Data Filter: Consumer Survey

Blog: Black History Month – Working to Promote More Affordable and Sustainable Homeownership

Op-Ed: Despite headwinds, homeownership remains important in Missouri and across U.S.

USMI President Seth Appleton authored an opinion piece in the Springfield News-Leader on the greatest challenges that future homebuyers face in his home state using data from USMI’s 2024 National Homeownership Survey. In the piece, he explains how thousands have been able to purchase with low down payment mortgages using private MI and calls for the renewal of a tax deduction that more than 14,000 Missourians claimed in 2021 before the deduction expired. “For 15 years, millions of homeowners relied on this deduction to offset some of the costs of homeownership. There aren’t that many no-brainers in Washington, D.C. This, however, is one of them,” said Appleton. Read the full piece here.

Press Release: USMI’s 2024 Homeownership Market Survey

Blog: USMI Celebrates Hispanic Heritage Month with New Data on Hispanic Homeownership

Blog: Mortgage Insurance Levels the Playing Field

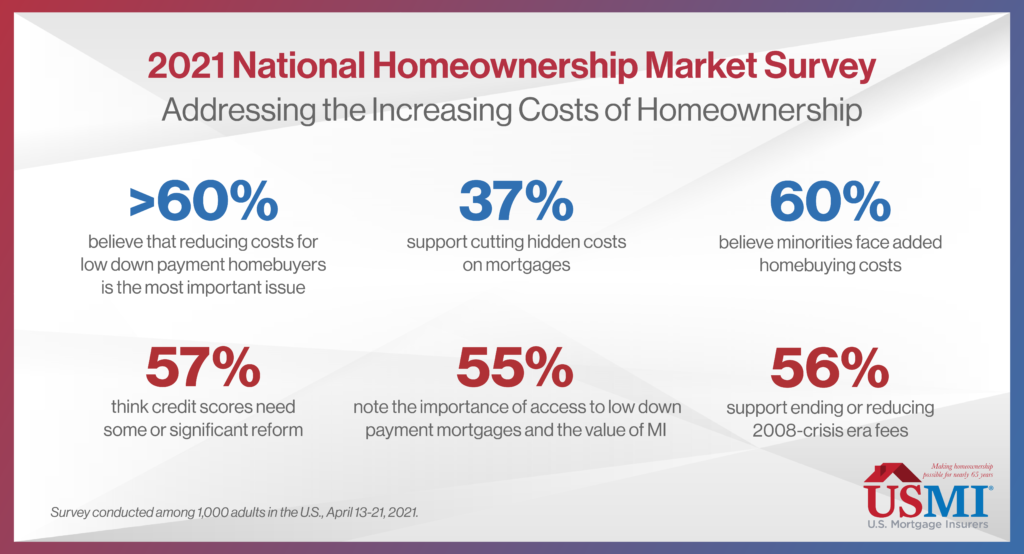

Blog: Addressing the Increasing Costs of Homeownership

Buying a home is the largest single investment most Americans will make, but during the last few years, that dream has become increasingly unreachable for a significant portion of the population as the housing market experiences strong home price appreciation (HPA) and historically low levels of supply. A recent Wall Street Journal article reported on this rising home price trend, outlining how mortgage payments can become unaffordable as a result. According to the Federal Reserve Bank of Atlanta, the median American household would need 32.1 percent of its income to cover mortgage payments on a median-priced home – the most since November 2008, when the same outlays would require 34.2 percent of income. Moreover, the Federal Housing Finance Agency’s (FHFA) 2021 Q3 House Price Index (HPI®) report indicates that house prices were up 4.2 percent compared to the second quarter of 2021, but the real surprise comes when you look over the one year period during which home prices climbed 18.5 percent.

With this in mind, it is no surprise that an increasing number of consumers (64 percent) believe it is a bad time for buying a home, according to Fannie Mae’s latest Home Purchase Sentiment Index (HPSI®). This is a dramatic change from a year ago when that rate stood at only 35 percent, a change driven by consumers’ sentiments that home prices (plurality at 45 percent) and mortgage rates (majority at 58 percent) will increase over the next 12 months.

