Author: Karl Howley

Letter: Support for Housing for the 21st Century Act

On February 6, 2026, USMI submitted a letter to Speaker Johnson and Leader Jefferies in support of the Housing for the 21st Century Act. USMI urges quick passage of the bill by the U.S. House of Representatives and commends the leadership of the House Financial Services Committee in advancing this important bipartisan legislation. USMI appreciates Congress’ and the Administration’s focus on increasing the nation’s housing stock and helping Americans become homeowners while ensuring safety and soundness in the housing finance system. For the full letter, see here.

Mortgage Insurance: Deductible Once Again Starting Tax Year 2026

Statement: FHFA’s 2026 – 2028 Enterprise Housing Goals

Statement: Senate Confirmation of FHA Commissioner, Ginnie Mae President, and FDIC Chairman

WASHINGTON — Seth Appleton, President of U.S. Mortgage Insurers (USMI), released the following statement regarding the Senate confirmation of Frank Cassidy as Federal Housing Administration (FHA) Commissioner, Joseph Gormley as President of the Government National Mortgage Association (Ginnie Mae), and Travis Hill as Chairman of the Board of Directors for the Federal Deposit Insurance Corporation (FDIC) by a vote of 53-43:

“USMI congratulates Frank Cassidy on his confirmation to serve as Assistant Secretary of Housing and Federal Housing Commissioner. Mr. Cassidy brings extensive experience in real estate and housing finance, and we look forward to working with him in this new role in support of mortgage financing that is affordable, accessible, and sustainable for working class families across the country while at the same time promoting safety and soundness in the U.S. housing finance system.”

“USMI further congratulates Joseph Gormley on his confirmation as President of Ginnie Mae, and Travis Hill on his confirmation as Chairman of the FDIC Board of Directors. We look forward to working with Mr. Gormley to promote a safe, sound, and liquid housing finance system, and with Mr. Hill to make prudent updates to bank capital rules that balance access to mortgage credit for low down payment homebuyers with a financially stable housing finance system.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Private mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.

Statement: House Financial Services Committee Approval of Housing Legislation

Newsletter: December 2025

Letter: Joint Trade Letter to SEC on Prioritizing “Asset-Backed Securities Registration and Disclosure Enhancements”

Letter: Comment to SEC on “Concept Release on RMBS Disclosures and Enhancements to Asset-Backed Securities Registration”

