Blog: Eyes on the FHA

As one arm of the federal government attempts to cool inflation and home price appreciation, another risks making things worse.

Earlier this month the Federal Reserve ordered the largest interest hike in more than two decades as part of its strategy to combat inflation. According to some reports, policymakers continue to talk about interest rates climbing 2% by the end of 2022, and close to 3% by the end of 2023. And rising rates increase the cost for all forms of credit, including home mortgages.

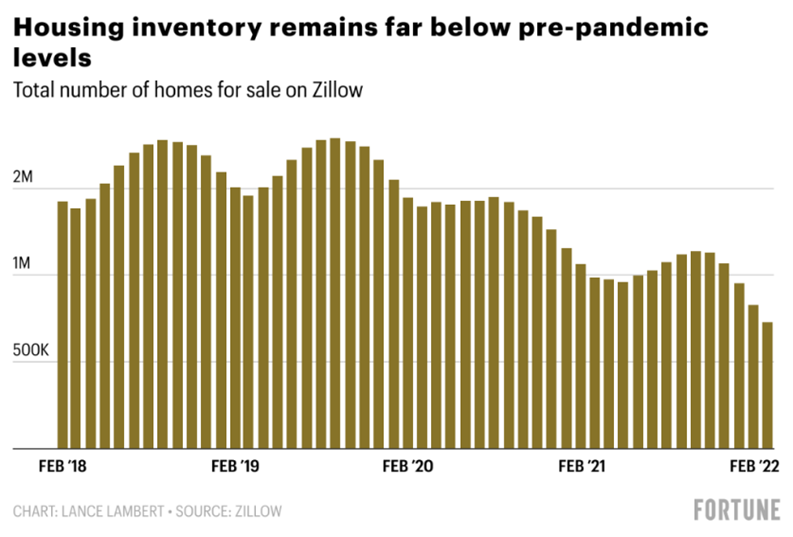

The rising cost of housing is a major barrier to access homeownership for families across the country, with a market characterized by record year-over-year home price appreciation driven by severely low housing supply. According to CoreLogic Home Price Insights, home prices nationwide, including distressed sales, increased 20.9% in March 2022 from March 2021—one of the highest increases on record for the index. No states posted an annual decline in home prices. The states with the highest increases year-over-year were Florida (31.4%), Arizona (28.7%) and Tennessee (26.7%). Supply of affordable housing, on the other hand, remains at historic lows—an estimated shortage of 3-5 million homes.

Unlike with fuel and food costs, it will take longer to address the housing shortage, and therefore inflation is not transitory. With the Federal Reserves’ anticipated rate increases this year, home price appreciation is expected to moderate by next year to the single-digits, which should begin to help create a better homebuying environment for sidelined borrowers who have been battling soaring prices for several years.

USMI has long called for a consistent and coordinated housing and mortgage finance market, where public and private sector stakeholders work in sync. Yet, as the Federal Reserve seeks to cool the market and battle inflation with increased mortgage rates, there are some in other parts of the government calling for pricing changes to government-backed mortgages insured by the Federal Housing Administration (FHA)—a move that will only inject more demand into a maxed out housing market. Instead of cooling the market, the change will push more borrowers into the market and push home prices even higher. And, because of the segment of the market that the FHA primarily serves, this will disproportionately and negatively impact first-time, minority, and low- to moderate-income borrowers.

The FHA should not reduce its mortgage insurance (MI) premiums at this time. While it may be well-intended to make the cost of a FHA mortgage cheaper at a time when it seems like all consumer goods are going up in price, it will have negative unintended consequences further increasing demand with minimal housing supply as well as the economic uncertainty related to the economy

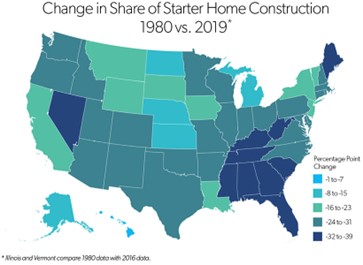

The chief problem experienced by low down payment borrowers isn’t the cost of MI (according to Fannie Mae, private MI ranks among the lowest costs associated with homeownership), but the lack of affordable housing within the market. USMI’s national homeownership survey found this to be true with regards to the personal opinions and sentiment among homebuyers and homeowners. Moreover, according to Freddie Mac, “the main driver to the housing shortage is the decline in construction of entry-level, single family homes.” If there isn’t enough housing supply in the market today, then reducing the cost of an FHA mortgage will only make things more competitive and reduce supply in the market tomorrow.

The FHA plays a critically important countercyclical role to the conventional mortgage market. When private capital and the conventional mortgage market pulls back, the FHA can and has expanded—while assuming greater default risk—to ensure liquidity remains in the market. Because FHA mortgages are 100% backed by the government and taxpayers, it is sound public policy to be cautious about expanding FHA’s footprint too far out front, especially for borrowers who can be served by the conventional market. Today, the conventional market is ready, willing, and able to serve more low down payment borrowers. In April, USMI announced that nearly 2 million low down payment borrowers became homeowners or refinanced thanks to private mortgage insurance in 2021.

The government should favor an expanded conventional mortgage market before it deeply discounts government programs. The government should not be the first choice when it comes to the housing market. This way, the FHA can remain strong and capable of serving underserved borrowers first and foremost, which aligns with the mission of the FHA.

Given the role the housing market plays in the broader economy, reducing FHA premiums now will make it difficult for the Federal Reserve to achieve its goal of combatting inflation and it will only put homeownership further out of reach for many Americans.

Learn more about USMI’s policy priorities on access, affordability, and sustainability in housing.