This entire situation only serves to push the goal of owning a home further out of reach for many prospective first-time, minority, and low- to moderate-income (LMI) homebuyers. In addition, there are other fees and charges that potential homebuyers could incur, increasing the cost of homeownership for creditworthy borrowers throughout the country. In fact, USMI’s 2021 National Homeownership Market Survey, which polled 1,000 adults in the U.S., found that 60 percent of respondents believe minorities face added homebuying costs because they tend to have lower credit and higher debt.

Moreover, when asked about the priorities and reforms the housing finance industry should focus on, over 60 percent of respondents believe that reducing costs for low down payment homebuyers is the most important item for the home buying process, and 37 percent support cutting hidden costs on mortgages. Other issues respondents conveyed include:

- Nearly 70 percent of respondents ranked the lack of affordable housing as the number one housing challenge and almost 60 percent stated that low housing supply is another top issue.

- 61 percent of respondents want to eliminate added costs for low down payment homebuyers and 56 percent of respondents specifically support ending Loan-Level Price Adjustments (LLPAs), 2008-crisis era fees that disproportionately affect minority and first-time homebuyers.

- 55 percent of respondents noted the importance of access to low down payment mortgages and the value of mortgage insurance (MI) to help borrowers qualify for mortgage financing.

- 57 percent think credit scores need some or significant reform, driven by respondents’ view that credit score is the underwriting element that most impacts mortgage costs.

Many of the “hidden costs” that borrowers reference when purchasing a mortgage are not really “hidden,” but instead are costs that they may not have anticipated incurring as part of closing the loan. Last week, Fannie Mae released a report titled, “Barriers to Entry: Closing Costs for First-Time and Low-Income Homebuyers,” which finds “[i]n a sample of approximately 1.1 million conventional home purchase loans acquired by Fannie Mae in 2020, median closing costs as a percent of home purchase price were 13 [percent] higher for low-income first-time homebuyers than for all homebuyers, and 19 [percent] higher than for non-low-income repeat homebuyers.” The report also finds that “Black and white Hispanic low-income first-time homebuyers on average paid higher closing costs relative to purchase price than their white non-Hispanic or Asian counterparts […] For some low-income first-time homebuyers, closing costs can be particularly onerous.” Fannie Mae found that some of these “homebuyers had closing costs equal to or exceeding their down payment.”

The FHFA released an Equitable Housing Finance Plans Request for Input (RFI) in September 2021, and the government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, are required to submit Equitable Housing Finance Plans to FHFA by December 31, 2021. The plans will be in effect on January 1, 2022. USMI submitted its comment to the RFI in October. Given the private MI industry is one of the only forms of private capital available through market cycles and whose core business is focused on helping people without large down payments achieve affordable and sustainable homeownership, private MIs share the FHFA and GSEs’ view that the two pillars of good mortgage lending are sustainability and affordability. The goal should be a strong housing finance system that ensures equitable access to all mortgage-ready borrowers. USMI strongly supports efforts to remove barriers to homeownership and increase access and affordability, including for historically underserved households, while instilling sustainability for these same borrowers. The MI industry welcomes the opportunity to work with the FHFA, the GSEs, and other housing finance stakeholders to advance these goals.