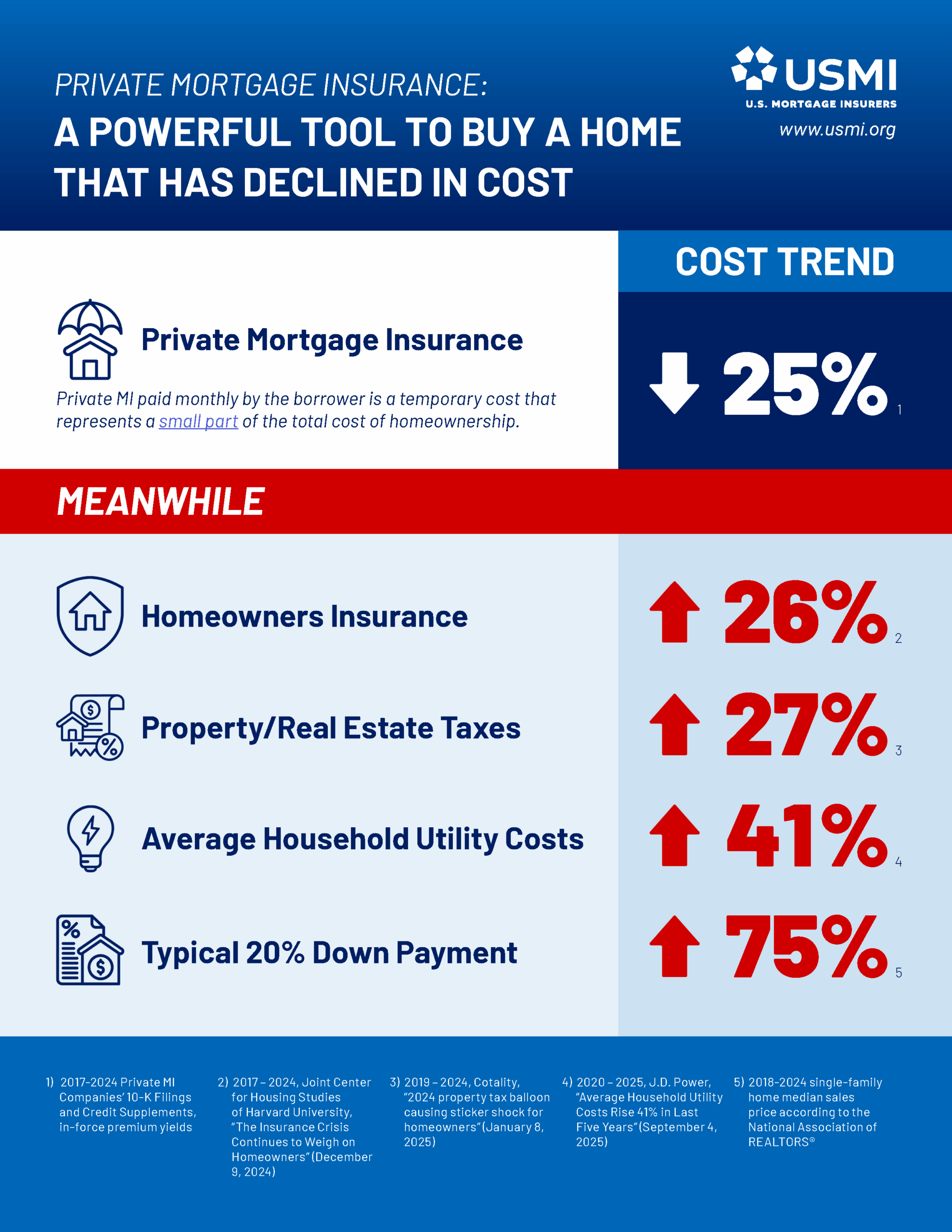

Blog: Private Mortgage Insurance: A Powerful Tool To Buy A Home That Has Declined In Cost

Private mortgage insurance is a powerful tool to buy a home that helps borrowers become homeowners with tens of thousands less at the closing table and without having to save for a 20% down payment. Private MI paid monthly by the borrower is a temporary cost that represents a small component of the total cost of homeownership. What’s more, private MI has declined in cost in recent years. Unlike other costs associated with homeownership that have increased significantly, such as homeowners insurance, property/real estate taxes, average household utilities, and the amount of money needed for a down payment, the cost of private MI has decreased by 25% based on in-force premium yields. See here or below for USMI’s new infographic detailing this striking difference!

Blog: New Analysis Demonstrates It’s Time to Modernize FHA’s Capital Ratio

Since 1990, the Federal Housing Administration (FHA)’s taxpayer-backed Mutual Mortgage Insurance Fund (MMIF) has been required by statute to maintain a positive economic value of 2% going forward to help cover any unexpected losses – a requirement often referred to as FHA’s 2% Capital Ratio. That was 35 years ago, and a lot has changed since then – including the Great Financial Crisis and updated, risk-based capital frameworks developed in its aftermath to ensure the housing finance system remains strong and resilient in the face of stress events. However, despite these significant changes, the 2% Capital Ratio remains the same to this day.

In the coming weeks, FHA will release its annual report to Congress detailing the financial status of the MMIF as of the end of the fiscal year. Every year, FHA provides an annual report to Congress on its fiscal condition. To help enhance transparency around the true fiscal condition of the MMIF and FHA’s forward mortgage program and contextualize these numbers, USMI commissioned Milliman, a third-party actuarial firm, to estimate the risk-based capital FHA would be required to hold if subject to the same capital frameworks as private mortgage insurers and the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac.

Milliman found that, if held to the same capital standard (PMIERs) that private mortgage insurers must meet to insure loans acquired by the GSEs in the conventional market, FHA would run a $31.7 billion shortfall. Similarly, FHA would need to hold $50 billion more to meet the GSE capital framework’s minimum requirement if applied to FHA’s book of business.

FHA is designed to enable access to homeownership for borrowers who may not qualify through traditional underwriting and plays an important countercyclical role in America’s housing finance system. It must remain strong and well-capitalized to perform these critical functions. After 35 years, Congress should consider replacing the 2% Capital Ratio requirement with an updated stress-based, loan-level risk-weighted standard that would ensure FHA has sufficient capital to meet its obligations during a time of severe stress, similar to how the GSEs and the private MI industry have built safeguards to ensure sufficient capital levels to withstand downturns.

Read our full policy brief here to learn more about why policymakers should consider modernizing FHA’s Capital Ratio to preserve safety and soundness in the housing finance system.

Op-Ed: Homeownership for working families is about to get more affordable

USMI President Seth Appleton authored an opinion piece in the Western Journal on the reinstatement and permanency of the mortgage insurance (MI) premium tax deduction as part of President Trump’s One Big Beautiful Bill Act and the benefits that American families will soon see from the provision. “Americans previously used the deduction 44 million times for combined deductions of $65 billion. In the last year it was available, taxpayers received back an average of more than $2,300. For middle-class families, that’s real money — enough to cover monthly bills, put food on the table, or help with school expenses for the kids. Thanks to the One Big Beautiful Bill Act, that tax relief is now back for good,” wrote Appleton.

Appleton added: “The impact of this deduction can be substantial. In 2024 alone, more than 800,000 Americans purchased homes with the help of private mortgage insurance. Nearly two-thirds were first-time buyers, and many earned under $75,000 a year. These aren’t Wall Street investors — they’re teachers, nurses, police officers, and young families finally getting their foot in the door of homeownership… The restoration of the mortgage insurance deduction means homeownership is now closer within reach for millions of families. It is a concrete win at a time when Americans are eager to see results from Washington. That’s good news for working families — and it’s worth celebrating.”

Read the full piece here.