. The House-passed version of BBB raised the SALT deduction cap from $10,000 to $80,000 for tax years 2021 through 2030 but, due to no chance of passage in the Senate, the cap remains unchanged. Outside of the BBB legislative process, lawmakers on both sides of the aisle have introduced standalone bills to address, in various manners, the current SALT cap, including:

- SALT Deductibility Act (R. 613 / S. 85) – repeals the temporary cap for tax years 2021 through 2025.

- SALT Fairness Act (R. 202) – repeals the temporary cap for tax years 2021 through 2025.

- SALT Deduction Fairness Act (804) – increases the cap to $20,000 for joint filers for tax years 2021 through 2025.

- SALT Fairness for Working Families Act (R. 2439) – increases the cap to $15,000 for individual filers and $30,000 for joint filers for tax years 2021 through 2025.

As Democrats look for legislative vehicles to address SALT, including upcoming spending bills and smaller packages that advance targeted portions of BBB, there is a growing sense that modifications should be tailored to help middle class Americans and not amount to a giveaway to millionaires and billionaires.

******

The pressure is on for Democrats to deliver on the Build Back Better agenda that was a pillar of the 2020 Biden campaign. One month in Washington, DC is a long time and eight months can seem like an eternity, but all eyes will be on the White House and congressional Democrats’ internal negotiations to determine what housing policies, if anything, can be passed before voters head to the polls in November.