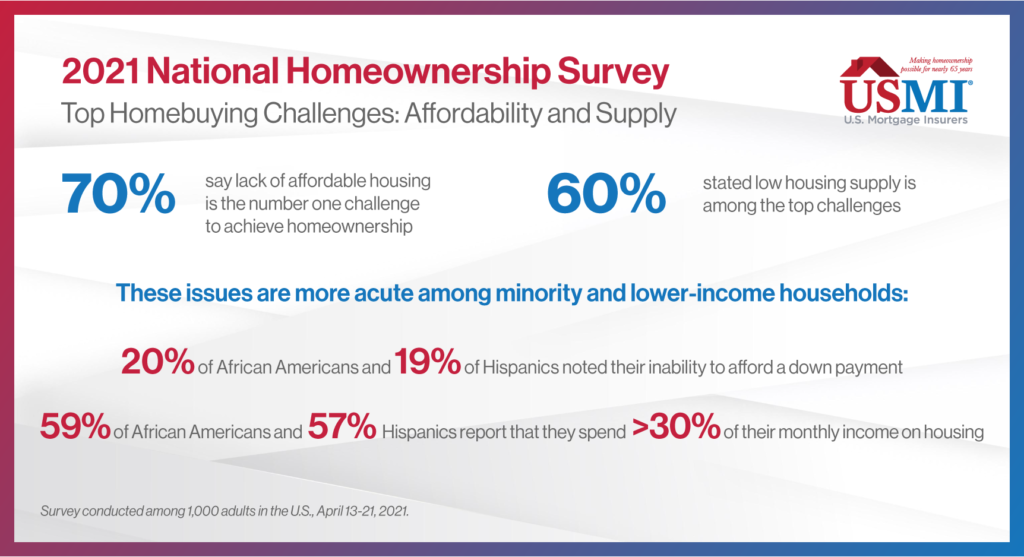

Blog: Affordability and Supply Among Top Homebuying Challenges

The lack of affordable housing continues to be a focal point for the mortgage finance community as low- to-moderate income (LMI) and first-time homebuyers continue to report challenges in buying starter homes. In fact, today, the Federal Housing Finance Agency (FHFA) released its Home Price Index and reported that home prices were up 1.7 percent in May, and up an astonishing 18 percent year over year. This significant home price appreciation is largely driven by the lack of housing supply in today’s market and is impacting borrowers’ access to homeownership across the country. Therefore, it is no surprise this topic has become an elevated policy concern, as the “underbuilt” gap has dramatically increased over the last decade, and between 2018 and 2020, the housing stock deficit increased by more than 50 percent according to a recent Freddie Mac report.

The National Association of REALTORS® (NAR) recently released a report that highlights the dire housing supply situation our nation currently faces. “The state of America’s housing stock […] is dire, with a chronic shortage of affordable and available homes [needed to support] the nation’s population,” and adds that “[a] severe lack of new construction and prolonged underinvestment [have led] to an acute shortage of available housing […] to the detriment of the health of the public and the economy.” In addition to finding an underbuilt gap of 5.5 to 6.8 million housing units since 2001, the report notes that unbuilt single-family homes account for 2 million of those units. This shortage of available and affordable homes, coupled with a robust demand, is fueling the rise of housing prices for potential homebuyers, putting the goal of homeownership further out of reach. NAR’s Chief Economist Lawrence Yun stated in the report, “[t]here is a strong desire for homeownership across this country, but the lack of supply is preventing too many Americans from achieving that dream.” In late June, USMI released its 2021 National Homeownership Market Survey, fielded by ClearPath Strategies among 1,000 U.S. adults in the general population, which found that Americans understand the importance of owning a home: more than 7 in 10 respondents see this as important for stability and financial security.

USMI, in representing a sector of the industry that is dedicated to facilitating affordable low down payment lending and promoting sustainable homeownership, explored this topic in our recent survey, which found that lack of affordable housing and low supply of housing ranked among the top homebuying challenges. In fact, nearly 7 in 10 respondents ranked the lack of affordable housing as the number one housing challenge and nearly 6 in 10 stated that low housing supply is another top issue. These issues were more acute among minority and lower income homebuyers as 20 percent of African American and 19 percent of Hispanic respondents note their inability to afford a down payment. Further, more than half of African Americans (59 percent) and Hispanics (57 percent) reported spending over 30 percent of their monthly income on housing, the threshold for a household to be considered “housing-cost burdened.” The complete findings from USMI’s national survey are available here.

These challenges are front and center of the nation’s housing agencies, FHFA and the Federal Housing Administration (FHA). Last month, President Biden appointed Sandra L. Thompson as FHFA’s Acting Director, having previously served as the Deputy Director of the Division of Housing Mission and Goals since 2013. In her accepting remarks, Thompson stated that “[t]here is a widespread lack of affordable housing and access to credit, especially in communities of color,” adding that “[i]t is FHFA’s duty through our regulated entities to ensure that all Americans have equal access to safe, decent, and affordable housing.” President Biden also recently nominated Julia Gordon to be the Assistant Secretary for Housing and FHA Commissioner.

