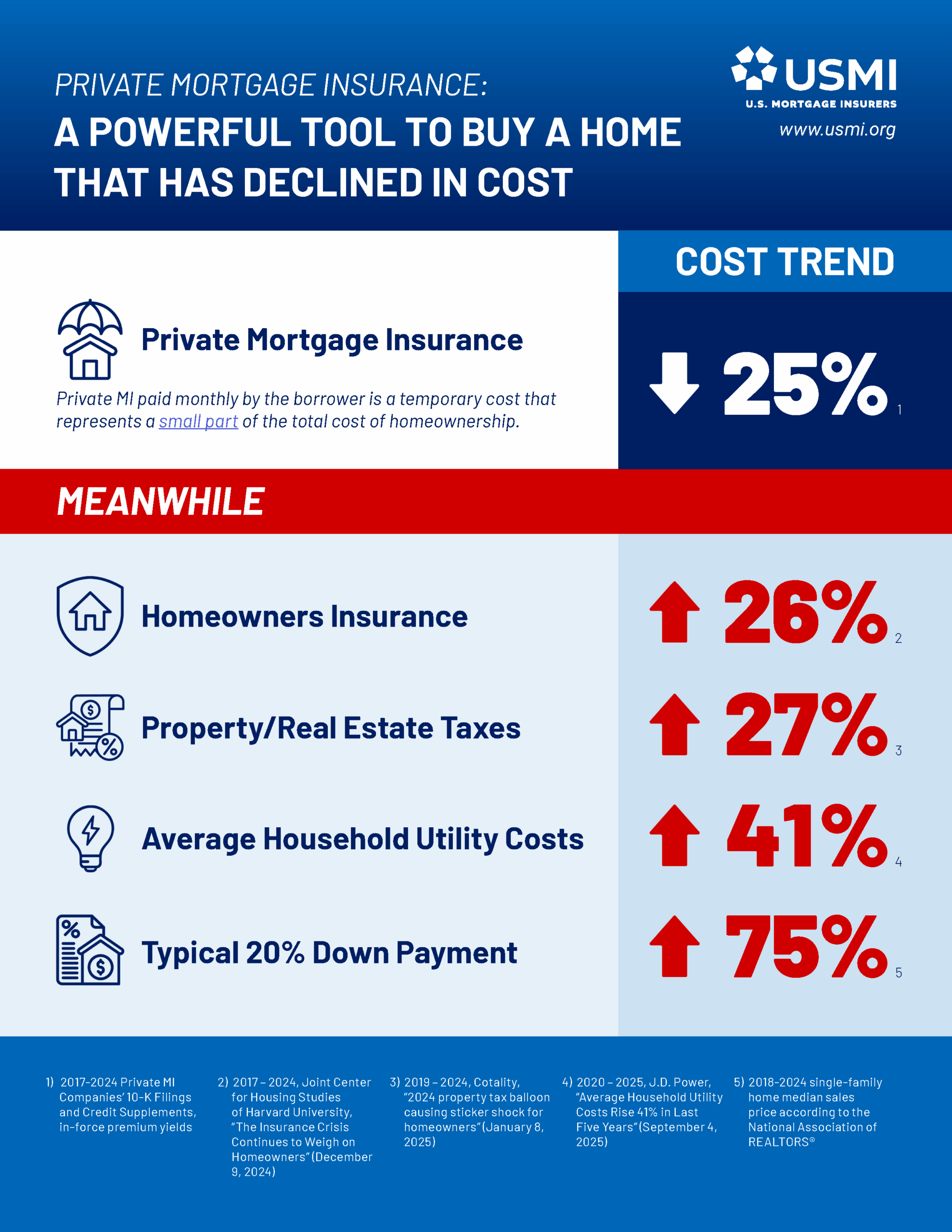

Private Mortgage Insurance: A Powerful Tool To Buy A Home That Has Declined In Cost

Private mortgage insurance is a powerful tool to buy a home that helps borrowers become homeowners with tens of thousands less at the closing table and without having to save for a 20% down payment. Private MI paid monthly by the borrower is a temporary cost that represents a small component of the total cost of homeownership. What’s more, private MI has declined in cost in recent years. Unlike other costs associated with homeownership that have increased significantly, such as homeowners insurance, property/real estate taxes, average household utilities, and the amount of money needed for a down payment, the cost of private MI has decreased by 25% based on in-force premium yields. See here or below for USMI’s new infographic detailing this striking difference!