Approximately 65% of purchasers that used private MI were first-time homebuyers

WASHINGTON — U.S. Mortgage Insurers, the association representing the nation’s leading private mortgage insurance (MI) companies, released its annual volume data for last year that show the industry helped more than 800,000 borrowers secure mortgage financing in 2024. Approximately 96% of these mortgages were new purchases, and first-time homebuyers represented approximately 65% of purchasers with private MI. In addition, the industry supported nearly $300 billion in mortgage originations in 2024, according to public filings. This represents $300 billion worth of mortgage credit extended to borrowers for which Fannie Mae and Freddie Mac (the GSEs), taxpayers, lenders, and investors are protected from risk of loss.

In 2024, the private MI market also served a large number of low- and moderate-income borrowers. Nearly 35% of those that purchased or refinanced a mortgage with private MI had annual incomes below $75,000, and the average loan amount with private MI was approximately $365,000, according to GSE data. The private MI industry has enabled nearly 40 million people to access affordable, low down payment mortgages in its 68-year history.

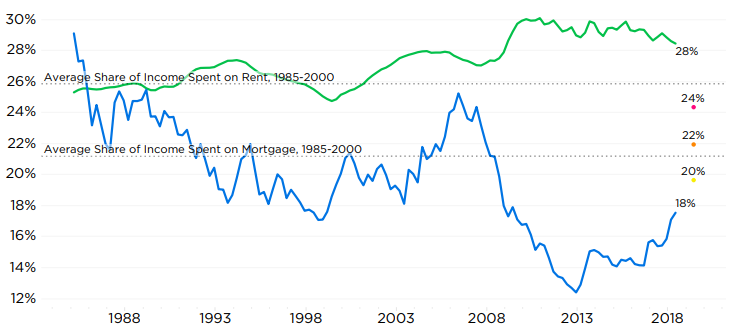

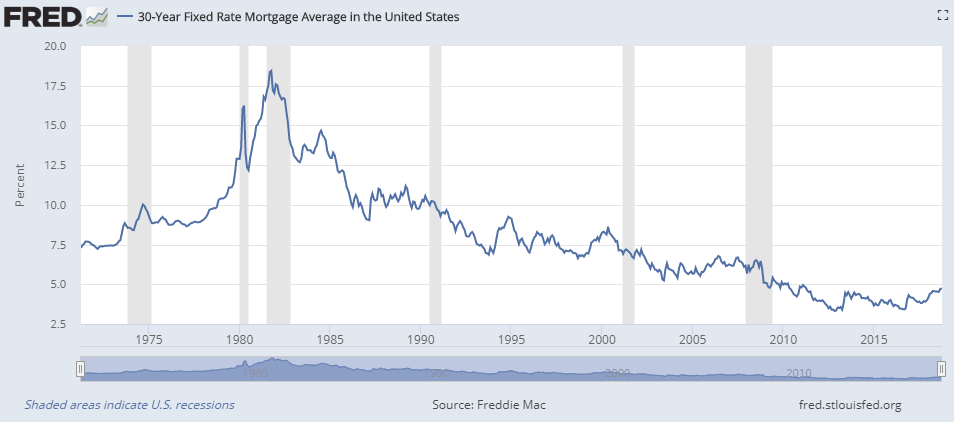

“At a time when nearly 80% of Americans believe owning a home is very important to them, despite challenges from interest rates and inventory, private MI continues to make the dream of homeownership possible for millions of people across the country that don’t have access to a 20% cash down payment,” said Seth Appleton, President of USMI.

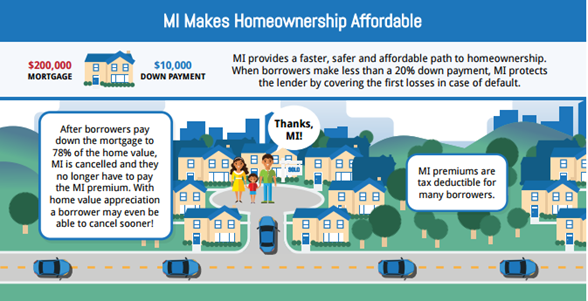

USMI’s “2024 National Homeownership Market Survey” found that the ability to afford a down payment ranks as the top challenge to buying a home. The survey further found that Americans see private MI as providing benefits including enabling borrowers to qualify for mortgage financing with a down payment as low as 3%, and allowing them to access homeownership and the ability to begin building equity sooner. Rather than waiting years to save for large down payments, private MI allows homebuyers to get off the sidelines quicker and is a small cost that has declined in recent years due to the Trump tax cuts and enhanced risk-based pricing.

By design, private MI serves as the first layer of private capital protecting the housing system against default risk, protecting more than $1.4 trillion in GSE mortgages and shielding taxpayers from risk. The industry has significantly expanded its role as a “second pair of eyes” during mortgage underwriting and post-close processes to serve as a check on fraud and credit quality. In addition, the strength and resiliency of private MI has been reinforced by safeguards and requirements that have been revised and refined over the years, including the Private Mortgage Insurer Eligibility Requirements (PMIERs), which set robust, granular requirements for insuring loans acquired by the GSEs.

“Since the GSEs entered conservatorship, the private MI industry has covered nearly $60 billion in claims, shielding the GSEs and the taxpayers who stand behind them from significant financial losses,” said Appleton. “A strong, dedicated source of private capital that protects taxpayers from the risks of future housing downturns and also works for homebuyers is truly a win-win.”

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to affordable and sustainable housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.