Blog: Black History Month – Working to Promote More Affordable and Sustainable Homeownership

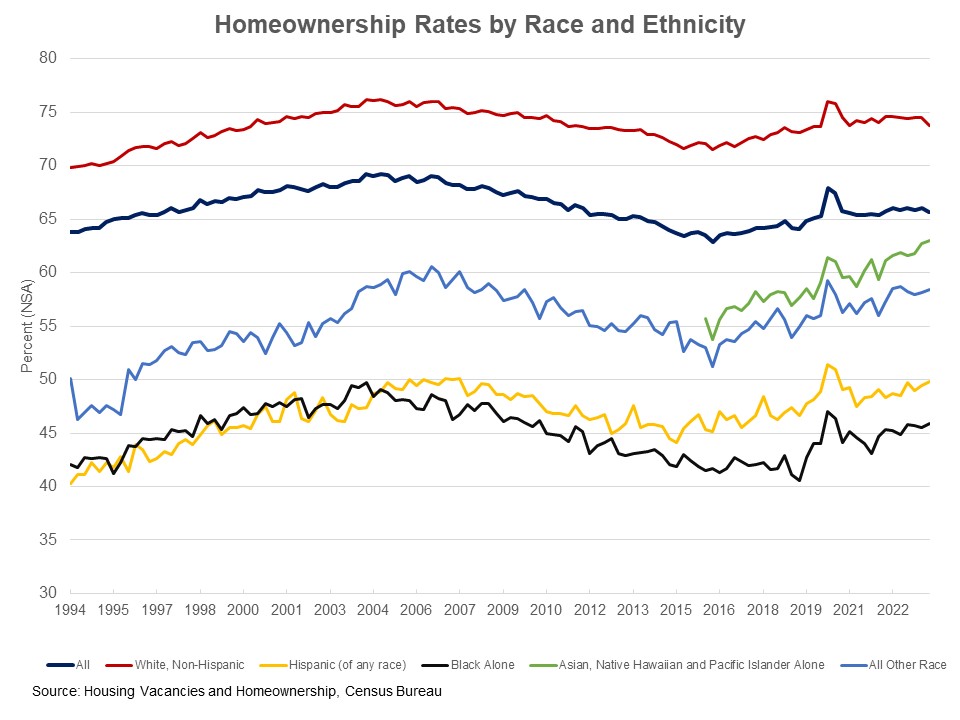

As an industry designed to enable access to homeownership, especially for first-time, low- and moderate-income (LMI), and minority homebuyers, during Black History Month we want to dive into the data, trends, and policies associated with Black homeownership in America. To do so, it is important to recognize the historical racial disparities that exist in the housing market and the lasting effects of redlining and other discriminatory policies. According to data from the United States Census Bureau, the Black homeownership rate was 45.9% at the end of 2023. This figure stands out in contrast to the 73.8% homeownership among non-Hispanic White Americans at the same time.

U.S. Mortgage Insurers (USMI) actively works to support policies that responsibly and sustainably expand access to affordable mortgage credit for underserved communities. After all, equal access to the American Dream of homeownership is critical for families to build long-term intergenerational wealth, as the Federal Reserve’s 2022 Survey of Consumer Finances shows that the median household net worth of a homeowner is nearly 40x that of a renter.

Source to graphic here.

Homeownership Gap

The National Association of Real Estate Brokers’ (NAREB) “2023 State of Housing in Black America” report noted that “[t]he Black/White homeownership disparity was 23.8 percentage points in 1970 and had climbed to nearly 30 percentage points in 2022.”

Several factors, including past systemic issues that unnecessarily created barriers for minority borrowers, lack of affordable housing inventory, inflation, and elevated mortgage rates, have played a role in these disparities. That is why access to low down payment mortgage financing through private mortgage insurance (MI) has become increasingly important for Black families to attain homeownership.

In 2022, private MI helped over 1 million low down payment borrowers secure mortgage financing, including nearly 130,000 Black households, with nearly 35% of all borrowers having incomes below $75,000, and 62% of purchase loans going to first-time homebuyers. Our industry is proud to have supported over $34 billion in mortgage originations to Black families in 2022 – with an average loan amount of approximately $270,000 – and we are committed to working with policymakers, industry stakeholders, and consumer advocates to address the racial homeownership gap. This includes support of the government-sponsored enterprises’ (GSE) affordable housing goals, “Duty to Serve” programs, and special purpose credit programs (SPCPs), in addition to promoting pre- and post-purchase financial literacy resources and partnering with local non-profits, Federal Home Loan Banks, and other market participants on programs aimed at increasing Black homeownership.

