Factsheet: Backgrounder on the Value of Responsibly Underwritten 97 LTV Loans

Bringing Back the 3% Down Payment Loan: Good for First-Time Homebuyers and Taxpayers

On October 20, Federal Housing Finance Administration (FHFA) Director Watt announced that FHFA and the GSEs were working on guidelines to expand access to 3% low down payment mortgages. Private mortgage insurance (MI) has been readily available to creditworthy borrowers in this market segment for many years, and those responsibly underwritten low down payment loans have a long track record of good performance – comparable in fact to 5% down payment loans. At a time when the share of first-time homebuyers is declining, restoring access to these loans is an important option that would help creditworthy borrowers, especially first-time homebuyers, achieve affordable homeownership in a sensible and responsible manner. Wider availability of prudently underwritten 97% LTV loans would present many benefits for both consumers and taxpayers.

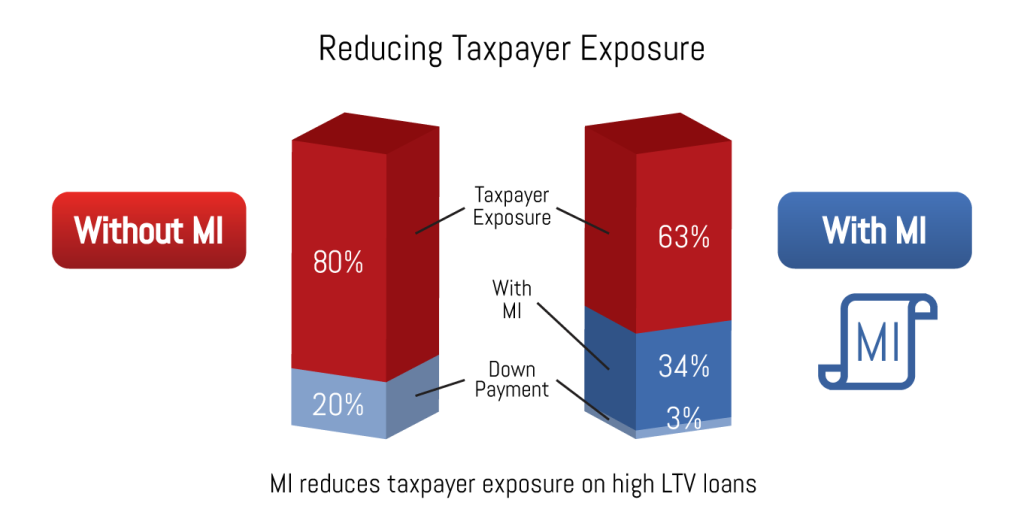

- Reduce Taxpayer Exposure with Private Capital: The return of a 3% down payment mortgage purchased by the GSEs for creditworthy borrowers would not present undue to risk to taxpayers because the GSEs require the use of MI, providing substantial first-loss protection for taxpayers in the form of private capital. Through the use of MI, a prudently underwritten 3% down payment loan with MI actually reduces taxpayer exposure below a comparable 20% down payment loan without MI.

In addition, the absence of low down payment options backed by private capital has only shifted greater risk to taxpayers. Offering a 3% down payment loan with MI purchased by the GSEs would reduce taxpayer risk by giving borrowers an alternative to FHA and other government programs, where taxpayers are responsible for 100% of losses. Furthermore, because FHA allows sellers to contribute up to 6% of the sales price, FHA loans may now already be effectively in excess of 97% LTV.

- Strong History of Performance: MI has been readily available to creditworthy borrowers in this market segment for many years, and those responsibly underwritten low down payment loans have a long track record of good performance – comparable in fact to 5% down payment loans. According to the Urban Institute, data on default rates for loans with a down payment between 3-5 percent was comparable to that for loans with a slightly larger down payment of between 5-10 percent.

- Provide Responsible Loans With High Standards: The regulatory and underwriting landscape has changed dramatically since the crisis. Fully documented low down payment loans were not the cause of the mortgage crisis, and Dodd-Frank requirements have removed the products that were. The return of 3% low down payment loans would have to be consistent with new Qualified Mortgage standards’ emphasis on responsible lending, and be fully documented.

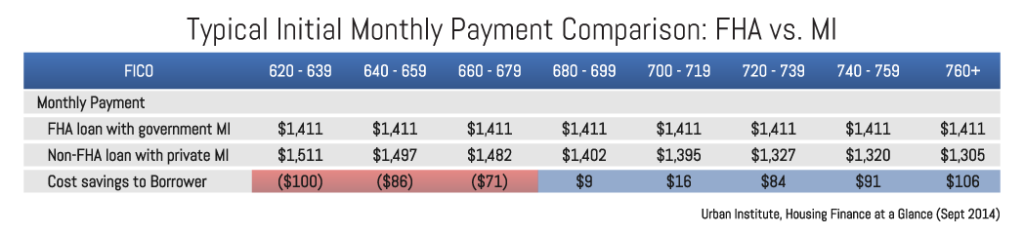

- Increase Affordable Options for Creditworthy Borrowers: Coming up with the required down payment can be one of the biggest hurdles to homeownership. For example, it could take about 20 years for the average firefighter or schoolteacher to save a typical 20% down payment. Right now, many low down payment borrowers are left with no other option but government lending programs such as FHA. Borrowers without a sufficient down payment are required to have government-sponsored mortgage insurance, which cannot be cancelled and thus adds significant additional costs to the borrower over the life of the loan. Loans with private MI offer borrowers an additional option, one that is not only highly competitive in terms of pricing, but also cancelable once the LTV has reached approximately 80%, thus providing substantial savings to borrowers. These borrowers would also benefit greatly from an opportunity to purchase while 30-year fixed rates are near historic lows.

Providing qualified buyers greater access to 3% low down payment loans is yet another example of how MI can help make mortgage credit available to more qualified borrowers, working with lenders of all sizes, while protecting taxpayers.

###

U.S. Mortgage Insurers (USMI) is dedicated to a housing finance system backed by private capital that enables access to housing finance for borrowers while protecting taxpayers. Mortgage insurance offers an effective way to make mortgage credit available to more people. USMI is ready to help build the future of homeownership. Learn more at www.usmi.org.