USMI continues to urge policymakers and the housing finance industry to focus on addressing this historic shortage of affordable homes to help balance housing prices and ensure access to homeownership. In a letter directed to the Department of Housing and Urban Development (HUD) Secretary Marcia Fudge, USMI urged HUD to avoid policies that would stoke more demand in the marketplace without addressing the supply issues, as not doing so will only worsen the affordability challenges. And while addressing supply and the shortage of affordable homes is imperative, policymakers must also not lose sight of addressing the issues that unnecessarily increase costs or create barriers for minority and lower income homebuyers. Importantly, expanding homeownership opportunities for these borrowers does not have to be at the expense of reforms made over the last decade that have strengthened the system to reduce risk, protect borrowers, and avoid another housing market collapse.

We appreciate that policymakers recognize the role of low down payment mortgage options in facilitating homeownership. USMI’s survey found that consumers view mortgage insurance (MI) as an important piece of the homeownership puzzle, specifically because MI levels the playing field by helping LMI and first-time buyers access home financing. In fact, 73 percent of all respondents view MI as needed and positive to obtaining homeownership, and nearly 70 percent of respondents citing that it is important to have access to these low down payment loans through both the conventional market backed by private MI and government-backed loans through FHA.

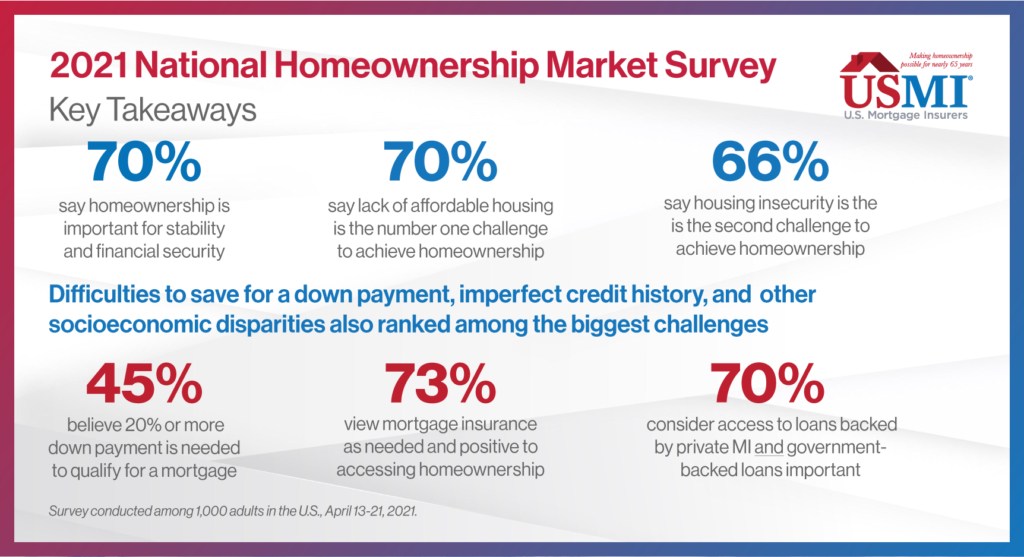

Blog: Key Takeaways from National Homeownership Market Survey

On June 22, USMI released the results of its 2021 National Homeownership Market Survey. ClearPath Strategies fielded the national survey among 1,000 U.S. adults in the general population from April 13-21. Quotas were set to ensure a cross sample of age, gender, race, region, and education as well as homeowners, first-time homebuyers, and prospective homebuyers. The purpose was to understand the perceptions around homeownership, the mortgage process, and the challenges people face when trying to purchase a home.

This blog is the first in a series that will explore the findings from this comprehensive survey around the housing and mortgage markets in the United States. We kick off the series with the seven key takeaways from the national survey. The complete findings from USMI’s national survey are available here.

- Owning a home matters. More than 7 in 10 respondents see owning a home as important for stability and financial security. However, as we dig into the other key findings, economic and access gaps lead to challenges to buying a home.

- Lack of affordable housing and low supply of housing ranked among the top homebuying challenges. In fact, nearly 7 in 10 respondents ranked the lack of affordable housing as the number one housing challenge and nearly 6 in 10 stated that low housing supply is another top issue. This is contextualized by the current historically low housing supply, which is most acute in the “starter home” segment of the market.

- Housing insecurity during the pandemic was also a significant concern for Americans, particularly among minorities. Sixty-six percent of all respondents ranked housing insecurity, including concerns about the ability to make mortgage and rental payments, as the second highest housing challenge. A further dive into the survey findings underscores these economic concerns are particularly acute among minorities. African Americans and Hispanics said that falling behind on rent or mortgage payments was their number one concern. Twice the number of African American respondents (20 percent) and more than one-half times the number of Hispanic respondents (16 percent) reported this concern compared to white respondents (10 percent).