Lack of Affordable Housing Inventory

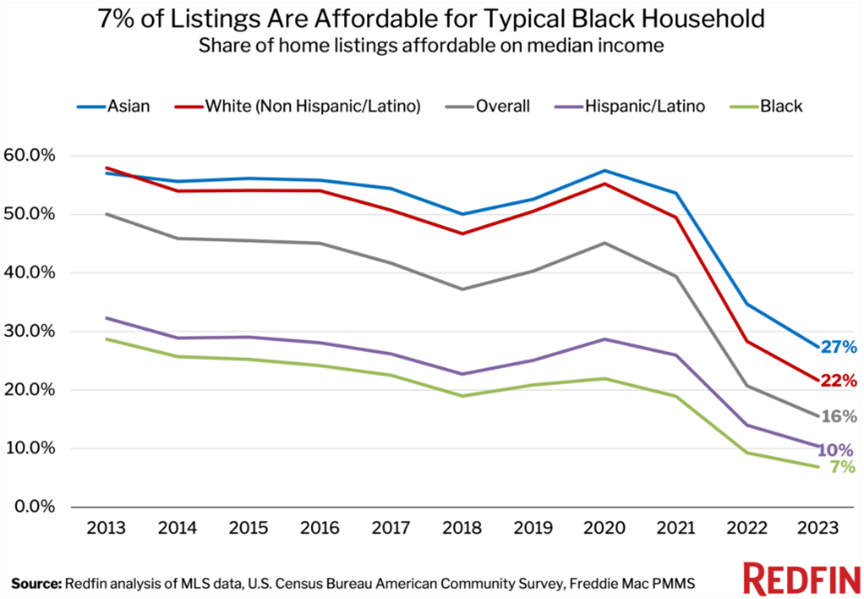

Access to affordable housing continues to be a challenge for many Americans. Analysis by Redfin highlighted that in 2023 “[j]ust 15.5% of homes for sale in 2023 were affordable for the typical U.S. household.” Even more concerning is that the analysis found that “[o]nly 6.9% of homes for sale in 2023 were affordable for the typical Black household.” Furthermore, NAREB reported that in 2022, “[h]ousing demand is outpacing new home construction by roughly 100,000 units annually, which has created the largest housing shortfall in nearly half a century.”

This is a pervasive trend and one that was captured in USMI’s 2021 National Homeownership Market Survey, which found that 74% of Black adults surveyed stated that the lack of affordable housing is the biggest homebuying challenge. Socioeconomic disparities that create barriers to making a large down payment – such as lower incomes, lack of intergenerational wealth (which may be passed to the next generation through homeownership), limited savings, and the percentage of monthly income dedicated to housing costs – were reported to make these challenges more acute. In fact, the survey also found that 59% of Black households were “cost burdened” and spent over 30% of their monthly income on housing.

Although these figures underscore challenges for Black homebuyers, organizations such as USMI work to remove barriers to homeownership and enable homebuying for all mortgage-ready borrowers, including historically underserved households. Recently, this included analyzing and submitting a comment letter on the banking agencies’ Basel III Endgame proposed rulemaking that highlighted how the proposal could harm minority homebuyers’ access to mortgage finance options and impede efforts to close the racial homeownership and wealth gaps. This aligns with feedback from leading consumer advocates and civil rights organizations, including the National Association for the Advancement of Colored People (NAACP) and National Urban League, which have stated that “[i]f [the proposed capital] standards are adopted, they will have a devastating impact on our efforts to increase Black homeownership and disadvantage all first-time, and in particular first-generation, homebuyers who do not have the benefit of multi-generational wealth or higher than average incomes.”

Inflation and Elevated Mortgage Rates

According to the Bureau of Labor Statistics, from December 2022 – December 2023, consumer prices for all items increased 3.4%. With the increase in prices for things such as rent, many have struggled to save for a down payment, with NAREB also reporting that “[i]n addition to curbing the ability of prospective homebuyers to save for downpayment, rising rents encourage more investors to purchase owner-occupied homes and flip them to rental stock.” Compounding affordability issues is the fact that mortgages rates remain high with the average rate for a 30-year fixed-rate mortgage increasing from 5.34% in 2022 to 6.81% for 2023, topping almost 8% in October of 2023.

In such an environment, saving for a 20% down payment is daunting. In June of 2023, USMI released its annual report on mortgage financing supported by private MI at the national and state levels, which found that on average it would take potential homebuyers 35 years to save for a 20% down payment plus closing costs. The report found that for potential Black homebuyers, it would take even longer to save, with the average time being 51 years.

Bottom Line

Fortunately, the private MI industry has a nearly 70-year history of serving borrowers and it is critical that policymakers recognize the role of low down payment mortgage options in facilitating homeownership. In fact, Urban Institutes’ 2023 “Mortgage Insurance Data at a Glance” report found that mortgages backed by private MI have been the most common execution for low down payment borrowers since 2018. While these options have enabled millions of people to become homeowners, there is still more work to be done.