Blog: How Private MI Serves the Housing Finance System as a Source of Strength and Resiliency

On January 16, USMI submitted a comment letter to the Federal Reserve System (Federal Reserve), Federal Deposit Insurance Corporation (FDIC), and Office of the Comptroller of the Currency (OCC) (collectively the Agencies) on the Basel III Endgame proposed rule. The comment letter detailed how the excessively conservative capital requirements proposed will have a detrimental effect on the U.S. economy while also limiting consumers’ access to mortgage loans, especially for first-time, low- and moderate-income (LMI), and minority homebuyers who overwhelmingly rely on low down payment mortgage products to achieve the American Dream of homeownership. This is largely due to the proposal’s departure from the current standardized approach by failing to provide capital credit for private mortgage insurance (MI) despite the industry’s strong historical performance and the numerous enhancements adopted since the Great Financial Crisis. These improvements were outlined in a November 2023 USMI report titled, “Private MI: A Source of Strength & Resiliency in the Housing Finance System,” which described the enhanced capital and operational standards implemented since 2008 to further private mortgage insurers’ ability to support the housing finance system and serve as a permanent source of strength and resiliency through all market cycles.

USMI President Seth Appleton also recently testified before the House Committee on Financial Services’ Subcommittee on Housing and Insurance. Appleton’s testimony highlighted the important role that private MI plays in the housing finance system, as it enables access to affordable and sustainable homeownership for borrowers who are unable to make a large cash down payment, including many first-time, LMI, and minority homebuyers. Importantly, he also noted the strength and resiliency of today’s private MI industry and how the critical risk protection it provides to lenders, Fannie Mae and Freddie Mac (the government sponsored enterprises or GSEs), and taxpayers significantly contributes to the overall stability of the housing finance system. Analysis of the 1994-2022 origination period by the Urban Institute underscores the risk mitigating role of private MI and found that “the loss severity of GSE loans without [private MI] was 37.6 percent, higher than the 26.4 percent severity for loans with [private MI].” The research further concluded that “[private MI] is highly effective in reducing losses to the GSEs” and “the reduced loss severity for the GSEs attributable to [private MI] holds across all origination years.”

During the hearing, Appleton stressed that U.S. financial regulators last updated bank capital requirements in October 2013, prior to the private MI industry’s adoption of many of the enhancements outlined in USMI’s new report, and provided recognition for private MI at that time. In contrast, the proposed rule does not recognize these enhancements, including the industry’s strong capital position and programmatic use of risk management tools. In addition, it diverges from the Federal Housing Finance Agency’s (FHFA) own Enterprise Regulatory Capital Framework (ERCF), which appropriately recognizes the value of private MI as the first layer of protection against risk by providing capital credit for GSE loans backed by private MI.

The industry’s enhancements since 2013 include:

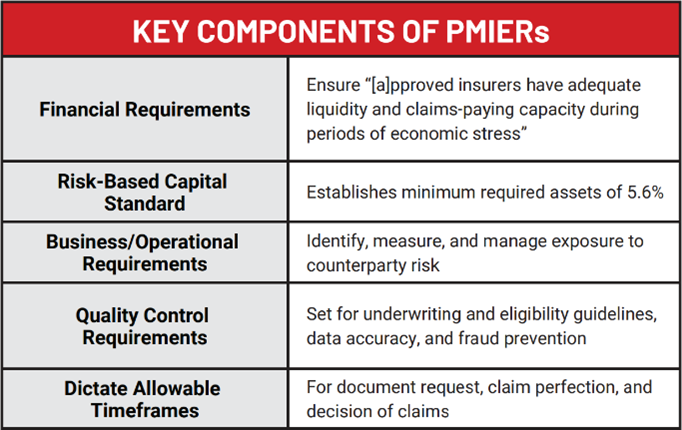

Private Mortgage Insurer Eligibility Requirements (PMIERs)

PMIERs consist of capital, financial, operational, and quality control standards for private mortgage insurers to be approved to insure loans acquired by the GSEs and were significantly revised in 2015. Among the requirements is that “[a]pproved insurers must have adequate liquidity and claims-paying capacity during periods of economic stress.” As of the end of 2023, private mortgage insurers held $11.4 billion in excess of the regulatory threshold or 72% more capital than required.