- The inability to save for a down payment and imperfect credit history also ranked among the biggest challenges to buying a home. African American (74 percent) and Hispanic (66 percent) respondents reported that in addition to the lack of affordable homes or lack of supply on the market, the inability to save for a down payment (39 percent of all minorities) and imperfect credit history (37 percent of all minorities) are the biggest challenges they face when it comes to buying a home. Of all adults surveyed, 60 percent view “credit score” as having the most impact on the cost of a mortgage, while 81 percent said they understand the factors that impact one’s credit score and 79 percent view credit scores as being fair.

- Socioeconomic disparities – such as lower income, lack of intergenerational wealth, limited savings, and the percentage of monthly income dedicated to housing costs – only add to the challenges to buying a home. These factors can lead to lower credit scores and higher overall debt loads to manage, which all can contribute to greater challenges to achieving homeownership. African American and Hispanic respondents rank these issues as more significant challenges compared to white respondents.

- Many Americans still do not realize that low down payment mortgages are widely available. Up to 45 percent of all respondents mistakenly believe that you need a down payment of 20 percent or more to qualify for a mortgage. Thirty percent of all adults surveyed indicate that they are not familiar with down payment requirements. In truth, homebuyers can qualify with a down payment as low as 3 percent with private mortgage insurance, and as low as 3.5 percent with a loan backed by the Federal Housing Administration (FHA).

- While down payments continue to be a significant challenge, mortgage insurance (MI) is seen as leveling the playing field and respondents express strong support for access to mortgages with MI in both the conventional and government-backed markets. Seventy-three percent of all respondents view mortgage insurance as needed and positive to accessing homeownership. MI provides access to home financing for those who might not otherwise be able to purchase a home due to limited funds for a down payment. Nearly 70 percent of respondents cited that it was important to have access to loans through the conventional market backed by private MI and government-backed loans through the FHA.

Blog: 2021 National Homeownership Market Survey

ClearPath Strategies fielded USMI’s 2021 National Homeownership Market Survey of 1,000 adults in the U.S. It was commissioned online April 13-21. Quotas were set to ensure a cross sample of age, gender, race, region, and education as well as homeowners, first-time homebuyers, and prospective homebuyers. The purpose was to understand the perceptions around homeownership, the mortgage process, and the challenges people face when trying to purchase a home.

The survey finds that 7 in 10 say lack of affordable housing is the biggest homebuying challenge in the United States, while many do not understand down payment requirements. Housing insecurity (66 percent) and low supply (57 percent) closely followed. Socioeconomic disparities – such as lower income, lack of intergenerational wealth, limited savings, and the percentage of monthly income dedicated to housing costs – were reported to make these challenges more acute.

“This survey underscores the need to address the nation’s undersupply of housing, and specifically affordable housing, because too many people are being left out of the market or face significant barriers to get into the housing market,” said Lindsey Johnson, President of USMI. “Our survey shows that low- to moderate-income households and underserved communities struggle to become homeowners due to several major factors including low housing supply, lack of affordable housing, and personal economic factors such as imperfect credit score or the inability to afford a 20 percent down payment.”

USMI members continue to help millions of borrowers bridge the down payment gap. USMI supports sensible regulatory and legislative reforms to further address barriers to homeownership and promote an equitable and sustainable housing finance system backed by private capital. In collaboration with more than 100 organizations and individuals involved in the Black Homeownership Collaborative, USMI also supports policies that promote equity and work to increase homeownership rates among Black Americans.

Full survey results can be found here. Press release on the survey can be found here.

Press Release: National Survey Confirms Low Housing Supply and Lack of Affordable Housing Among Biggest Homebuying Challenges for Minorities and Americans Overall

2021 National Homeownership Market Survey Also Finds Most Americans Don’t Understand Availability of Low Down Payment Mortgage Options

WASHINGTON — U.S. Mortgage Insurers (USMI) today released its 2021 National Homeownership Market Survey that finds nearly 7 in 10 (69 percent) ranked lack of affordable housing and nearly 6 in 10 (57 percent) ranked low housing supply among the biggest homebuying challenges in the United States. The survey also revealed that many people continue to not understand the down payment requirements to purchase a home. Housing insecurity (66 percent) was also among the top concerns from respondents. Socioeconomic disparities – such as lower income, lack of intergenerational wealth, limited savings, and the percentage of monthly income dedicated to housing costs – were reported to make these challenges more acute. The survey also specifically looked at these responses by race to better understand minorities’ perceptions and challenges to homeownership.