New Master Policy

The MI Master Policy, which governs claims paying guidelines and procedures, underwent significant changes in 2013 with substantial input from FHFA. Changes included increased clarity of terms which streamlined the payment of claims to ensure that private MI coverage results in reliable and predictable payments to lenders and the GSEs in the event of borrower defaults. The new Master Policy creates high visibility and responsiveness for performing loss mitigation, including through workouts for homeowners who become delinquent on their payments. In addition, private MI companies work closely with servicers and investors to help homeowners prevent foreclosure. In 2019, USMI members developed a common Master Policy, which became effective on March 1, 2020.

Rescission Relief Principles

First published in 2013 and revised by the GSEs in December 2017, the rescission relief principles have been well-received by the industry because they provide greater clarity and predictability on claims payments and are designed to align with the GSE representations and warranty framework. The principles include automatic relief after 36 timely payments, which addressed concerns of lenders, and early relief available after 12 timely payments with a full file review. It also provides private MI companies with the ability to offer increased rescission relief.

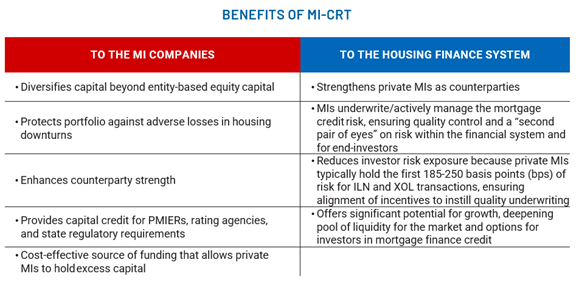

MI Credit Risk Transfer (MI-CRT) Structures

Since 2015, MI-CRT structures have transformed the industry from a risk management approach of “Buy-and-Hold” into “Aggregate-Manage-Distribute,” demonstrating that private mortgage insurers are sophisticated experts in pricing and actively managing mortgage credit risk. Through MI-CRT structures, private mortgage insurers have enhanced their ability to be more stable, long-term managers and distributors of risk by using a combination of capital markets-based and traditional reinsurance executions to reduce volatility and exposure of mortgage credit risk within the housing finance system. Urban Institute’s report noted that “private mortgage insurers have become increasingly proactive in managing and distributing credit risk.”

Since 2015, private MI companies:

• Have transferred more than $75.2 billion in risk on $3.6 trillion of insurance-in-force (IIF);

• Have executed 55 deals using Quota Share Reinsurance (QSR) and Excess of Loss (XOL) transactions, ceding $53 billion of risk to the traditional reinsurance market;

• And have issued 56 insurance-linked notes (ILN) transactions, transferring nearly $22.3 billion of risk on more than $2.3 trillion of notional mortgages.

For over 15 years, the private MI industry has worked in partnership with FHFA, the GSEs, and its lender customers to strengthen the safety and soundness of the housing finance system through enhanced capital and operational standards, thereby improving resiliency and the ability to withstand severe economic stress. The private MI industry is an essential check on mortgage credit quality throughout the financial system, reducing systemic risk in the housing and financial markets. Private MI is well-equipped to continue promoting access to mortgage credit for consumers while also shielding taxpayers from mortgage credit risk.

Through these significant enhancements, the private MI industry has demonstrated an ability to tap multiple available sources of capital, including equity, debt, traditional reinsurance, and capital markets-based reinsurance, to efficiently manage and distribute risk. It has also demonstrated that private MI is scalable and efficient, working with lenders of all sizes and types, from the largest money center banks to community banks, credit unions, and independent mortgage banks.

Private MI has enabled affordable homeownership for more than 38 million people over the past nearly seven decades, and in 2022 alone, more than 1 million borrowers purchased a home or refinanced a loan with private MI. Nearly 62% of purchase loans with private MI went to first-time homebuyers and more than 34% had annual incomes below $75,000. There are nearly $1.6 trillion in mortgages with active private MI protection.