“This survey underscores the need to address the nation’s undersupply of housing, and specifically affordable housing, because too many people are being left out of the market or face significant barriers to get into the housing market,” said Lindsey Johnson, President of USMI. “Our survey shows that low- to moderate-income households and underserved communities struggle to become homeowners due to several major factors including low housing supply, lack of affordable housing, and personal economic factors such as imperfect credit score or the inability to afford a 20 percent down payment.”

USMI’s survey found that when broken down by race these economic factors are even more pronounced. Seventy-four percent of African American and 65 percent of Hispanic respondents reported that in addition to the lack of affordable homes or low supply, the inability to save for a down payment (39 percent of all minorities) and imperfect credit history (37 percent of all minorities) are the biggest challenges they face when it comes to buying a home.

Housing insecurity during the pandemic was also a significant concern among survey respondents, particularly for minorities. The number one concern among African American and Hispanic respondents was falling behind on rent or mortgage payments. In fact, twice the number of African American respondents (20 percent) and more than one and half times the number of Hispanic respondents (16 percent) reported this concern compared to white respondents (10 percent).

“The survey also shows that more education is needed around the mortgage finance process, particularly to ensure more buyers understand that low down payment mortgage options are widely available,” said Johnson.

USMI’s survey found that up to 45 percent of all respondents mistakenly believe that you need a down payment of 20 percent or more to qualify for a home purchase. Another 30 percent indicated that they do not know about down payment requirements. In truth, you can qualify with a down payment as low as 3 percent. The survey also asked respondents about the role of mortgage insurance. According to survey respondents, the top reasons for MI are it “levels the playing field” and “increases lower-income families’ access to homeownership.” A majority of respondents also said it was important to have access to low down payment loans through both the conventional and government-backed markets, such as the Federal Housing Administration (FHA).

USMI members support sensible regulatory and legislative reforms to remove barriers to homeownership, and they promote an equitable and sustainable housing finance system backed by private capital. In collaboration with more than 100 organizations and individuals involved in the Black Homeownership Collaborative, USMI also supports policies that promote equity and work to increase homeownership rates among Black Americans.

ClearPath Strategies fielded USMI’s 2021 National Homeownership Market Survey of 1,000 adults in the U.S. It was commissioned online April 13-21. Quotas were set to ensure a cross sample of age, gender, race, region, and education as well as homeowners, first-time homebuyers, and prospective homebuyers. The purpose was to understand the perceptions around homeownership, the mortgage process, and the challenges people face when trying to purchase a home.

The complete findings from USMI’s national survey are available here.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org

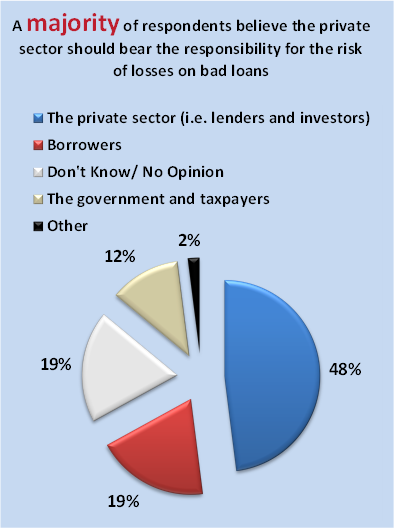

Poll: Results and Forum Highlight Interest for Reducing Housing Risks

(February 10, 2016) Today, USMI released new polling results showing strong national support for reducing GSE and taxpayer risk through increased reliance on private capital. The data comes in advance of tonight’s Urban Institute /Core Logic Forum on risk sharing, “Credit Risk Transfer: Making a Successful Program Even Better.”

For more information about tonight’s Urban Institute/ Core Logic Forum CLICK HERE

To see complete topline poll results CLICK HERE

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.